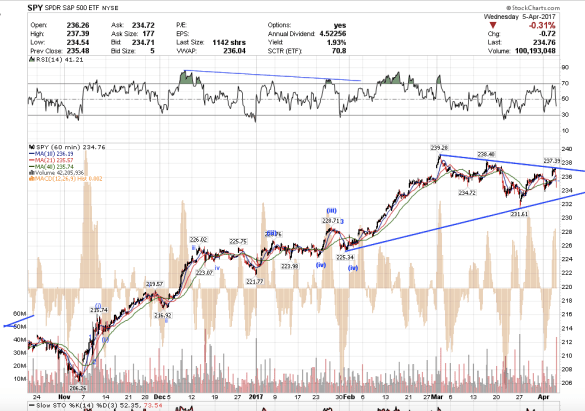

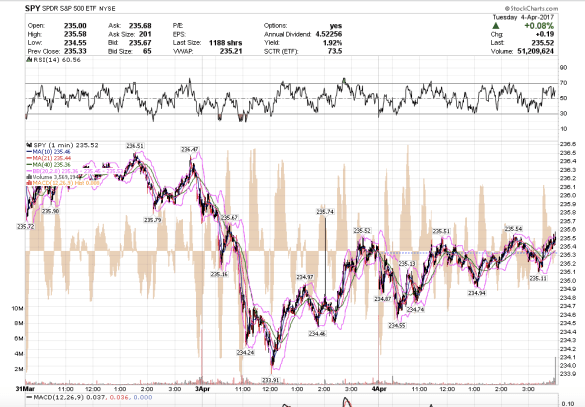

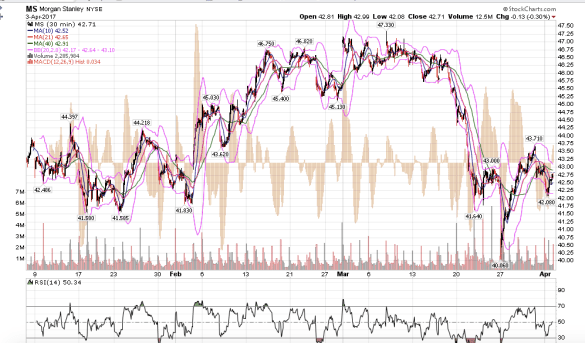

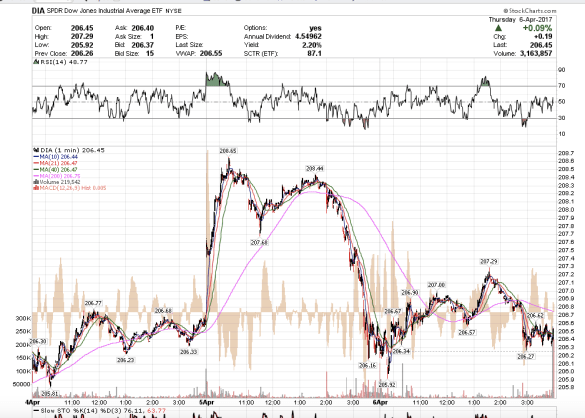

1:10 pm PST. I thought the Dow had a very constructive close. After yesterday’s 250+ point movements in both directions, the Dow traded in a narrower range with a lot of traders looking for further downside movement. However, I remain bullish and believe that today’s price action is the beginning of a new uptrend into about May.

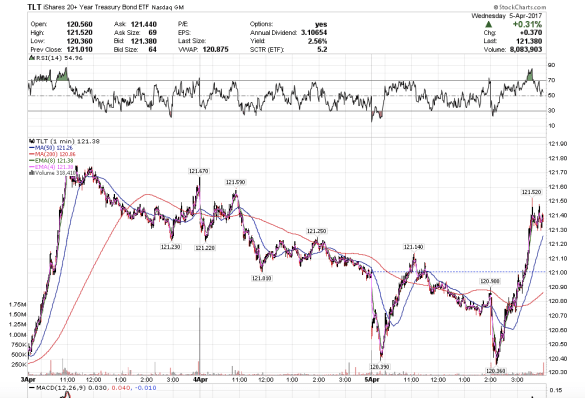

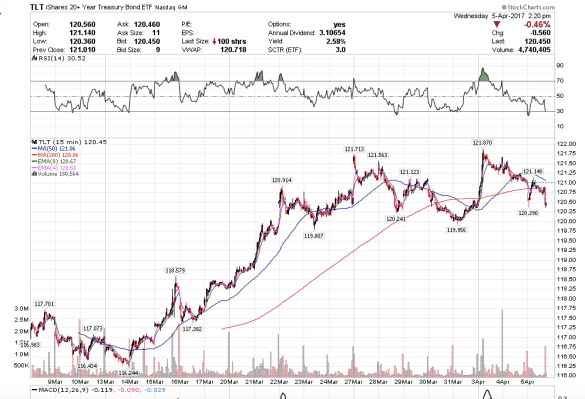

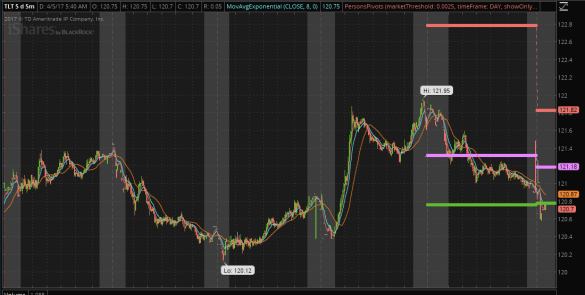

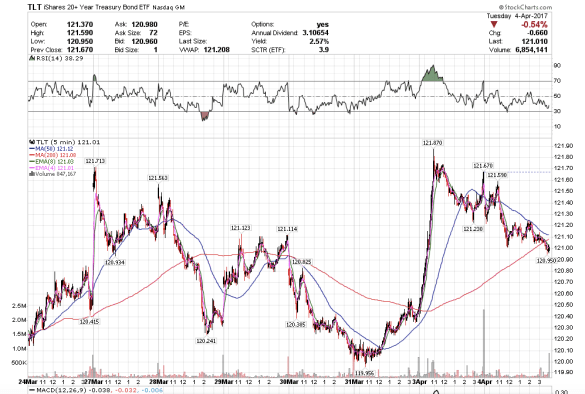

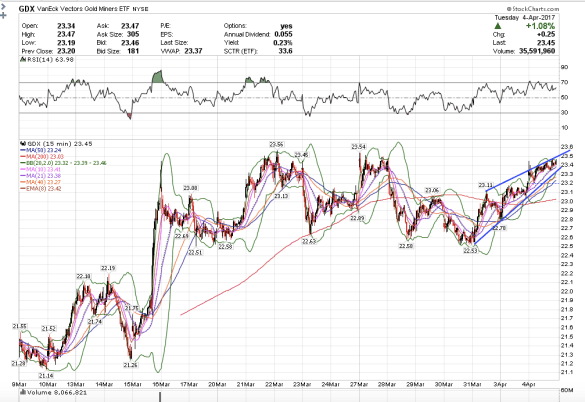

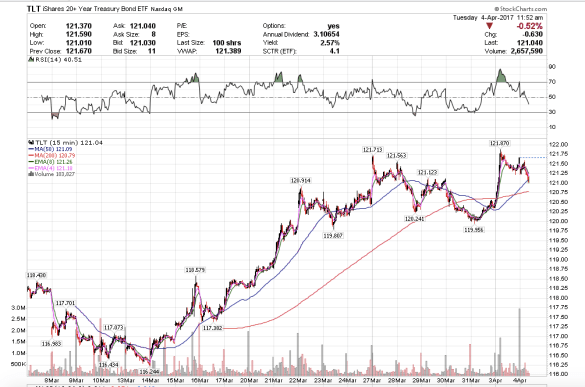

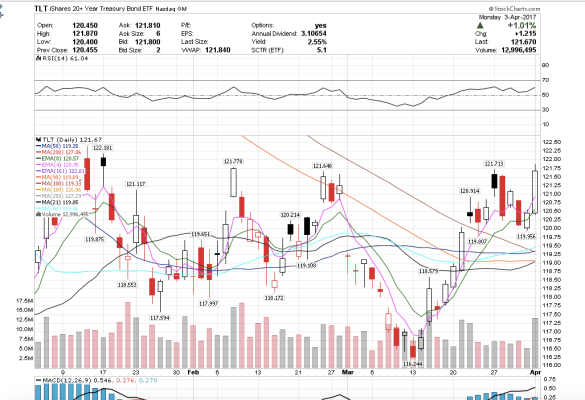

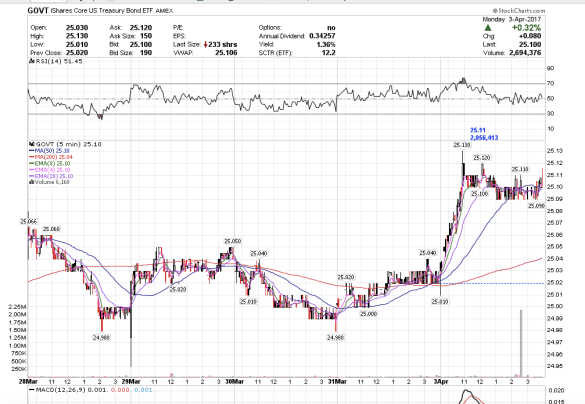

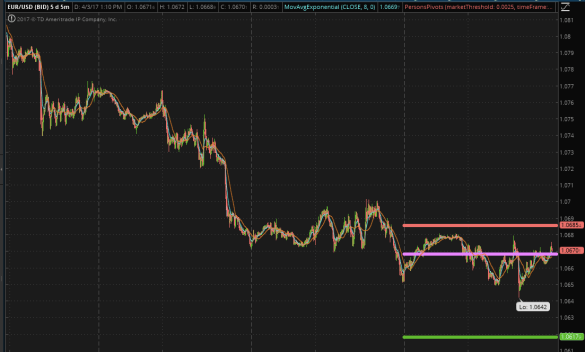

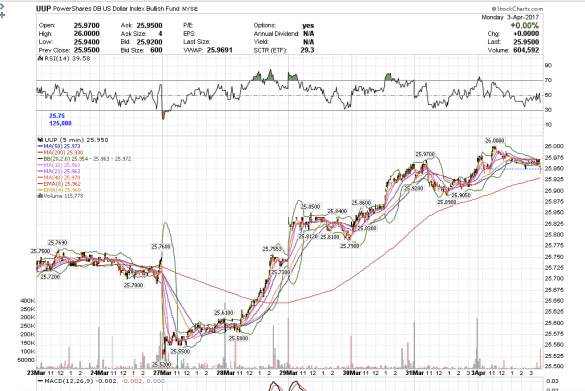

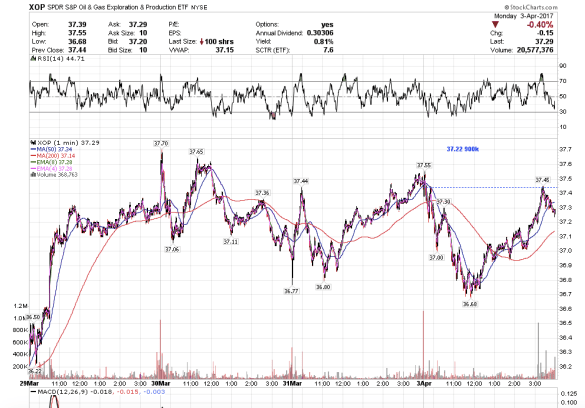

Gold gapped down at the open and failed to close the gap. I saw an IAU print at 12.06 for 972k and we closed a penny below. The pattern plus a bearish print makes me think gold and treasuries are about to tank. Plus the dollar looks bullish.

Non-farm payrolls get released tomorrow morning at 8:30 am EST and I think this will ignite a rally higher in the indices.