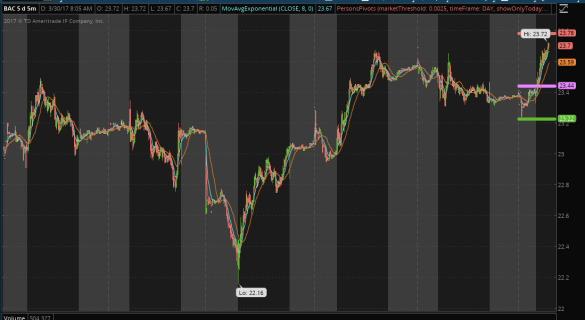

8:39 am PST. BAC high 23.75, options 100%. I want to see at what price they expire tomorrow.

8:08 am PST. BAC almost reached my target 23.78, reaching a high so far of 23.72. My options would have increased 90% at 23.72. Very interesting!! On an option that I purchased just out of the money and expiring tomorrow, I had no clue how theta would play against delta and whether BAC would actually reach my target. Target practice is key! On an option that expires in one day, theta is going to eat away real fast at those contracts. You want the stock to move in your favor immediately on an option that expires the next day, and here that is what BAC did. The trade would have taken about 1.5 hours with a return of 90% from the print to the target, with an underlying price move of .28. 🙂 The stock went from out of the money to in the money. I think once the price moves in the money, theta has less of an effect. Just learning these things – half real trading, and half paper trading in my mind. I have to have some skin in the game to really learn. 🙂 Also, to learn how much the options would move against me on the minuet corrections.