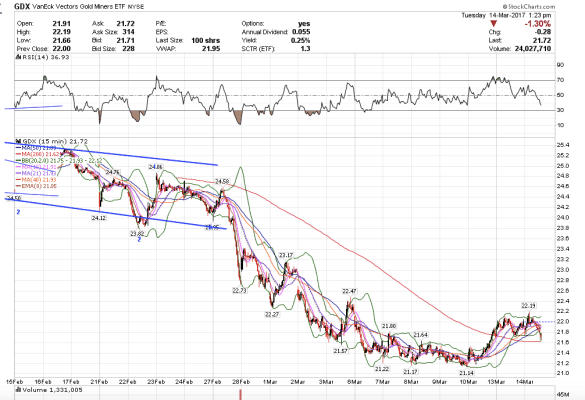

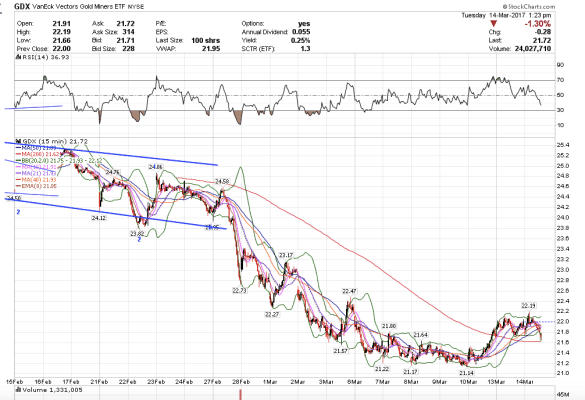

10:24 am PST. Heading down now. Could see $20.35 tomorrow. JNUG had a print at 6.87 900,000 shares and we are below.

10:24 am PST. Heading down now. Could see $20.35 tomorrow. JNUG had a print at 6.87 900,000 shares and we are below.

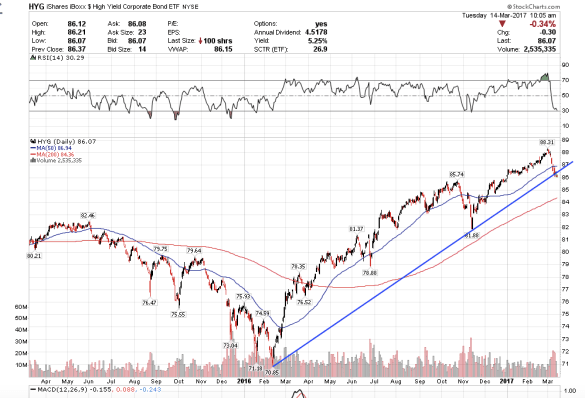

8:46 am PST. It looks like the market makers are expecting bonds to sell off after FOMC announces a rate hike tomorrow. BND had 1.3 million shares block traded at 80.13 and if we close below that’s bearish. AGG had 772k traded at 107.31. TLT will finally reach my downside target of $116 before seeing a multi-month bounce. That will probably give the necessary energy for BAC to finally also pop to $26.25 to complete wave (3) up, and then do a more lengthy correction. It is all coordinated. HYG and JNK might do a lower high tomorrow, which would be negative divergence.

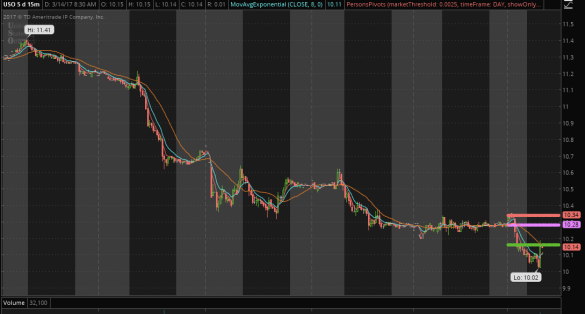

8:30 am PST. USO went to $10.02, just about my target and is bouncing now. Could bounce back to $10.34.

Happy Pi Day.

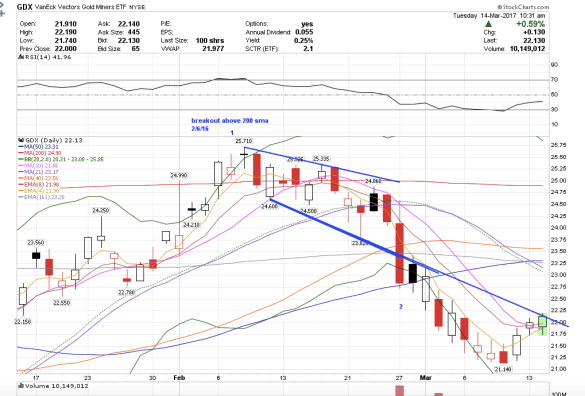

7:32 am PST. GDX bounced off support. Perhaps the low is in and after the Fed we might see a higher low. Just guessing.

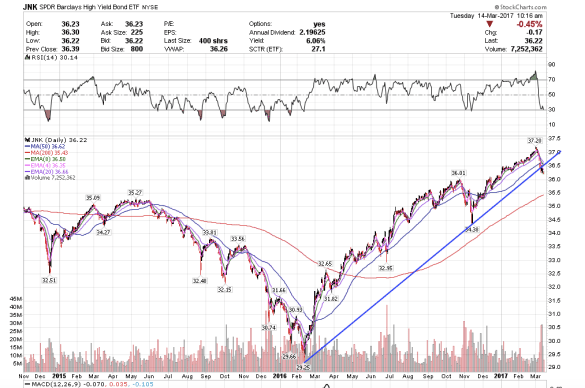

7:17 am PST. Barclays High Yield Bond ETF, JNK, is having a lot of block trades this morning, about 3.3 million shares block traded from 36.24-.28. The pattern is similar to HYG. Not sure, but it could be short covering rather than outright selling. We are below those trades now on positive divergence. It will depend on the close.

7:06 am PST. HYG has broken below the trendline which makes me biased towards the bearish side now on SPY. BAC is just going sideways. Perhaps too early to tell until the Fed.

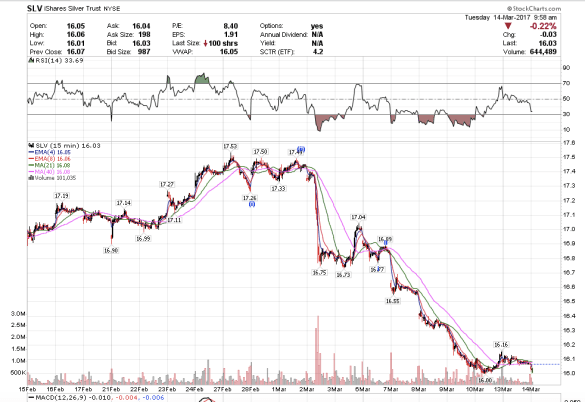

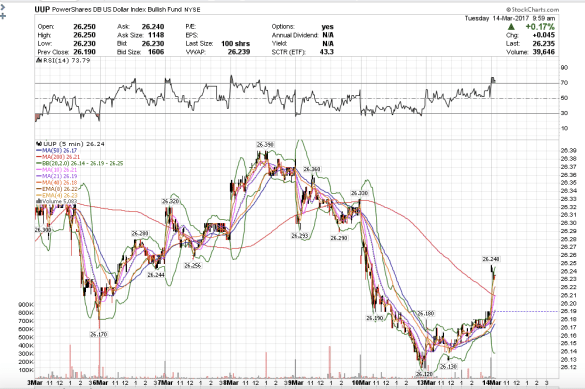

7:00 am PST. GDX is catching a little bit of a bid this morning and could make a new high, while gold and silver are selling off this morning as the dollar catches a pop higher. I think tomorrow’s Fed announcement is going to shake anything gold-dollar related.

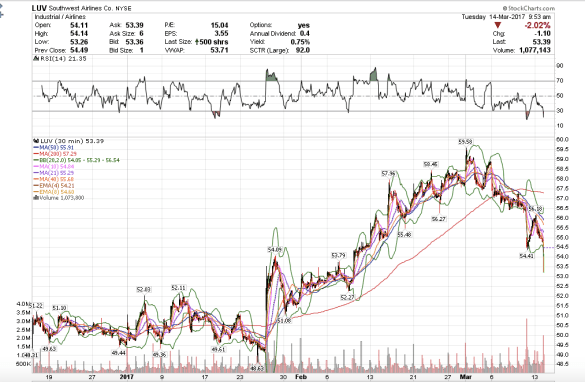

6:54 am PST. LUV is having a more serious correction and could go to $50.

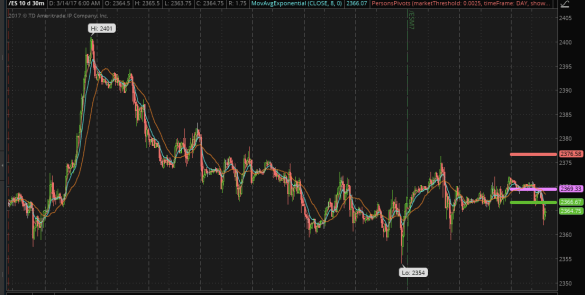

6:19 am PST. E-minis down this morning after what looked like a bullish close yesterday. The market is just going sideways waiting for the Fed tomorrow.