8:12 am PST. Bullish now.

7:36 am PST. It has been a choppy morning which could continue for the rest of the day.

8:12 am PST. Bullish now.

7:36 am PST. It has been a choppy morning which could continue for the rest of the day.

The Gap between the rich and poor are widest in those societies where wealth depends on access to government, where government decides who can access wealth by force, by taking wealth from one and giving it to another. I wonder what Milton Friedman would say about the state of the world today.

1:06 pm PST. I learned a lot from last Friday and today. Very interesting gap down this morning after Friday’s bounce. Trump pulling the bill really distorted the magnitude of the bounce, but it was just short-term and indeed the indices intended to make a new low in accordance with the pattern which is where I thought it would go, but got shaken out by an unexpectedly stronger bounce last Friday into the close. This is something very new and interesting that I learned today: News can distort the price pattern for a short-term but not the general pattern and trend to where prices ultimately intend to go.

Likewise the dollar finally made its spike down today while the EURO finally did its spike higher. They sure did take their sweet time. I think I was early in looking for it. The currency markets move a little more slowly than the indices and this is another new thing that I learned. 🙂 They certainly have their own personalities. I think UUP, though, still looks like another possible new low tomorrow on positive divergence, and that is probably it for the interim. I am looking for 25.45 tomorrow.

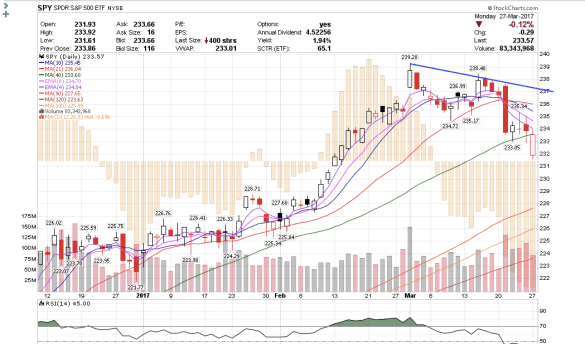

I really like how the indices recovered today filling the gap. I think there could be some chop in the morning tomorrow as the dollar makes its final low, and then SPY could rally to 236 over the next week or so.

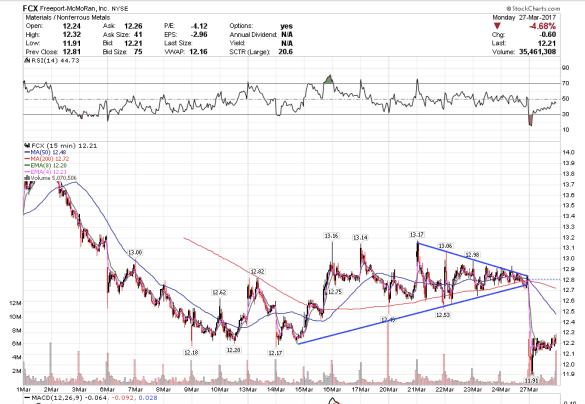

FCX broke down from that triangle as USO also sold off this morning.

Quants run wall street now, but I think it does not matter if you are a quant. Are quants the new Wall Street Scam? Well, maybe they are useful for high frequency trading. Human emotion still runs the market. The price patterns have not changed, which means it runs on human emotion – greed and fear – regardless of the quants.

I will probably reduce my intraday posting that I have done so I can focus more on my trading. While it helps to clarify my thoughts, and I like having readers, I find posting intraday has become somewhat distracting to do my trading at the same time. However, I want to put these charts up for Monday so I can focus on trading tomorrow instead of writing. 🙂

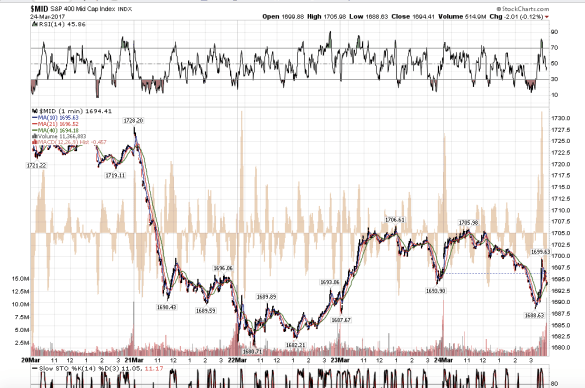

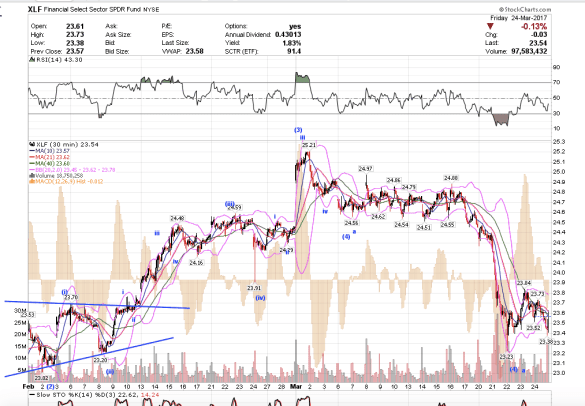

Midcaps held the March 22 low and made a higher low on Friday, which positively diverges from the Dow performance. Similarly XLF also made a higher low. The Dow eventually went to my 20,500 target, landing on 20,529.67, which I had suspected might occur all along, but then posted a possible lower target of 20,222 which I think distracted my focus a bit, perhaps – not sure – in exiting the remainder of my SPY puts which I had a really nice profit on and then turned into a small loss on the bounce, and then eventually I stopped out of. I really hate turning profits into losses. I suspect last Friday for the Dow was the low of this corrective wave.

At some point TLT and GLD are going to have to decouple if gold is going to rally to $5000, while government bonds crash. They have been rallying and declining in the same pattern since the end of 2015.

When I look at this chart it appears that U.S. treasuries are not always inversely correlated to the stock market. When the market crashed in 2008 and 2009, people did sell stocks and bought up treasuries. But in the bull market since the 2009 low, stocks and treasuries rallied have together from 2011 until last year July, when an inverse relationship returned. It appears by looking at this chart that there is some other force driving the top of the U.S. treasury market and stock market rally. The money going into stocks since 2009 certainly did not come from people selling bonds, although that could be the fuel that drives the market even higher from here on.

SPX outlined in black.

“Subversion to State Power” in China is an offense for which the state can send a person to jail for at least five years. Subversion to State Power = Contempt of Court? Refusing forced Vaccinations is subversion to state power.

Is Capitalism Humane? Capitalism is not humane or inhumane, socialism is not humane or inhumane per se, but capitalism lends itself to the free rein of the more humane values of human beings. It tends to develop a climate of higher moral responsibility and to the greater achievement in every realm of human understanding. The great virtue of the market is that people who hate each other can come together without any problem in the market. A loaf of bread may have been made by someone of disparate political views or of a different race, by people who may hate each other in any other context, but can work together in the production of that loaf of bread. In this way, capitalism promotes peace and cooperation.

In contrast, one of the effects of the welfare state is that it promotes regionalism, division, and ethnic divisiveness. “We must be fearful of the extent to which the welfare state is encroaching on our freedom,” Friedman said. “Encroaching on it indirectly by its fiscal effects. Putting us in a situation where the fiscal crisis that it tends to create, as in Britain, as in New York City, interferes with our freedom. Interfering with our freedom through which we become subject to bureaucratic control.”

He was so right on capitalism, and still is.

1:06 pm PST. When it appeared Trump would not receive enough votes the Dow began to sell off. When Trump pulled the bill, SPY recovered strongly into the close. I usually do not trade the news, but today I think it made a short-term difference. UUP made a marginal new low on positive divergence and I think it could rally to 25.85. The miners sold off into the close as did treasuries and I stopped out of JNUG with a loss. Corporate bonds rallied strongly. Have a great weekend!