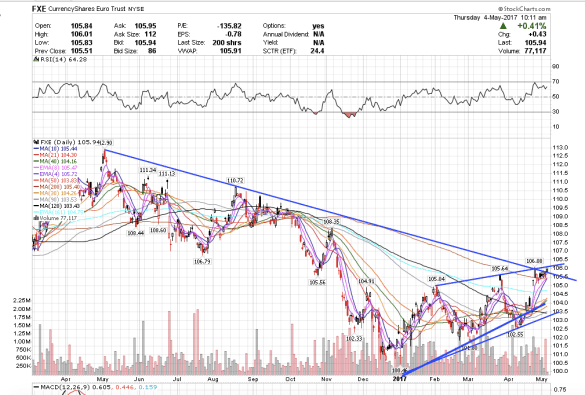

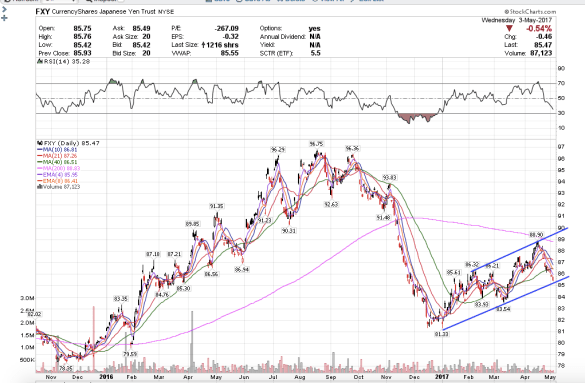

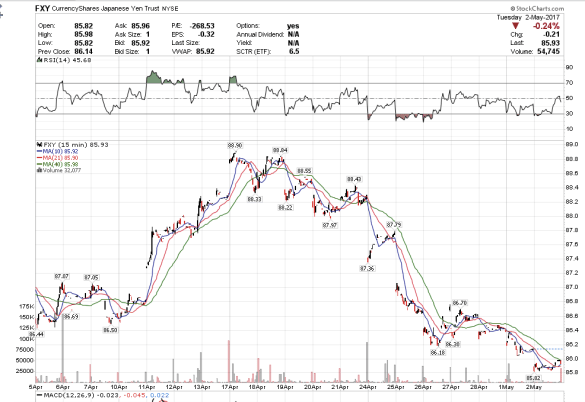

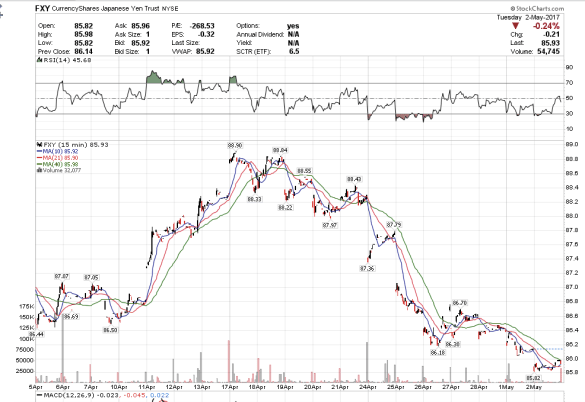

1:05 pm PST. The FXY had a little bounce into the close but could not close the morning’s gap and still looks vulnerable to yet another drop tomorrow as a result. But it’s getting close to the lower trendline.

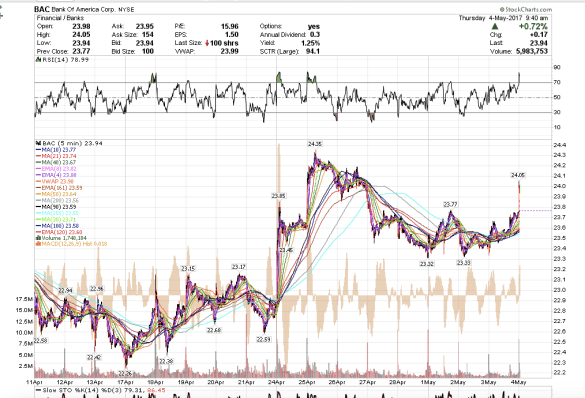

The Nasdaq continues to outperform the Dow and SPX. The Nasdaq is for retailers, someone told me. If so, the retailers are really coming back in force while the institutional traders on the Dow and SPX are feeling more cautious as we can see the Dow and SPX lagging.

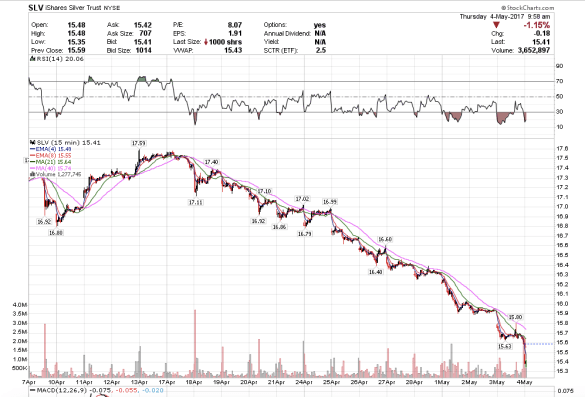

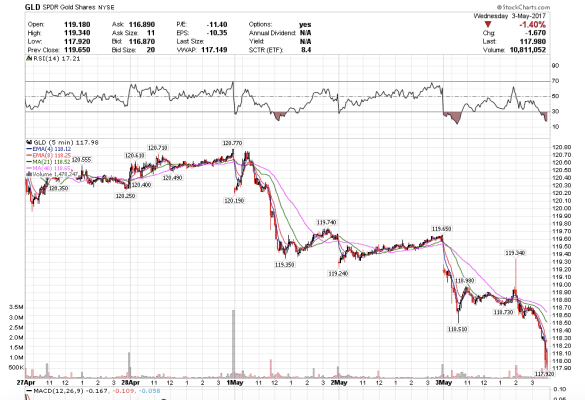

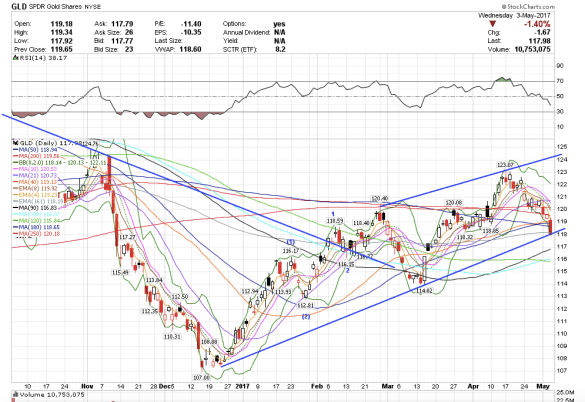

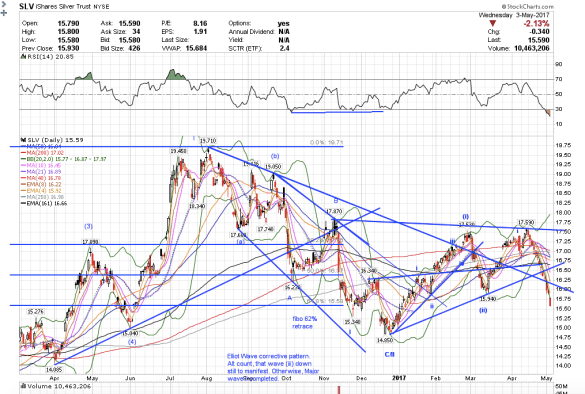

Gold managed to mostly close the morning’s gap, while SLV did not. I saw some interesting buying in the dark pool in silver and we closed above. We will see if that indicates bullishness. I am cautiously bullish because of FXY which looks almost done selling off, but not necessarily done, plus I saw some interesting silver buying in the dark pool – not huge, just interesting.