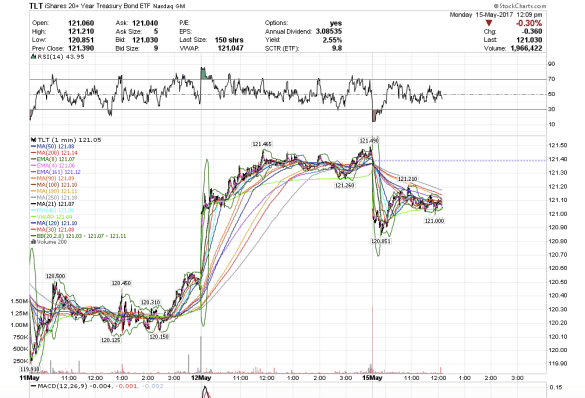

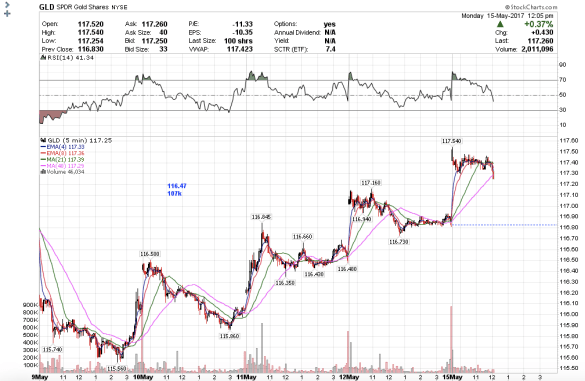

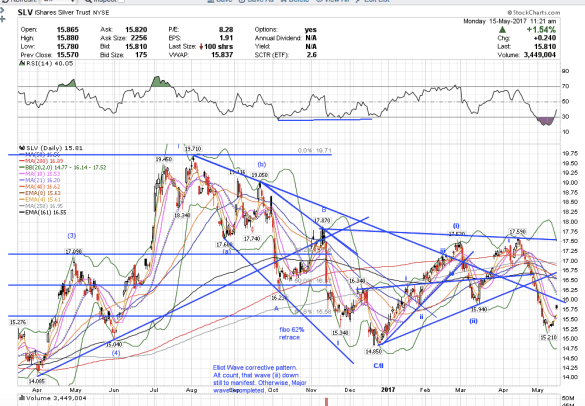

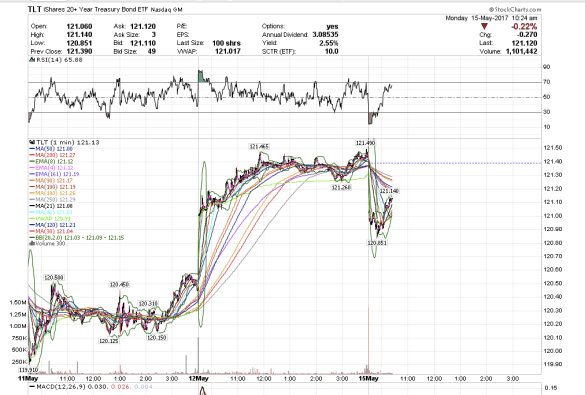

4:44 am Hong Kong. Hi Everyone, I am in Hong Kong now. It looks like gold, silver, and treasuries continue to correct to the upside. It looks like gold still has room to the upside. I have no positions on. The dollar broke down from key support and the Euro has rallied. I wanted to post a chart of the USD/JPY as a correlated piece of information for everything else.

It appears to me that USD/JPY could correct as far down as 111.58. It has reached the first level of key support. The next level down is 112.54, then 111.71, then 111.58.