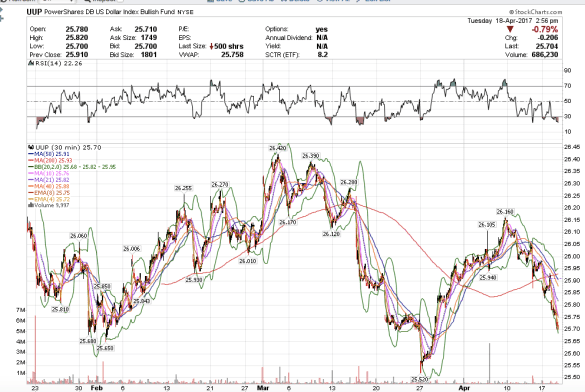

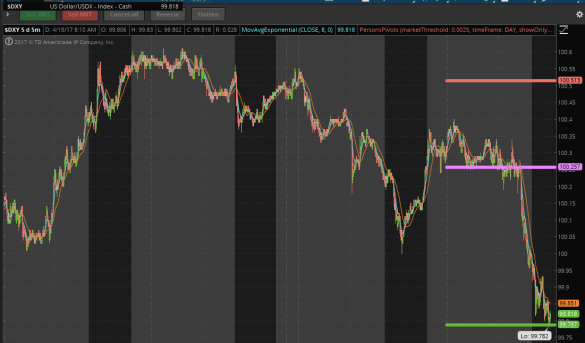

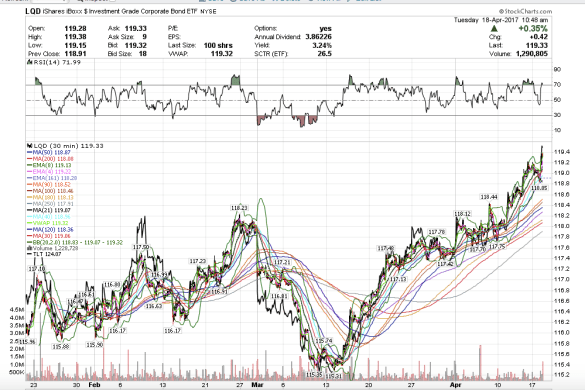

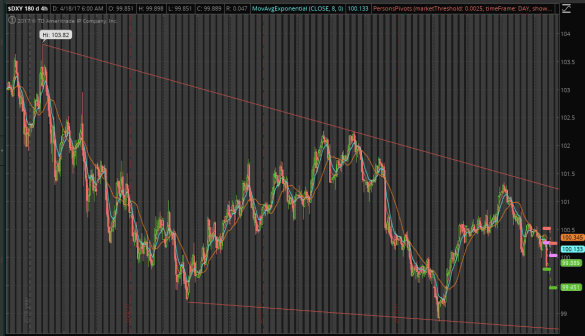

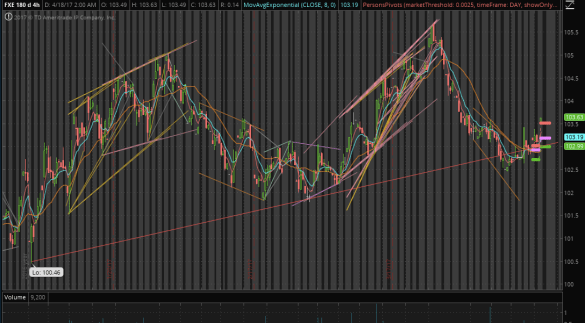

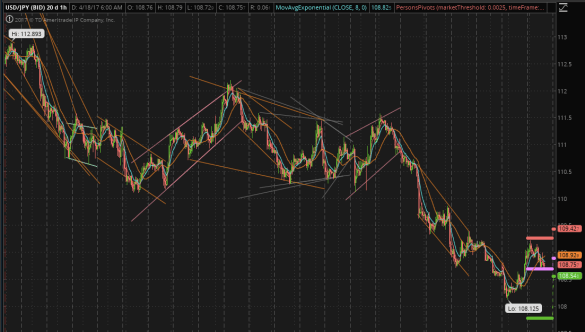

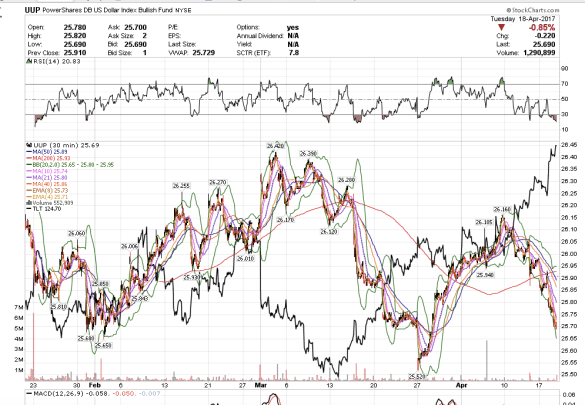

1:00 pm PST. Today’s price action is proof positive that one should not both buy treasuries and dollars. I see hedge fund managers saying buy treasuries and the dollar. One ought to trade them inversely. A bullish dollar is bearish on treasuries, and conversely and bearish dollar is bullish on treasuries.

The dollar etf, UUP, juxtaposed with TLT in black.

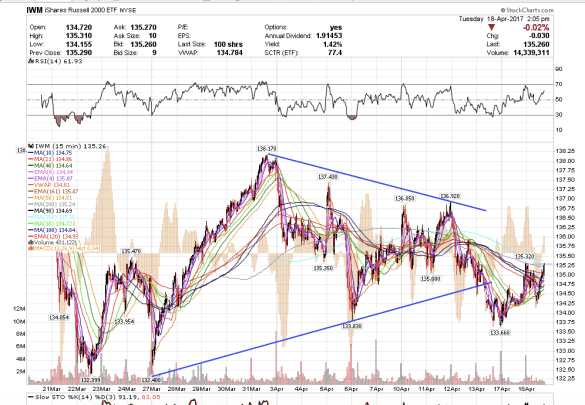

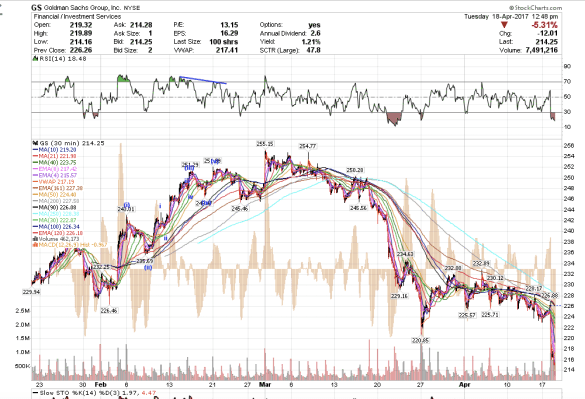

IWM closed green. GDX closed red and looks bearish.