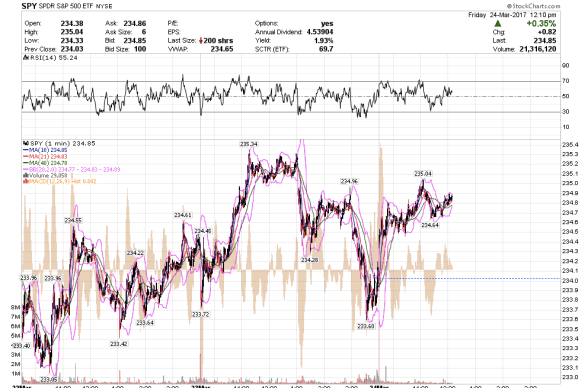

12:39 pm PST. stopped out the rest SPY puts -.01, bounce a lot stronger than expected.

12:26 pm PST. Sold AIG puts +65%.

12:22 pm PST. Scaled out of some SPY puts +80%.

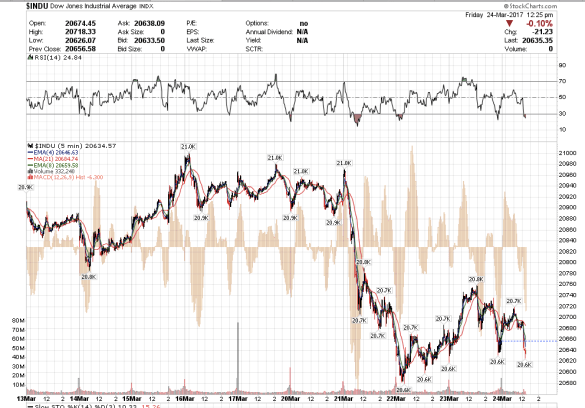

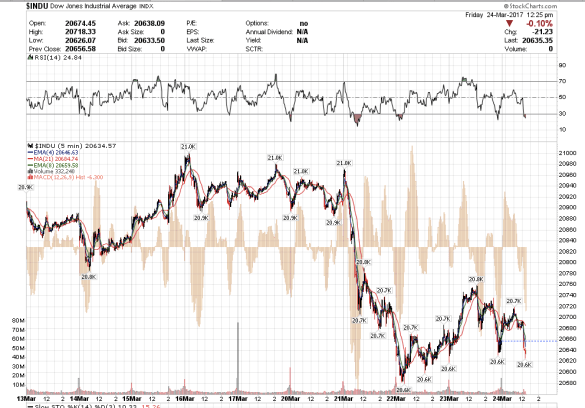

9:25 am PST. The Dow is not looking too good. I think it could go to 20,222.

12:39 pm PST. stopped out the rest SPY puts -.01, bounce a lot stronger than expected.

12:26 pm PST. Sold AIG puts +65%.

12:22 pm PST. Scaled out of some SPY puts +80%.

9:25 am PST. The Dow is not looking too good. I think it could go to 20,222.

9:11 am PST. Stopped out SPY calls -.03. TLT was starting to look bullish so I go out just before that spike down, phew.

8:28 am PST. My upside target for SLV is 17.11.

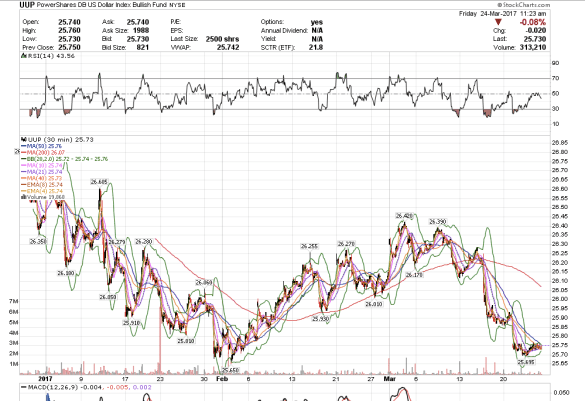

8:24am PST. UUP needs to make a final wave low to 25.60ish.

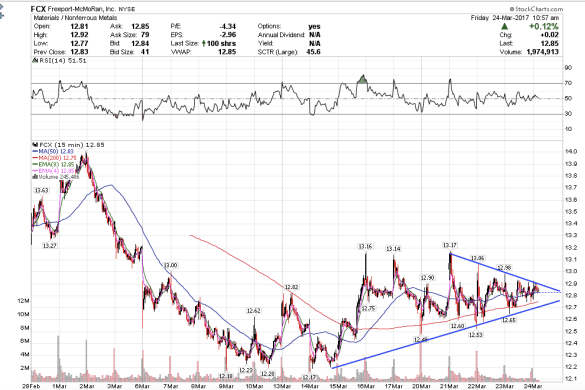

7:57 am PST. Freeport is in the tightest range ever and I think it is going to break to the upside soon.

6:08 am PST. The indices are about flat this morning. IF /es breaks above 2345, then I will probably exit my puts and go long. If we have seen the bottom, then I expect an a-b-c-d-e wave 4 triangle-wedge formation to occur over the next couple of weeks before we break to new highs. The UUP and FXE might just do those final-ending waves to the targets I mentioned in a previous post.

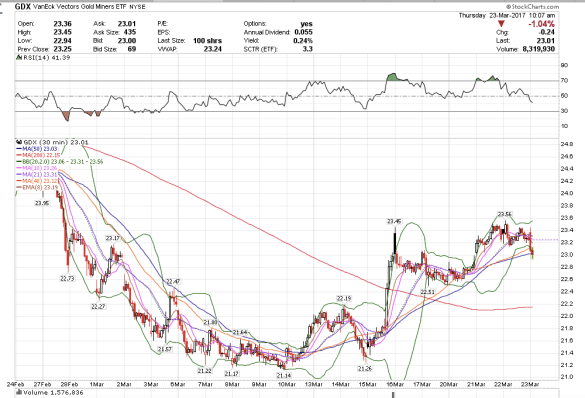

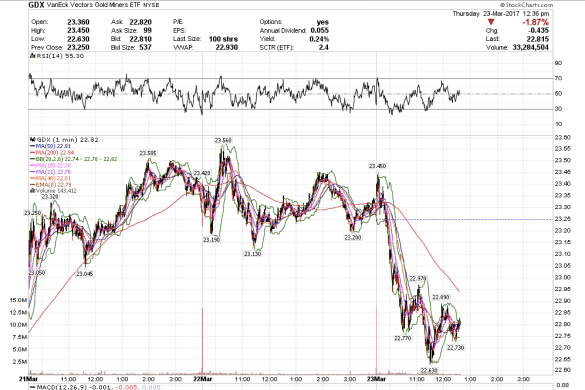

1:01 PM PST. GDX looks like a bullish close. I have a small SPY put position.

12:18 pm PST. The Dow might go to 20,250. The bottom perhaps is not yet in. Stopped out XLF calls -.01, VXX puts -.06ish.

10:07 125,000 share block trade on UUP. Bullish above, bearish below. The dollar might finally spike down, and gold might rally as a result. Or the reverse, depending. Watching UUP.

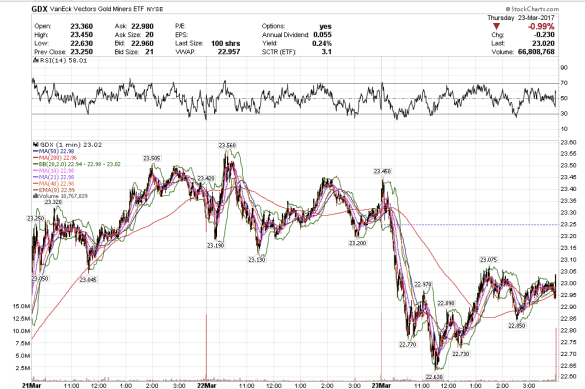

9:37 am PST. GDX almost reached my 22.50ish target, bouncing off 22.63. I think it might still get there today.

7:23 am PST. sold remaining GDX puts, weeklies expiring next week, for +50%. Bought at .20 sold at .30.

7:07 am PST. Sold GDX puts for about +90%. Bought .13, sold .25. Trade took about 30 minutes. I am just learning to trade options. Expiry was tomorrow.