5:17 am PST. I closed JDST for about +.92. It is countertrend. Silver is up this morning. Maybe we will see that spike low on UUP and spike high on FXE to my targets that I was looking for yesterday.

5:17 am PST. I closed JDST for about +.92. It is countertrend. Silver is up this morning. Maybe we will see that spike low on UUP and spike high on FXE to my targets that I was looking for yesterday.

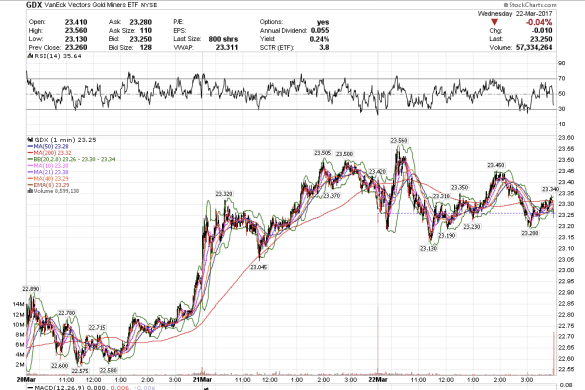

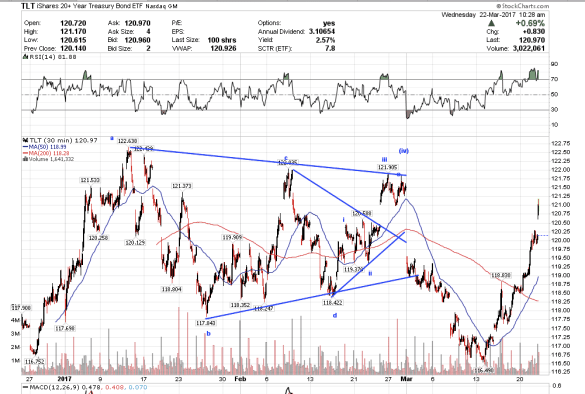

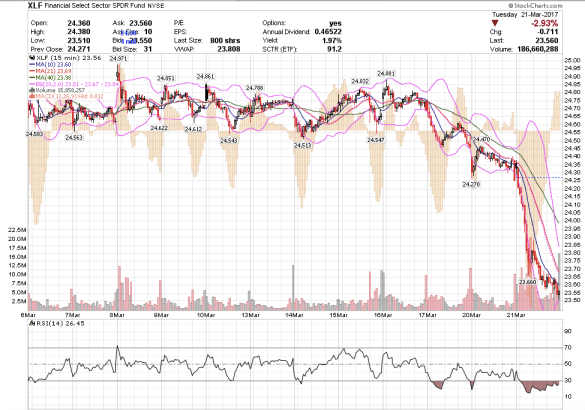

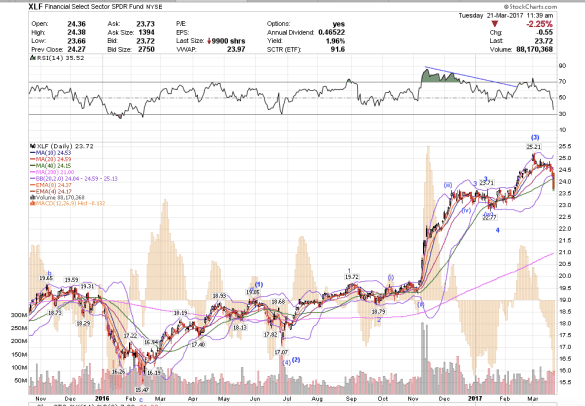

1:04 pm PST. It was a range bound, but very constructive day for the U.S. indices. XLF tagged the 23.25 target area, spiking down to 23.23 and bounced. Gold and TLT look to have an interim top. I changed my mind about TLT going to $115 next, as TLT and gold have similar patterns, but gold seems to be diverging from TLT, so I suppose $115 is possible, but I would have to see how the price performs. Nonetheless, I am short-term bearish on treasuries now, bullish on the Dow, financials, and the dollar.

I would have liked to see UUP spike further down below 25.65 and the FXE a little higher, but with gold looking like an interim top, I think UUP is done on the downside and FXE on the upside for now.

GDX had a bearish close and I am looking for a retracement back to 22.50ish.

7:29 am PST. This might be the top here for TLT and next stop $115.

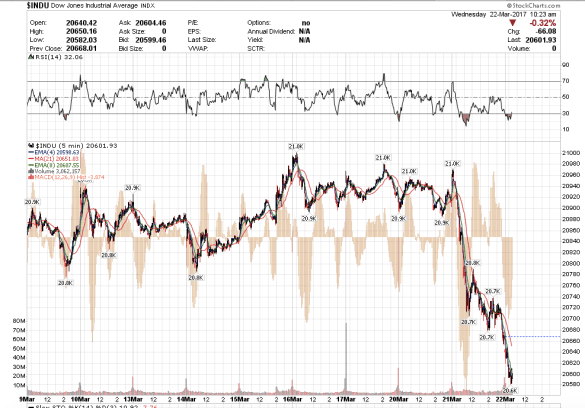

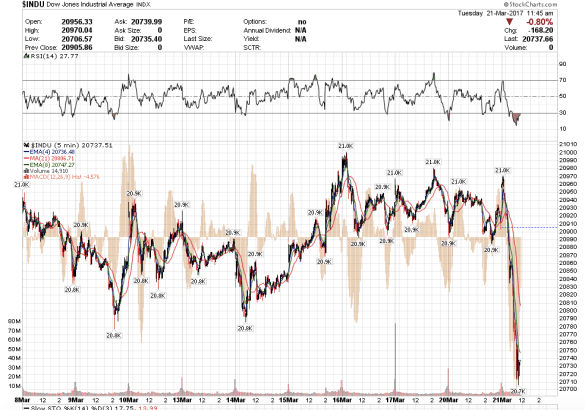

7:24, the Dow is bouncing now off 20,582. If we close above 20,640, there is a good chance the bottom is in here.

6:48 XLF spiked to a low of 23.23, about .o2 from my target and is reversing now. I think the bottom could be in for XLF. The dow went to 20,600, still might do 20,500.

1:08 pm. XLF almost reached my target of 23.25. FXE is almost at the target, UUP almost there as well. Everything is just almost there. I think tomorrow will be key. I started scaling into positions, very small, though.

10:57 am PST. The FXE needs to just pop a little above 105.04 for a double top and that is going to be a big short on the Euro down to new lows. Once XLF tags 23.25, everything might just reverse. Dow up, treasuries down, dollar up, gold and the Euro down, VXX down. Or it could do it here, either here, or we are close.

8:45 am PST. Dow bouncing exactly off 20,700. Let’s see how it does. If XLF has further downside, 20,500 in the cards.

8:40 am PST. XLF really selling off. I am looking at 23.25 target for XLF.

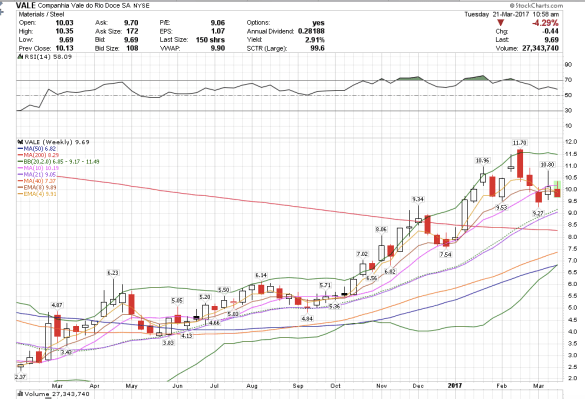

7:58 am PST. VALE selling off today. Could go to $9 instead. Not trading it, just watching it.