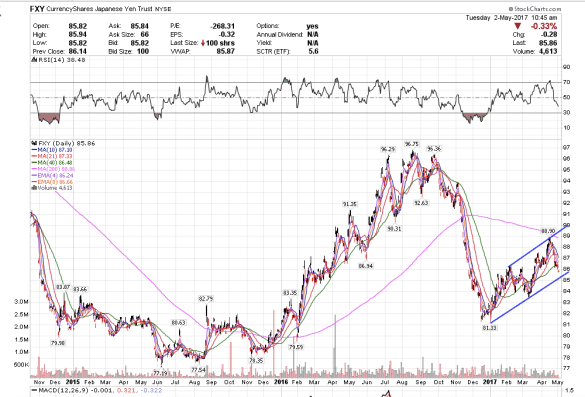

7:37 am PST. The Yen etf, FXY, is coming down to the bottom channel line, which I expect it to do a dead-cat bounce off of along with gold and silver. It is almost getting there, but not quite there yet.

7:37 am PST. The Yen etf, FXY, is coming down to the bottom channel line, which I expect it to do a dead-cat bounce off of along with gold and silver. It is almost getting there, but not quite there yet.

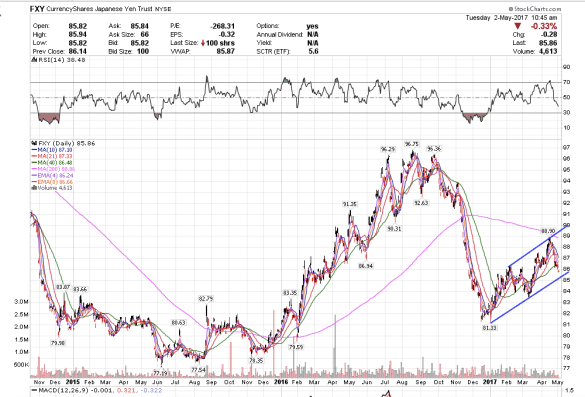

6:11 am PST. Today is day 12 from Sunday’s high from the previous week. Silver has gone in nearly a straight line down since then. I have not seen a whole lot of action from the market makers in the gold/silver sector lately. Maybe soon. I cannot imagine they would pass up a good buying or shorting opportunity.

5:21 am PST. /GC continues to sell off this morning while silver holds its yesterday lows. /GC trading at 1253 as of this writing. These types of patterns can produce waterfalls, but I think possibly unlikely given how much silver has fallen already, and GDX is starting to positively diverge. So, I anticipate more of a choppy bounce in gold perhaps back to 1280, 1275 when silver bounces back to $17-17.50.

/gc 1250 is possible today, and then we will see, maybe 1244.

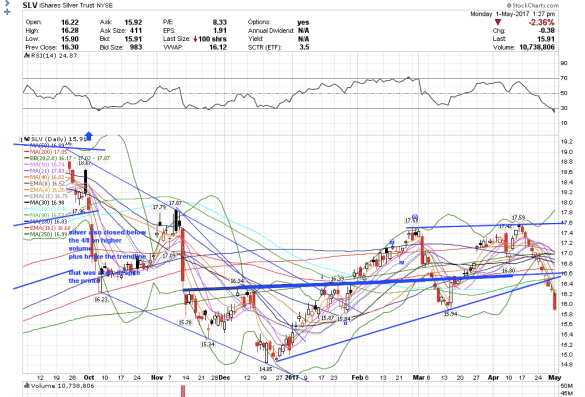

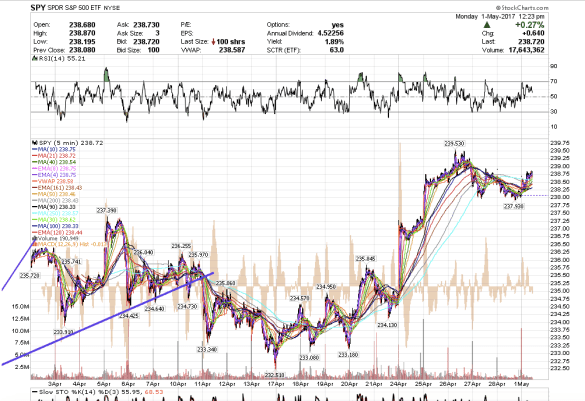

12:38 am PST. Perhaps SPX will go to 2405 after all. That was a steep sell off midday, some of which I caught, but stopped out on the rest of my SPY calls when buyers came right back in and took the SPY higher.

“Beijing has inveighed against the deployment and criticized the South Korean government for undermining bilateral relations by hosting the missile system.

Chinese citizens, among whom a sense of nationalism is strong, have also taken up the anti-THAAD mantle, protesting and boycotting South Korean businesses and tourism.

Several Chinese state-run media outlets have called for organized voluntary boycotts of South Korean businesses and imports. China is Seoul’s largest trading partner, receiving one-quarter of South Korea’s exports.” http://www.businessinsider.com/china-south-korea-economic-boycott-protests-over-thaad-missile-system-2017-3

10:28 am PST. Silver is getting absolutely crushed. It finally looks just about done. I am looking for a retrace back to 16.38, then 16.60 on a dead-cat bounce.

9:24 am PST. New target for SPY 237.50, then 236.58 by Friday.

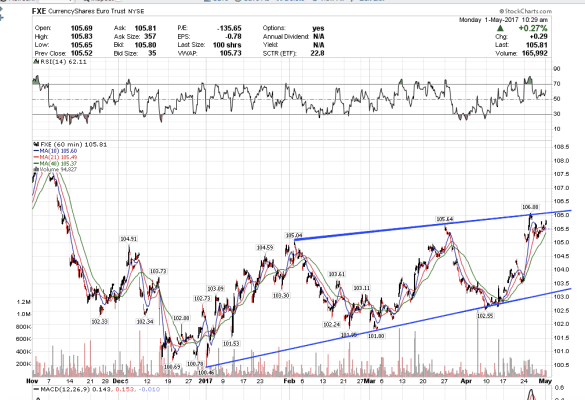

7:29 am PST. It looks like the FXE will probably retest the upper trendline of this channel into the French election on May 7. I exited my SPY calls for about 25% and TLT puts for about 40%. Treasuries and gold are bouncing now, while the indices are pulling back. I think this will be a choppy week into the French elections, after which time the markets will probably trend again.

4:46 am PST. SPX futures, /es, is up slightly this morning, which was to be expected. I hedged my gold positions over the weekend with a long SPY position and short treasuries position. Silver made another new low as I suspected would occur and the sell-off still does not look done in silver. Maybe $17 in silver and then bounce back up to $18ish before heading down again. USD/JPY also made a new high nearly reaching my 112 target. Depending on what happens today, I may or may not exit my gold positions. I continue to think SPX goes to 2405 before the summer correction sets in, which I think will continue to put pressure on treasuries and gold.