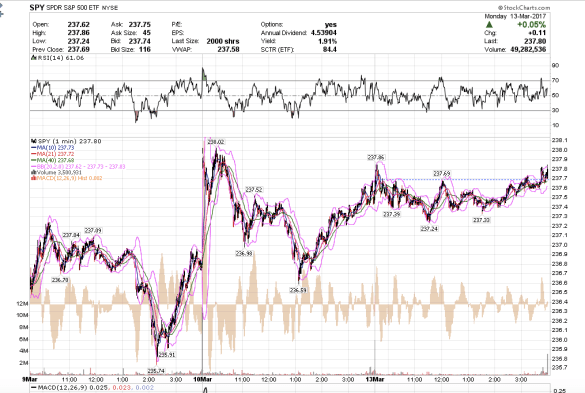

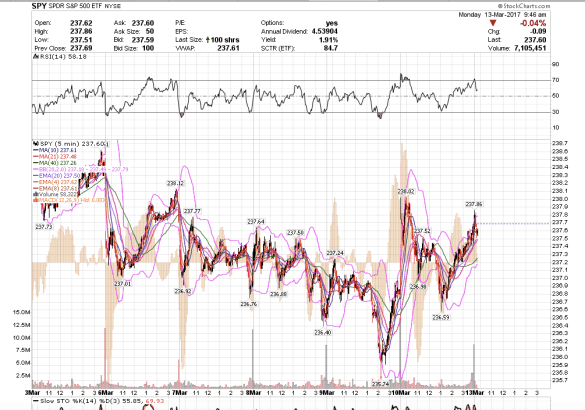

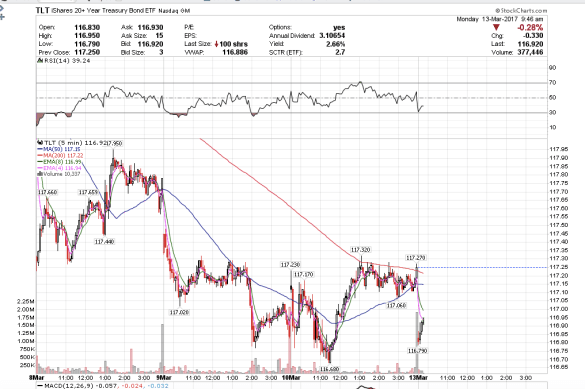

1:01 pm PST. Spy consolidated in a really tight range today and closed in a bullish posture for tomorrow. TLT continued its slide.

1:01 pm PST. Spy consolidated in a really tight range today and closed in a bullish posture for tomorrow. TLT continued its slide.

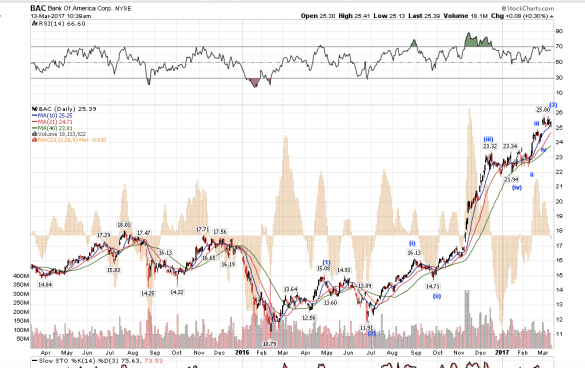

7:40 am PST. I feel like I have been waiting forever for BAC to go to $26.25 on negative divergence to finally complete this wave (3).

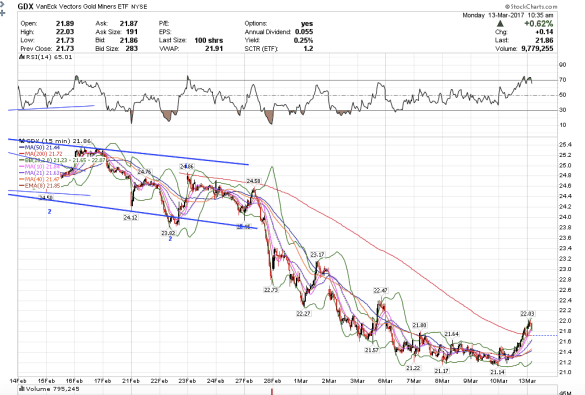

7:36 am PST. GDX is bumping its head up against resistance and probably headed to $20.35.

6:47 am PST. TLT continues the slide after the bounce. SPY probably more consolidation today.

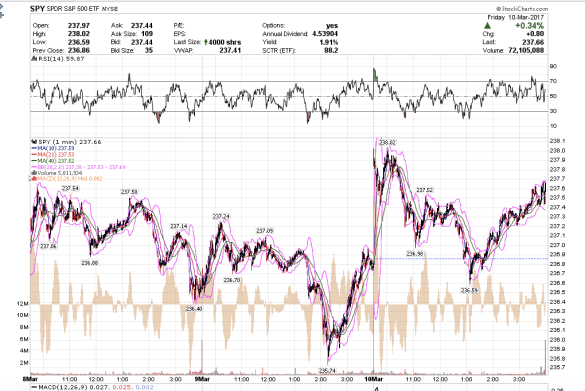

1:05 pm PST. This week was a good one for short sellers in so many different markets from gold and silver, to oil, to U.S. indices, to the U.S. dollar today, and even some emerging markets.

SPY closed well and it looks bullish. Have a great weekend!

11:47 GDX is having a bounce and I am looking for 21.80. I think after this bounce GDX still probably has a little more downside just like TLT.

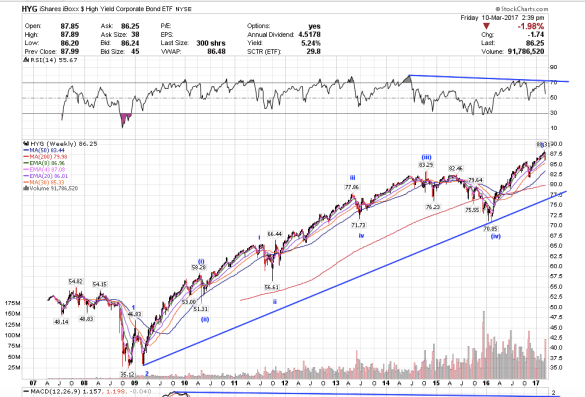

11:40 am PST. The High yield corporate bond etf, HYG is at risk of breaking down from the up-trendline. If it does, that spells bearishness for the U.S. core indices too as the HYG tracks the Dow. If HYG breaks down, then it could drop to $80, possibly $77.50. There was a 1,795,376 share block trade at 86.44 and we are below that now, but bouncing off the trendline.

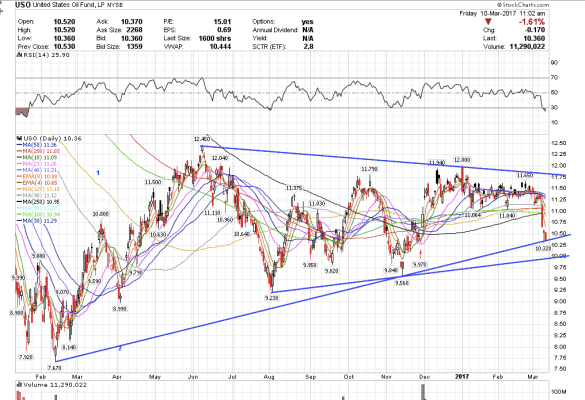

8:02 am PST. USO about to breakdown from the first lower trendline. Next is $10.

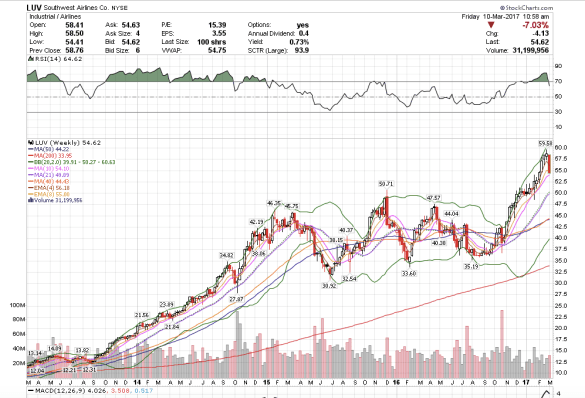

7:58 am PST. Southwest is really dropping hard today, which is interesting. It could spell a much larger correction on the horizon for the indices, and I would be wary of looking for $25.50 on XLF.

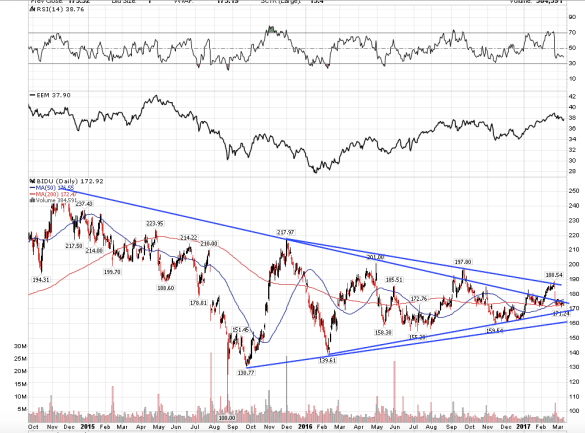

7:49 am PST. BIDU is still in the triangle. Watching for a break either way.