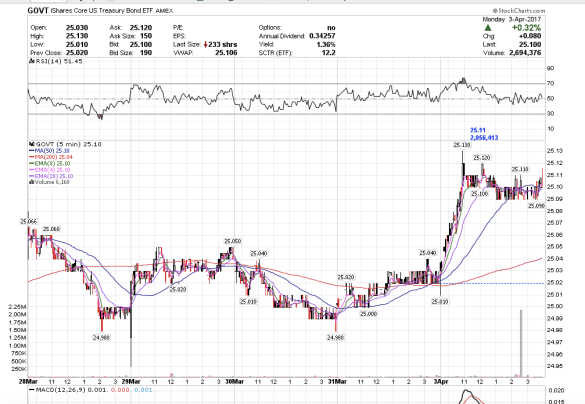

1:06 pm PST. Lots of action today. Treasuries popped a lot higher today on what looks like an ending move. It could have one more minor high tomorrow at the open, and then TLT is going to drop like a rock to new lows. Or treasuries could start dropping like a rock tomorrow right at the open. I saw a block trade for GOVT, the core treasuries etf, at 25.11 for 2,056,413. We closed a penny below which means treasuries could start the fall as early as the open tomorrow morning.

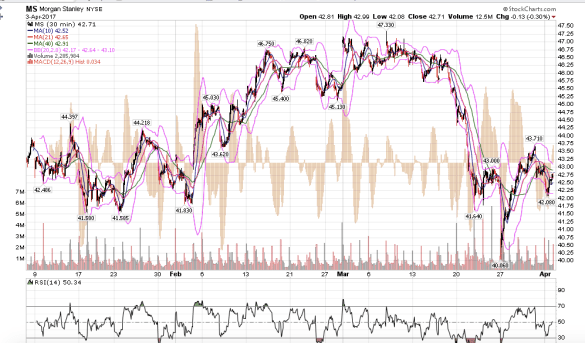

This morning’s sell off on the indices was a great buying opportunity for blue chip stocks and financials. I saw the market makers doing some bottom fishing on Morgan Stanley and JP Morgan.

I closed MS calls weeklys for +70% with an underlying move of about .50.

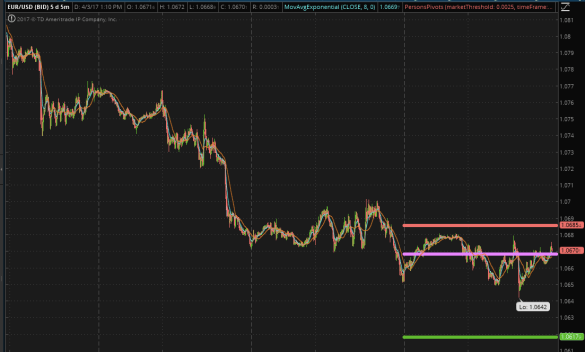

The EUR/USD ultimately went down and tagged my target at 1.0642 and bounced. I am not sure if the bounce is done yet. Generally, I am still bearish on the Euro.

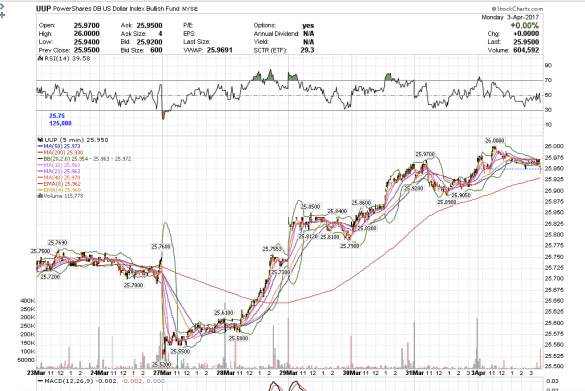

The UUP could correction as far down as 25.79, which means that there is probably more upside for GDX and GLD.

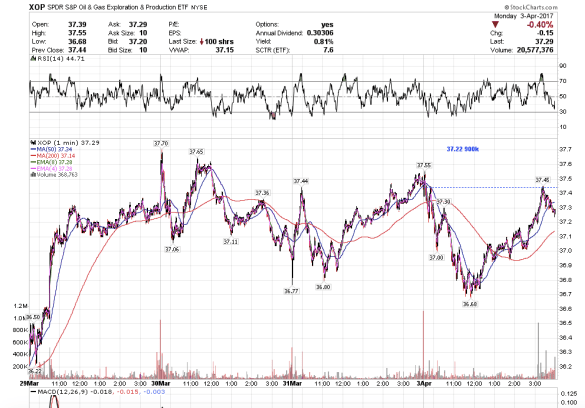

I saw a block trade on XOP at 37.22 for 900,000. We closed above which makes me bullish on XOP.