“Many participants expressed the view that it might be appropriate to raise the federal funds rate again fairly soon” if data on jobs and inflation are “in line with or stronger than their current expectations” or if risks increased that the Fed might overshoot its goals, the meeting summary stated.

Jobs numbers indeed have been solid and the Consumer Price Index inflation indicator is at its highest level in years.

The minutes added that “a few” members believe raising rates at “an upcoming meeting” would allow the Fed greater flexibility to respond to higher-than-expected economic growth ahead. – CNBC.com

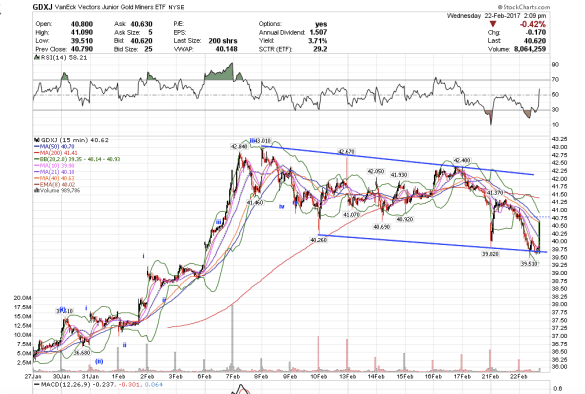

And GDXJ bounced right off the bottom of the channel. I jumped back into JNUG. The indices do not like the news. But they were topping anyway.

Susan,

Greatly appreciated if you can comment on the wave counts for UNG on the daily chart since it bottomed in Mar 2016.

Thanks for your great insight.

SKT

LikeLike

UNG still looks like a sell to me, Siu.

LikeLike

Let me give it a try. This is my wave count thinking. Please correct if I am wrong.

* Mar 3, 2016 (bottomed and beginning of A);

* Oct 13, 2016 (end of A and beginning of a/B);

* Dec 9, 2016 (end of a/B and beginning of b/B);

* Dec 28, 2016 (end of b/B and beginning of c/B);

* Dec 29, 2016 till now is still c/B and, hopefully, the end of B is near. What will be the possible ending point?

* whenever c/B ends, C will start which projected to exceed top of B.

What do you think?

Greatly appreciated your comments and insight in advance.

LikeLike

Siu, that’s great effort, but I really cannot see it. I looked at UNG this morning and it is getting a bid now. I would say if UNG can rally back above 7.57 you might have a major wave 2 bottom in. But, I am not trading it, so this is just my own personal thoughts of how I would trade it for myself. Thanks.

LikeLike

Thank you for your thoughts. Appreciated.

LikeLike