7:16 am PST. I had hoped for another pop up, retrace in the Euro so I could add onto my short position in FXE. 🙂 Now we have it. This looks like another great shorting opportunity. I will wait until the close to make a decision.

7:16 am PST. I had hoped for another pop up, retrace in the Euro so I could add onto my short position in FXE. 🙂 Now we have it. This looks like another great shorting opportunity. I will wait until the close to make a decision.

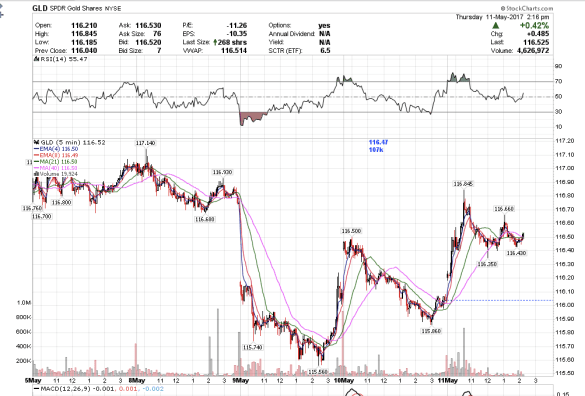

6:49 am PST. I shorted GLD. It could still test upwards, but it will not last. Looking for a gap fill today.

6:39 am PST. I am looking to short gold this morning. Next Monday I fly out to Hong Kong for the World Economic Conference with Martin Armstrong. (on United Airlines of all airlines – the only one I could find with nonstop-direct flights, round trip). As a result I have to plan for reduced trading next week. They are 15 hours ahead of California time.

The mining stocks are strong, but they too will drop along with gold. I think gold will probably drop to 1206, while mining stocks make a higher low. The mining stocks might eventually made a new low by June as gold sells off to somewhere below 1200 – perhaps 1180. Watching to see what happens in the dark pool today, especially towards the close.

6:07 am PST. TLT has rallied up to 121.09 this morning, to about my target mentioned as yesterday’s close. Gold rallied up 1231. GLD closed right on my line yesterday and it looked somewhat bearish, but silver and treasuries were the clue, plus the mining stocks. Today is day three of the correction, so there is a risk that gold could stop today and then drop. Plus The dollar is correcting down, the Eur/USD up as I saw completed five waves on the Eur/USD & Treasuries, and the JPY is correcting all in tandem.

Dow futures down this morning as well. Glad I exited my VXX puts yesterday. It might, however, be another buying opportunity if this is the end of the three-day correction for gold.

1:09 pm PST. TLT had a 383,000 block trade at 120.51 and we closed below. I think, however, TLT could retrace back up 120.94. Gold sold off some into the close and GLD closed right on 116.50 with a somewhat bearish posture. The Euro continues to look bearish, while it might have a retrace soon, and the dollar bullish.

12:25 pm. Closed my TLT calls scalp. +45%

11:46 am PST. TLT looks bullish here, which is another warning sign for gold bears. It spiked down to a new low on positive divergence, plus the wave count looks complete, five waves down.

11:30 am PST. Silver says that this could turn into a three day correction until tomorrow with another pop higher again. I have no positions on in the gold sector right now. I exited my VXX puts +20%.

11:16 am PST. Gold has a classic zigzag pattern which I suspected would occur, but did not trade like it would happen. I think yesterday at the close I had a momentary lapse of confidence in my overnight swing short trade, which I only made worse by adding on short at the open, then ultimately stopped out at the high. Classic newbie mistake, that I did trading options, which I am new to trading. Go figure. Maybe it is time I go back to trading stocks. GLD has to closed below 116.50 today to indicate that gold plans to sell off. The U.S. indices rallied back up and this morning’s sell off was another buying opportunity. I bought VXX puts on the sell off.

8:03 am PST. I think gold is probably done here on the upside and I anticipate we will probably head to new lows by Monday perhaps, 1206.

7:35 am PST. Stopped out, GLD could go as high as 117. Or it could be done here.

7:20 SPX need not go all the way down to 2370, to be done correcting. It could finish at 2380, but 2370ish is stronger support. Going to watch the close today for clues.

7:00 am PST. SPY is getting knocked down hard this morning, which is why gold is up. The 2303 completed the wave pattern, and SPX is headed down to the 2370 area my earlier projection, rather than 2408.

5:48 am PST. Gold is slightly higher this morning making this day 2 of the correction. I still expect new lows and may just add onto my short position instead of stopping out. S&P futures are down this morning, but it still looks bullish.