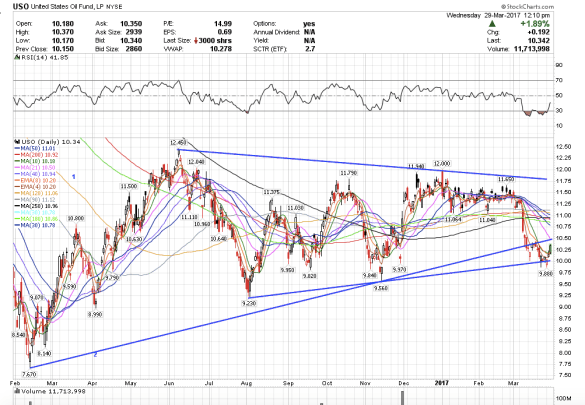

8:01 am PST. USO continues to make gains today.

8:01 am PST. USO continues to make gains today.

7:22 am PST. Selling off now, perhaps the second print was a sell.

7:18 am PST. another 584K at 23.61, going to really rip higher now, but I am out. Doing post-mortem now on my trade. lol. Calls would be up 60%. Interesting

7:04 am PST. Sold calls for +25%, expiring tomorrow. now its probably going to rip higher.

6:35 am PST. BAC had a 549,536 share block trade at 23.35. Upside target 23.78.

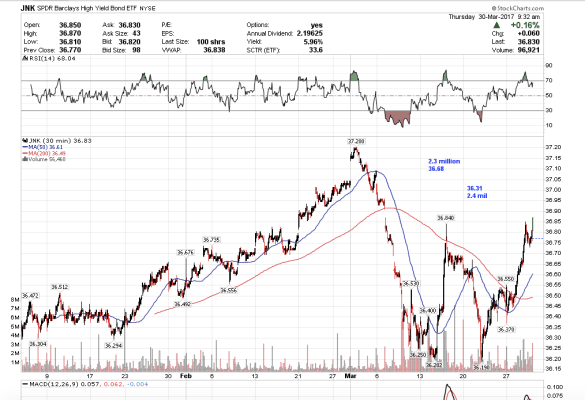

6:33 am PST. JNK getting a pop higher at the open. It closed .01 above the prints yesterday which implied bullishness today and having it now. Target $37.

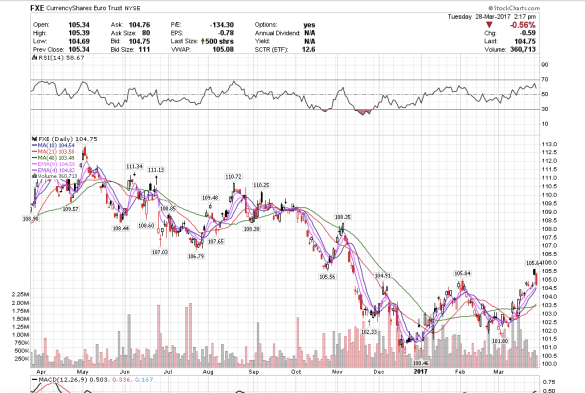

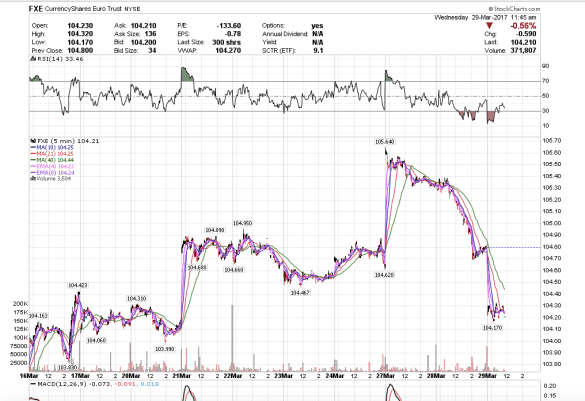

6:13 am PST. FXE has made a new low to 103.98 this morning. I think post lunch it could do a countertrend bounce back up to 104.50 over the next day or two.

1:08 pm PST. I had to laugh because SPY decided to do the range-bound correction first before making another attempt at $236. I did two good trades today – I closed out my FXE puts for +120%, the best returns I have had so far since wading more into the options market this year. Second, I closed out BIDU calls from two days ago for about 40%. The rest I stopped out of and there were a lot of em: GDX, GLD, SLV, TLT puts; AAPL, SPY, DAL, FXI calls. I trade the weeklies. Some of them expire this Friday and they move fast. I think, however, had I held onto my AAPL and SPY calls until the end of the day in accordance with my view that SPY would try for $236 I probably would have profited, but being new to options and seeing that the trade was not going in my favor I think I got shaken very easily. So, good learning experience today. The rest, I am glad I got stopped out of.

JNK closed .01 above the prints, which would imply bullishness on SPY, but I am not sure, so I have no trade on there.

Interestingly, treasuries were up today along with the indices, dollar, and gold.

9:10 am PST. Oil is really making some gains today. I wonder if USO will now rally up to $12+ over the coming months. It looks bullish to me. Either it could do one more wave down to $9 or that is it on the downside….worth watching.

9:03 am PST. The high-yield corporate bond etf, JNK, saw a 590,065 share print at 36.76. JNK tracks HYG and SPY. That is interesting for what it says about what direction the market makers have bias towards. Bullish above, bearish below.

8:46 am pst. The Euro etf, FXE, gapped down this morning and continues to look bearish.

1:05 pm PST. SPY chopped around during the morning session and found its footing rallying almost to my $236 target. I closed out AAPl calls for 25%, SPY calls for 25% and GDX puts for 60%. But my AAPL and SPY calls eventually more than doubled during the rally. Live and learn. I think we could still see 236 tomorrow on SPY and then we will see how it does there. Could doji and then do a range-bound correction.

11:17 am PST. The Euro is done on the upside. We finally got that spike higher that I had been looking for nearly a week and it is done. The Euro is now going to sub $100 in a month or two. Happy skiing!