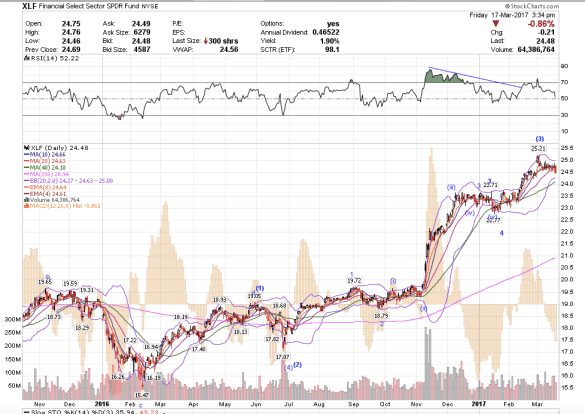

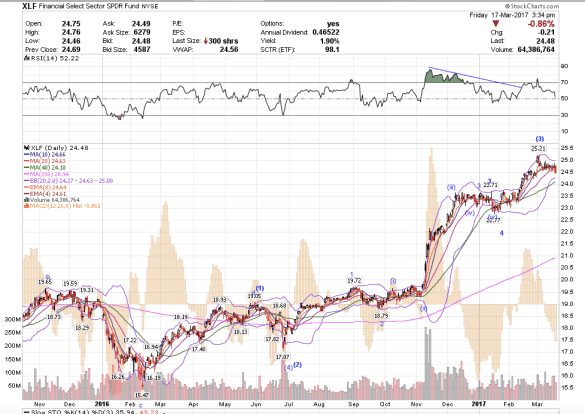

12:37 pm PST. XLF looks like it could retrace to $24. The NDX is up near the all-time highs. VIX could be bottoming.

12:37 pm PST. XLF looks like it could retrace to $24. The NDX is up near the all-time highs. VIX could be bottoming.

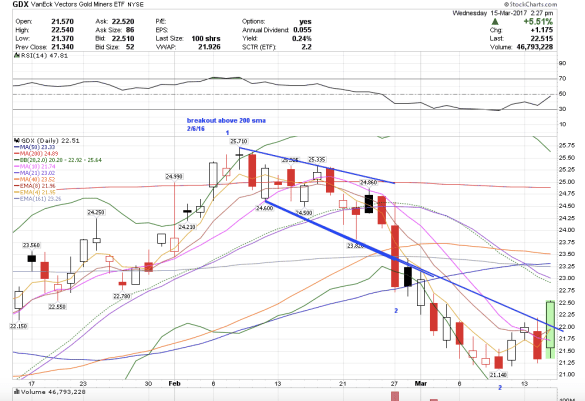

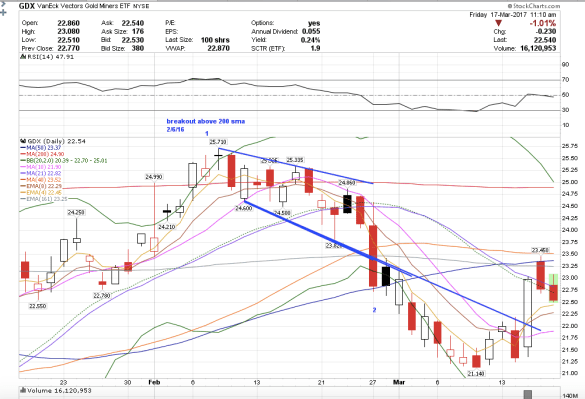

8:41 am PST. Bought some call options on GDX going out a couple of weeks.

8:11 am PST. GDX got stretched too far on Fed day, rallying to the 50 ma, and now has to retrace back and test the 4/8s. It is like a rubberband. Probably putting in a handle to the cup.

6:25 am PST. I am watching silver this morning. It has to break, hold, and close decisively above 17.39 in order to have a shot at 17.72.

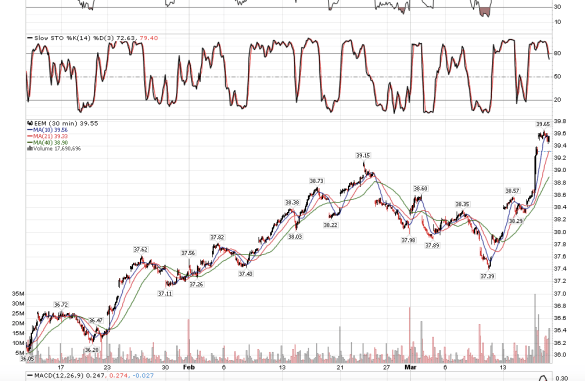

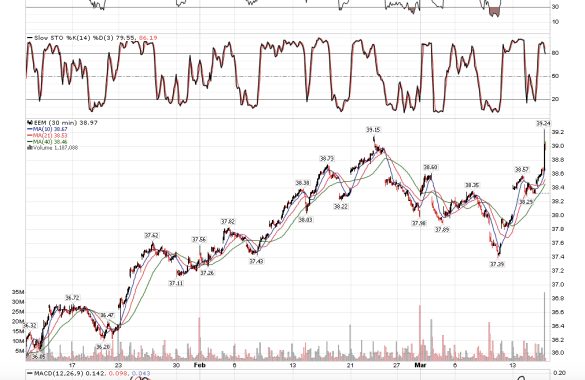

1:05 pm PST. It was a range-bound day in the gold market, treasuries, and the U.S. indices. Traders took profits after yesterday’s big run up. EEM ran past $39.50 and consolidated. It looks like it could go to $40, possibly $41 in a few weeks.

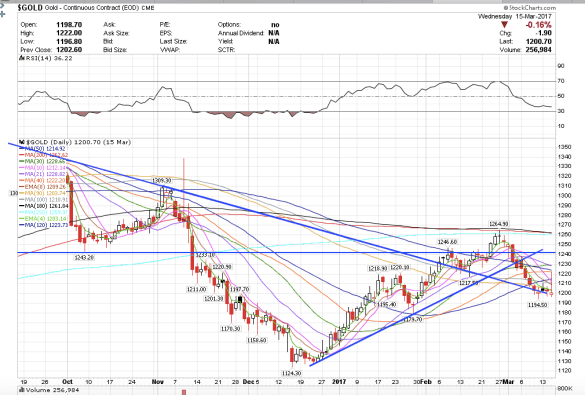

6:45 am PST. Gold found resistance at the 21 sma, and is probably going to come back down and test 1222. At the low of 1194, gold did a successful backtest of its breakout from the July downtrend line and held.

5:27 am PST. It looks like gold could go to 1238 before consolidating, and silver to 17.72. /es looks like it has further upside too.

1:01 pm PST. Huge move in the gold market today with the dollar selling off. My total account gained 21.96% today. Not bad for a day’s pay. The Dutch elections tonight could derail the gold rally for a bit, but I think there is more upside after some consolidation. That was a quick move to the upside. Huge volume coming into JNUG and GLD today, much more than usual. PVG gain more than 13 percent today, huge move.

The U.S. indices all finally saw gains after moving in a tight range for days. The banks, on the other hand, sold off.

The Bond etfs TLT and AGG also saw gains, interestingly, without making new lows. We could see FXE rally to 109 over the next several weeks, while UUP could drop to 25.50.

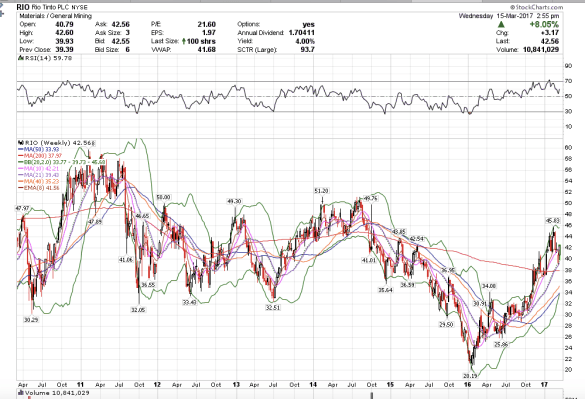

12:07 pm PST. 780,000 shares block traded at 42.00

11:56 am PST. RIO looks like it is going to $50 over the next several weeks.

11:35 am PST. EEM loving this rate hike too. We are almost there at 39.50 fast, lol. I thought this month, but it looks like possibly by tomorrow. 🙂

11:28 am PST. I think we will see $24 on this wave.