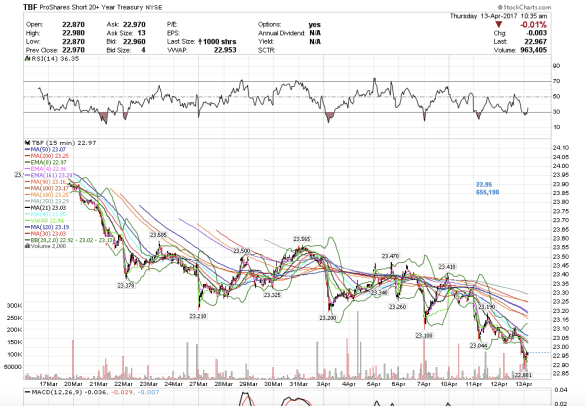

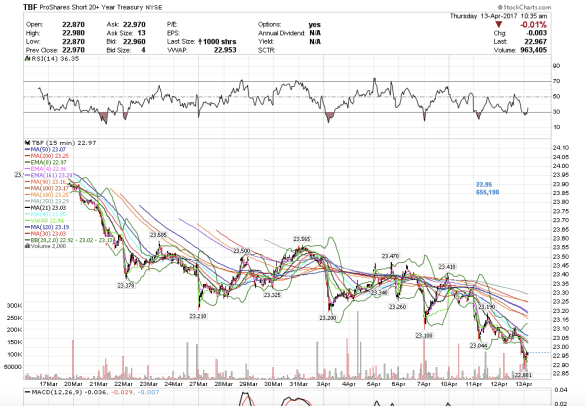

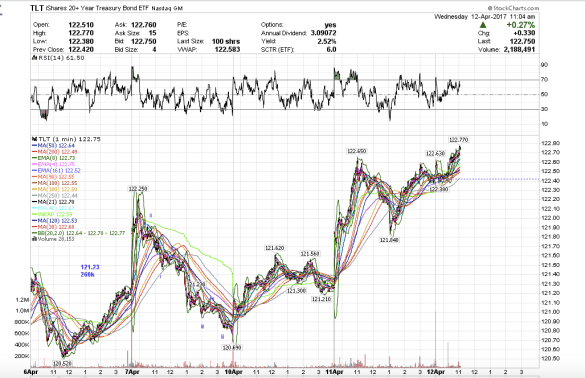

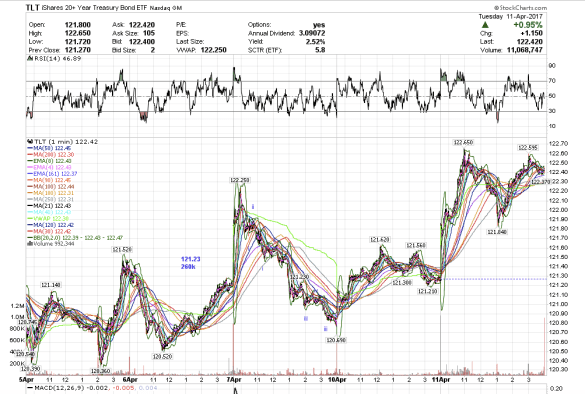

7:36 am PST. I just saw a large trade come in on TBF, the 20-year treasuries short etf, at 22.95 for 655,190 shares. I think it could be a buy.

7:36 am PST. I just saw a large trade come in on TBF, the 20-year treasuries short etf, at 22.95 for 655,190 shares. I think it could be a buy.

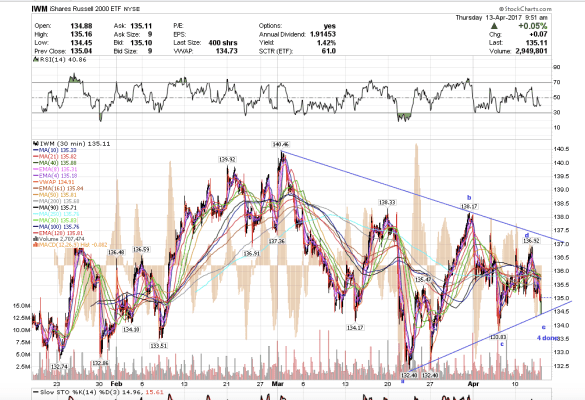

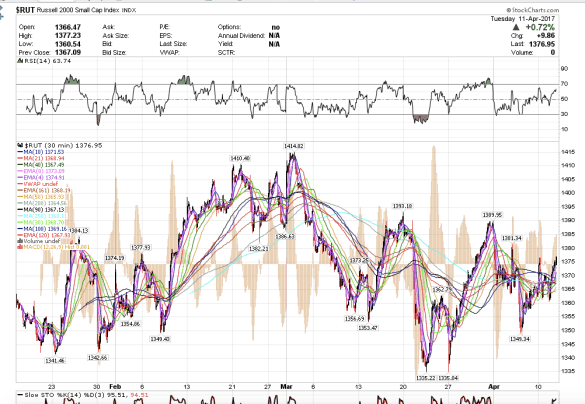

6:52 am PST. It looks like we are finally done correcting. The IWM shows a completed a-b-c-d-e wave 4 completion. Time to rally! Wow. I am so amazed at how exact prices stayed just in the trendlines. It must be the computers trading?

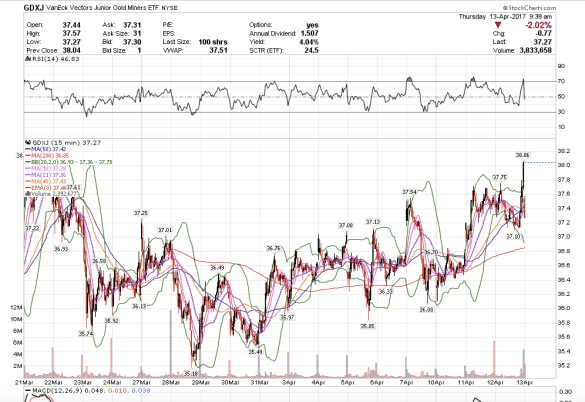

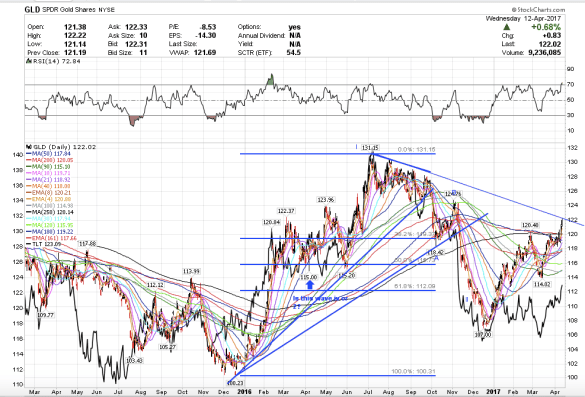

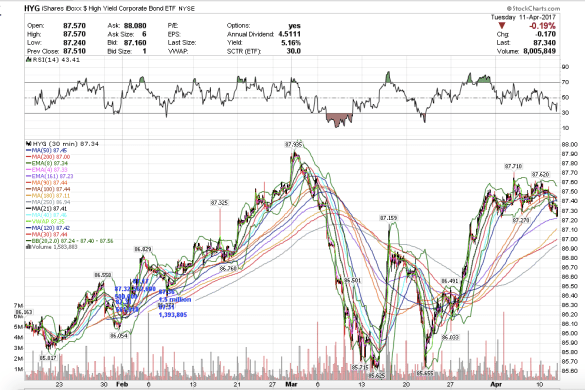

6:39 am PST. The junior gold miners, GDXJ, have left the gold party early. GDXJ has had a weak rally in comparison to GDX these past weeks, which is telling. The money is leaving gold and treasuries and heading back over to the equities party.

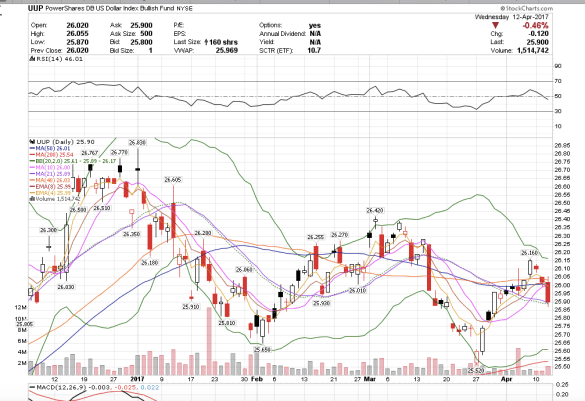

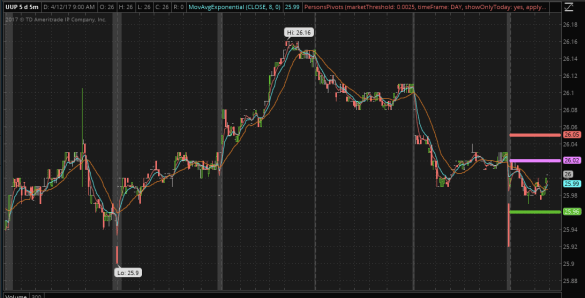

1:12 pm PST. Trump says the dollar is too strong and UUP cash market went right back down to the 21 sma.

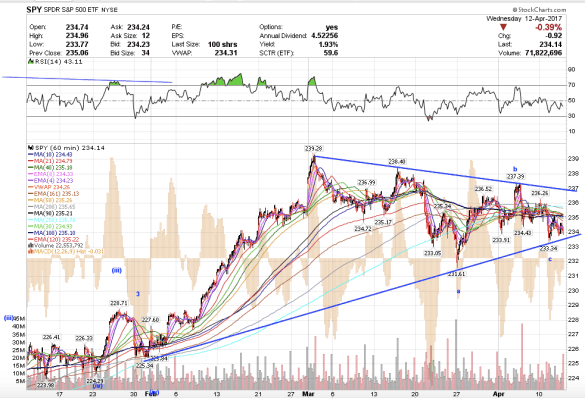

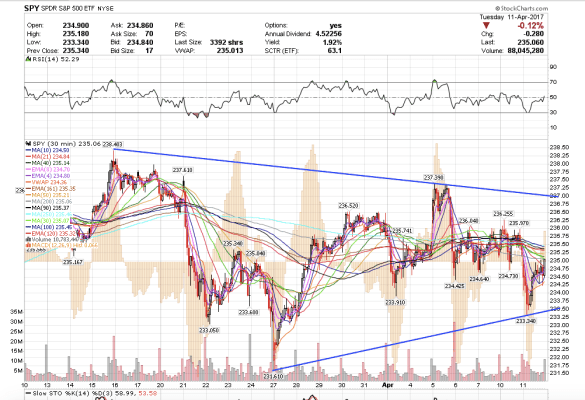

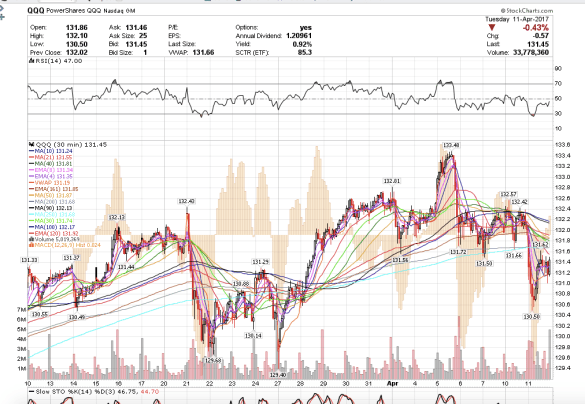

SPY still holds the triangle, but if the lower trendline goes, it could get ugly.

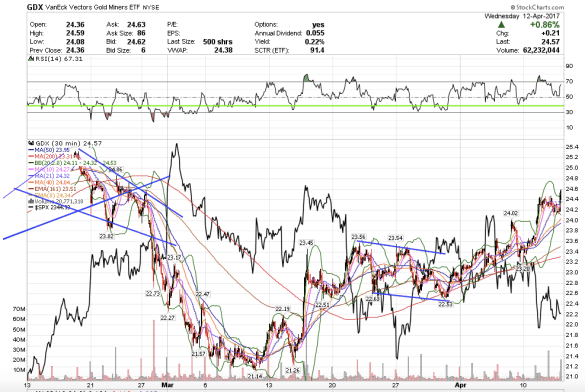

The miners ripped higher into the close, along with treasuries and gold. Gold is just about tagging the upper-down trendline from the July high. If gold breaks above that, we have breakout to the upside.

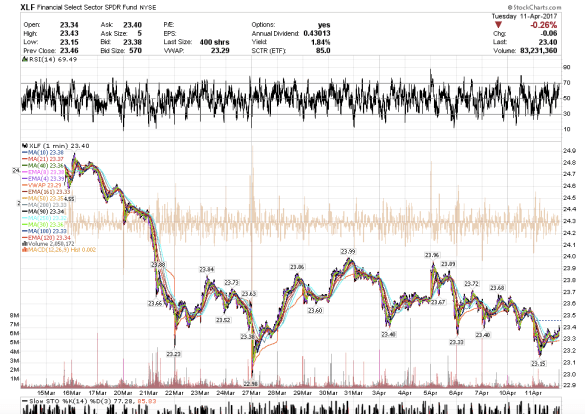

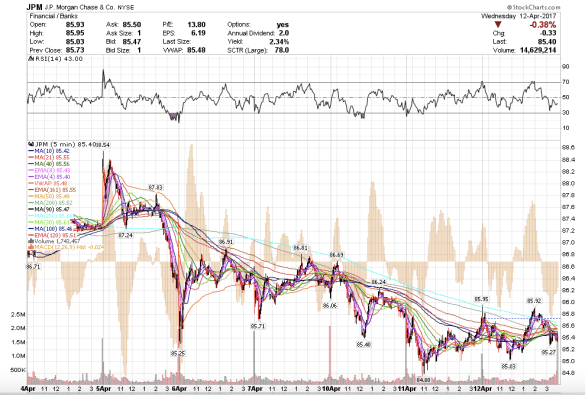

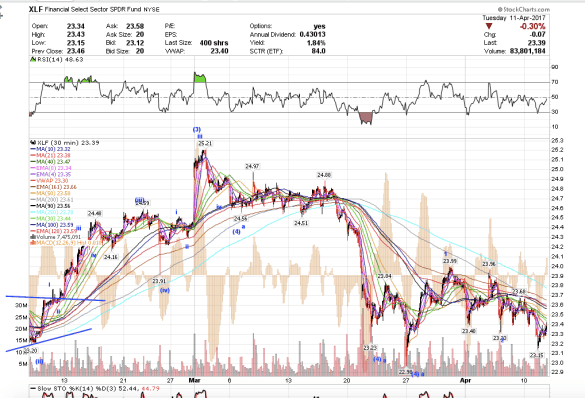

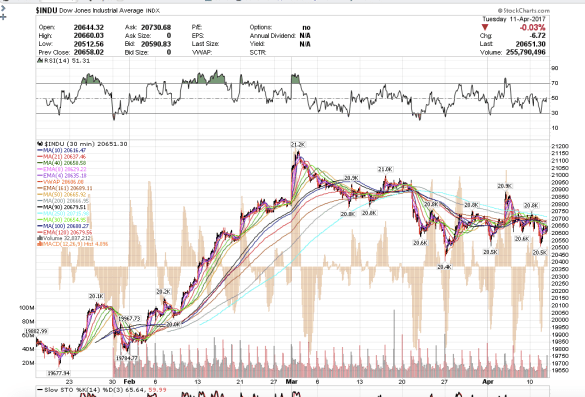

Banks stocks closed weak as JPM kicks off earnings tomorrow.

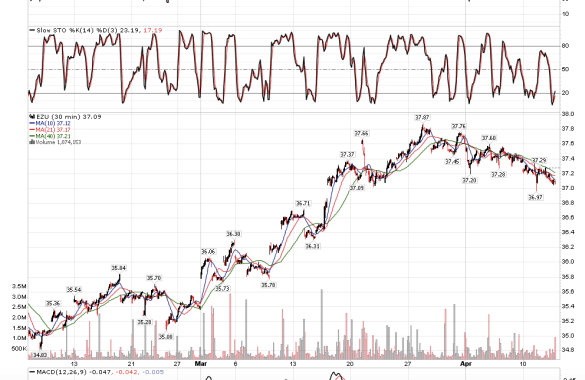

The only encouraging thing I can say about the markets is that I spotted a ton of global stocks buying and prices closed above most of them. That is the only piece of good news I have for SPY. EZU, IEMG, EWT, INDA, EIDO, EWP, and EWT all closed above their prints. IAU saw a 650k print at 12.35 and we closed below.

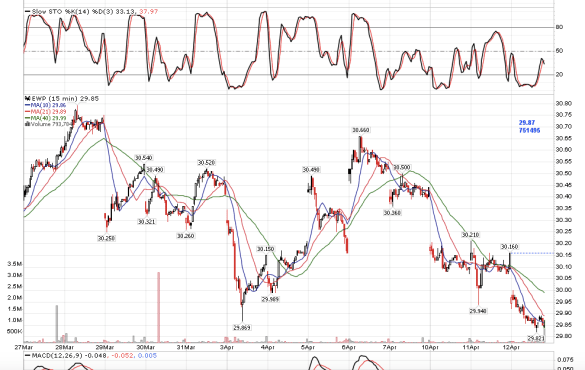

12:01 pm PST. Another interesting print on EWP at 29.87 for 751,495.

11:55 am PST. Interesting bit of information on EZU etf. I saw a 687,000 block trade at 37.08. The price pattern is similar to SPY.

9:10 am PST. Pre-market UUP almost reached my target 25.90, going to 25.92 and bounced. It looks the dollar has finished correcting. Watch out Euro and gold.

9:07 am PST. Large 1.435 million block trade at 122.68.

8:04 am PST. TLT’s momentum is slowing down, and it has almost reached my target of $123. I think it is just about done on the upside. We could see a gap fill, and then drop tomorrow.

4:28 am PST. I am burning these fractals into my brain because I think this is what this summer will probably look like starting June.

1:01 pm PST. There is a possibility that TLT could gap one more time to the upside tomorrow perhaps to $123, but I do not think it will get very far. GDX also looks it could do another high tomorrow, but I still think this is an ending wave.

The Russell 2000 closed very well, and I have a bullish bias. The financials were able to rally off their lows and I am bullish. SPY held the triangle low and bounced off the lower trendline. It looks constructive.