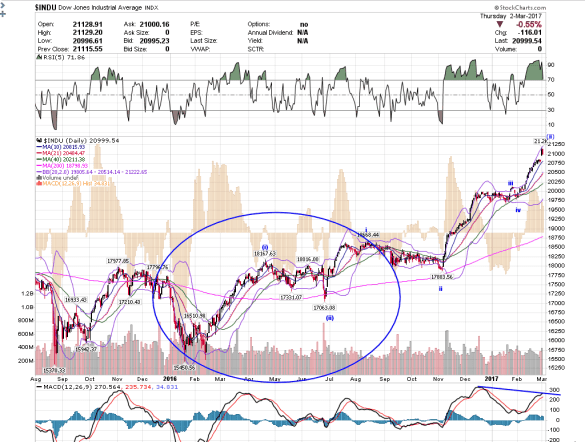

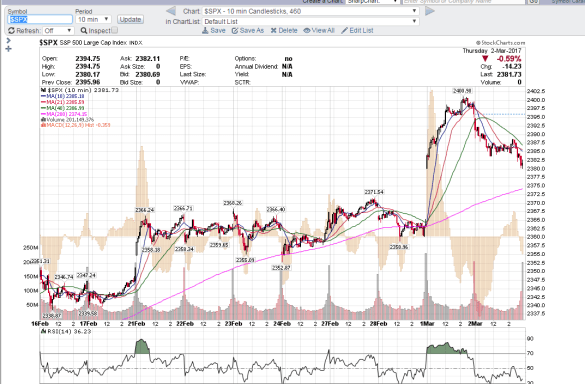

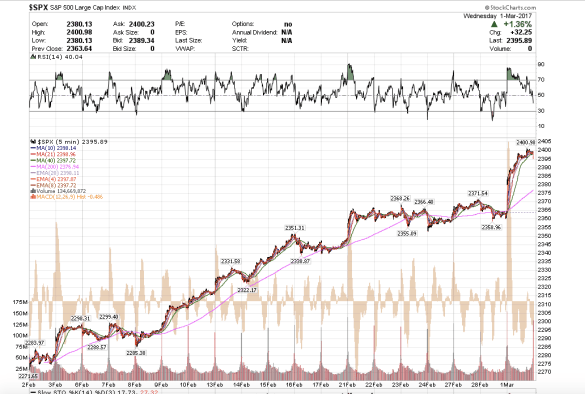

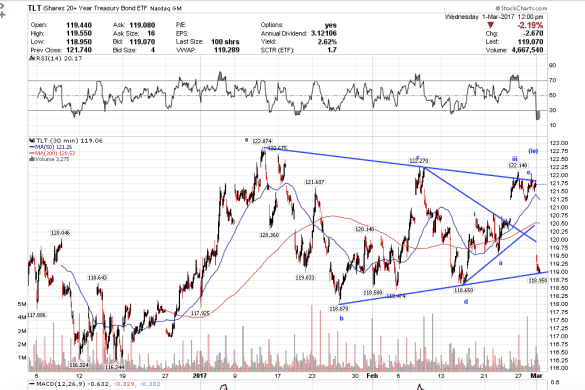

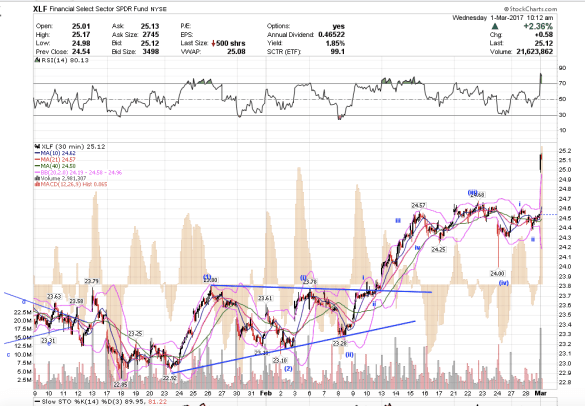

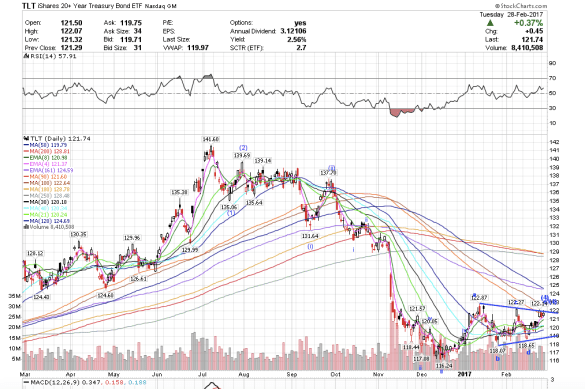

1:05 pm PST. The Dow and U.S. core indices sold off into the close as traders understandably took profits off the table. It has been quite a run! I think the wave (iv) correction can start at anytime. I am seeing a lot more newsletter posts about “if you missed this rally you can still buy”, etc. I think people are starting to realize what they have missed. There is an outside possibility that SPX could make one more high to 2410 on negative divergence next week, and then corrective wave (iv) could start. It is interesting that TLT and the VXX never made a new low while the indices rocketed higher yesterday.

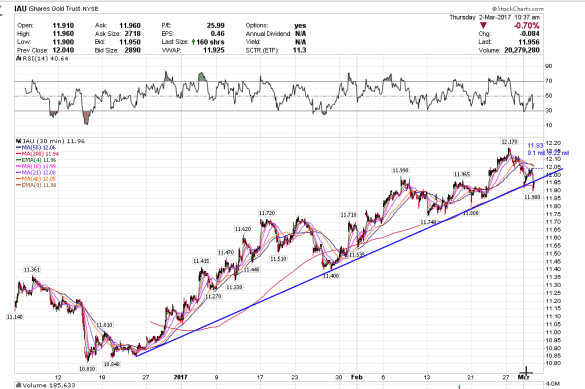

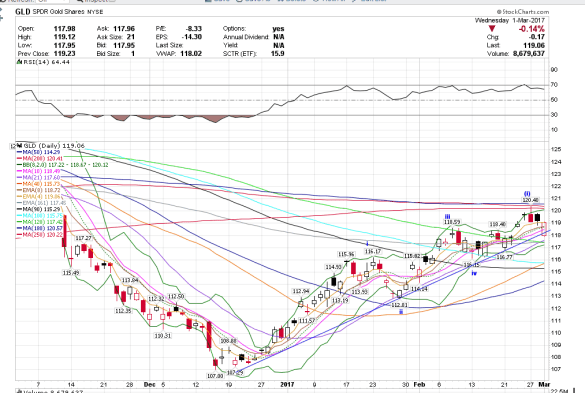

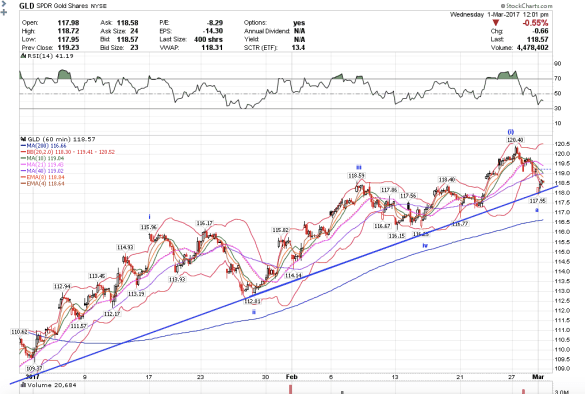

Silver broke down very quickly today. I was short GLD off those IAU prints, but it would have been interesting to consider shorting silver too. lol. I am still a bear on silver. The precious metals are going to have to do some bottoming work.