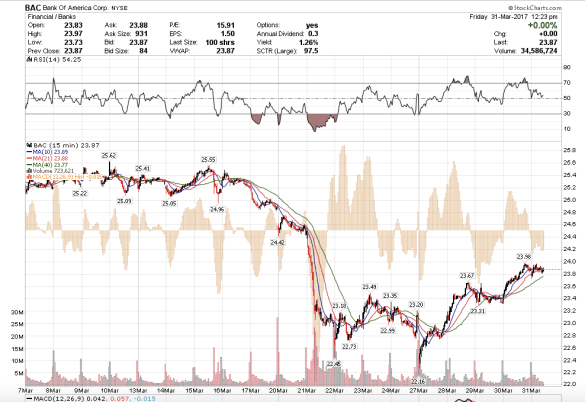

9:25 am PST. How did I know to go long BAC yesterday at the open? Mostly pattern recognition and a few other hints, such as watching the market makers. I only got 25% on that move up, actually, not the whole thing. Being new to options I was not sure how theta would decay it against delta on an option expiring the next day, so I got out after showing a little profit wanting to lock it in and not turn it into a loss. Time decay goes a lot faster the closer you get to expiration.

I bought the 23.5 calls at .14, March 31 weeklys. They eventually went up 340%. Today they are trading at .38, in the money now. So it appears that once you go in the money theta has less of an effect because you can now buy the underlying at a lower price than where it trades today. The option expires today.