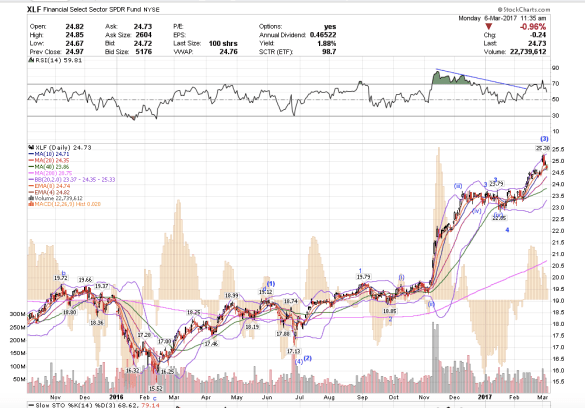

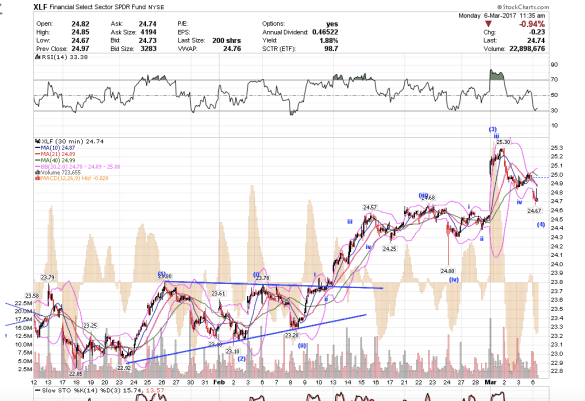

8:36 am PST. I think we could be either in a minor degree wave (iv) in XLF, which would only be about a week-long corrective a-b-c-d-e triangle, or a larger wave degree (iv) which would take one-to-two months. I think what happens next week with the Fed is going to jolt the market, but leading up to that event, the pattern will probably give us a lot of clues. Unless XLF drops below 24, I think we could be in a minor degree wave (iv). Typically corrective wave iv’s are choppy making you think that it is definitely going in one direction all the way, only to turn around and go the other way, while eating up time.