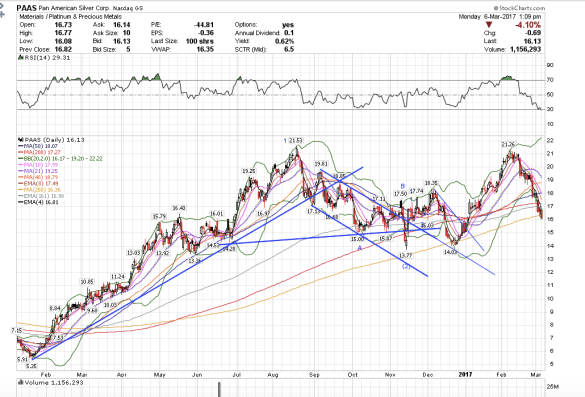

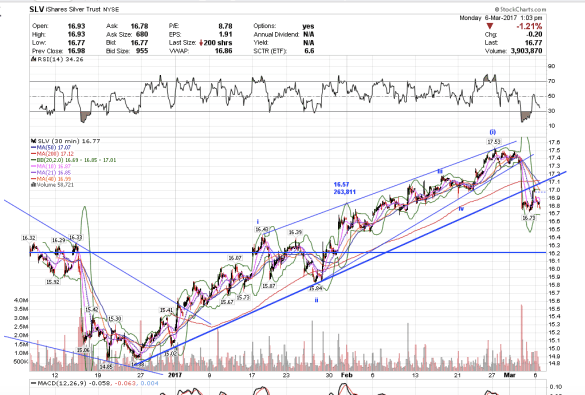

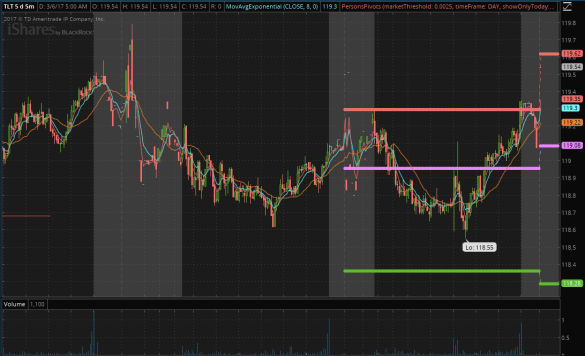

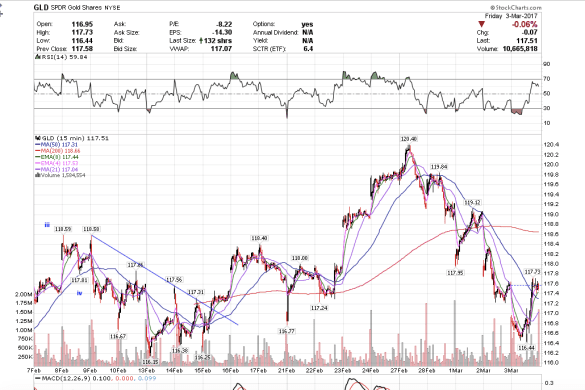

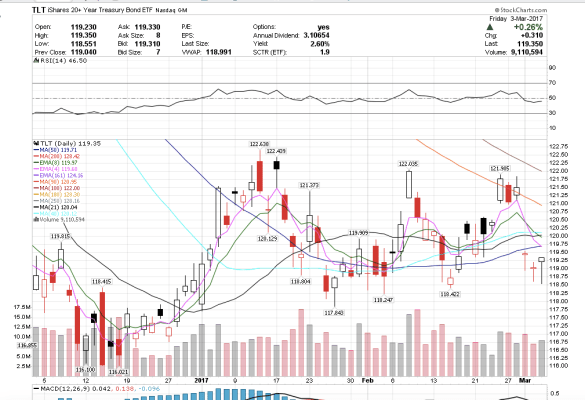

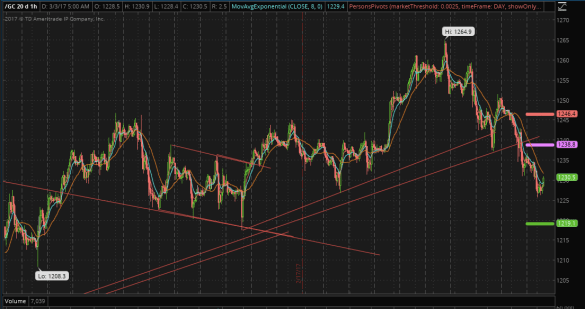

10:10 am PST. PAAS could drop all the way down to $13 by the time gold and silver are done correcting. Likewise, I think TLT is going to go to sub $116 on this current move after the Fed rate hike announcement. Just because everyone knows that the rate hike is going to happen does not mean that the market is done pricing it in yet. That is what I thought the last time the Fed raised rates last December- that the rate hike was already priced in – but it was not the case. Gold and treasuries both rallied into the Fed, and then sold off dramatically after the announcement despite the fact that I thought everyone knew the rate hike was coming. I expect probably a similar reaction this time. The market will probably go into a sideways holding pattern until next Wednesday, with gold and treasuries bouncing into the Fed. If I see that happening, I am going to watch out below.