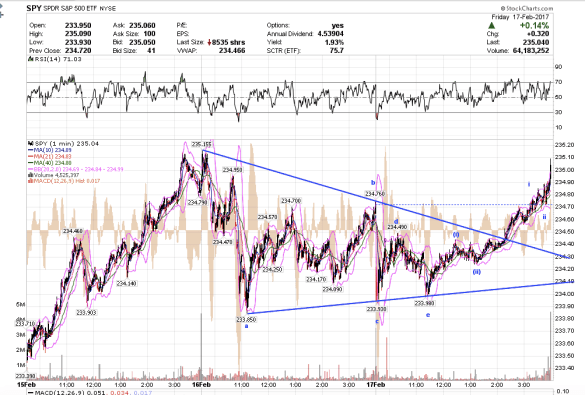

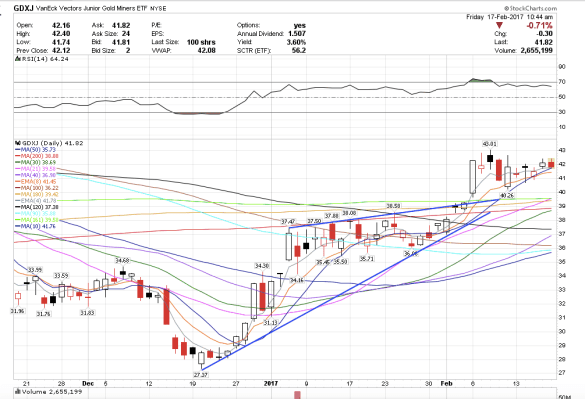

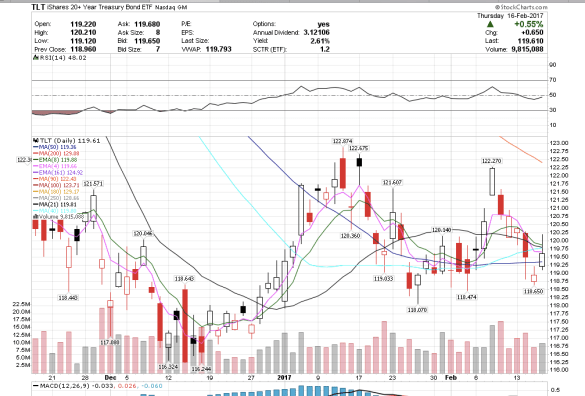

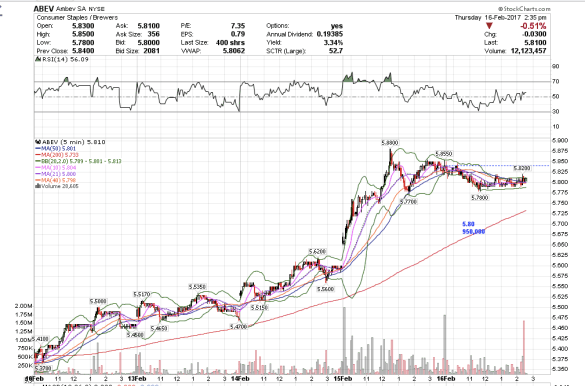

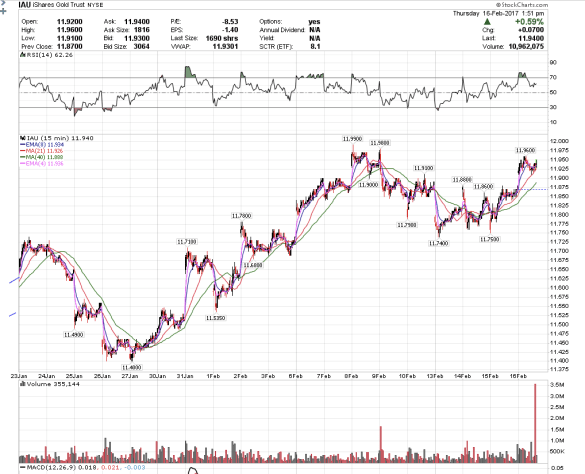

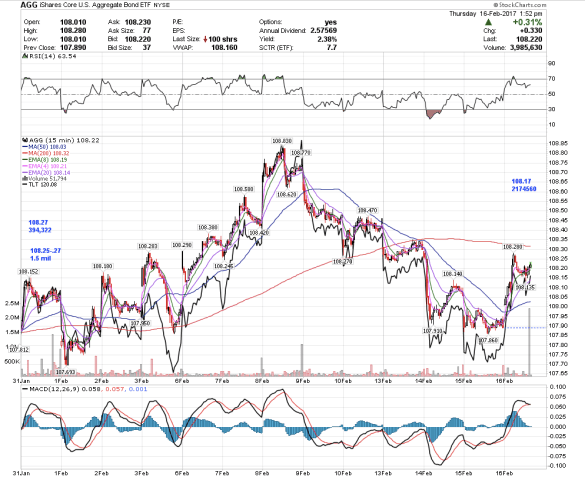

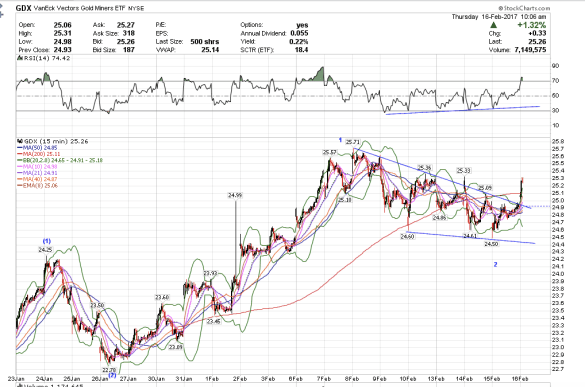

2:48 am PST. Yes, I do watch and trade the market during the wee hours of the morning in California. Lol. If you are in the east coast, its probably just regular morning hours, but you are lucky that I am up now. 🙂 This is when I think best. Now I think I understand what is happening. Gold and bonds are going up because the SPY still needed to do its wave c-d-e, which I had mentioned, but then seemed to forget at the close yesterday when I got preoccupied with the AGG prints. Yes, the market makers were indeed buying gold and bonds. Good thing I came to my senses and turned around and bought gold, lol. But it is an ending wave v in gold. I stopped out of my TLT this morning.

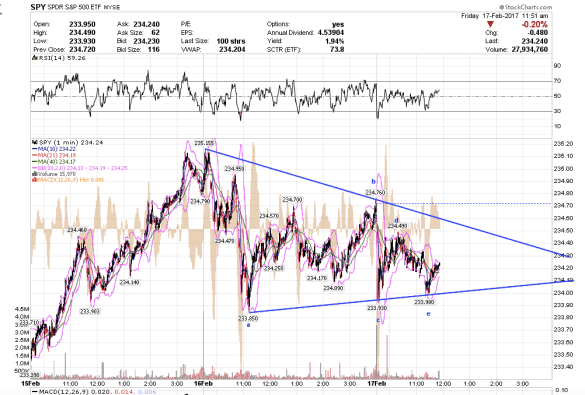

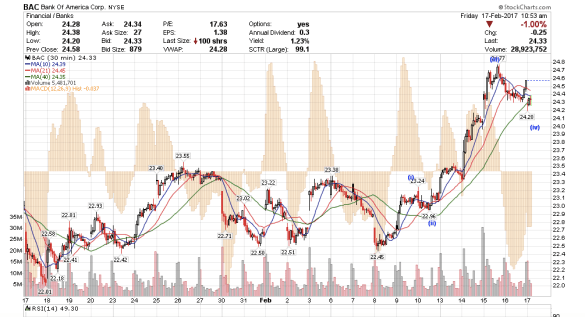

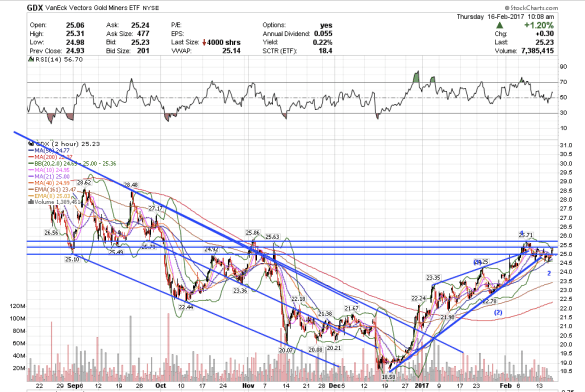

What I see is that the SPX will go up to new highs in an final ending wave to end the Major wave 3 up from 2009 by next week as gold makes a minor retrace. Then the indices will likely correct for 3-7 months as gold rockets higher in its wave 3. After the market finishes its Major wave 4 correction, gold will correct again.

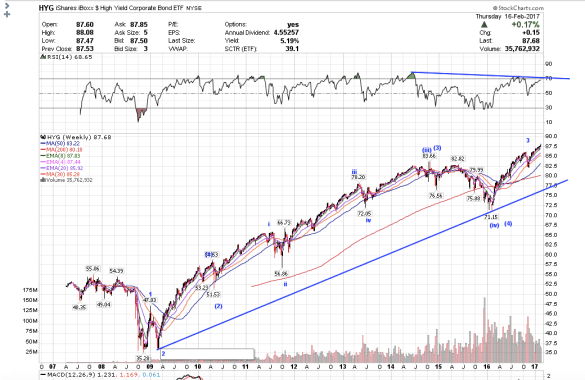

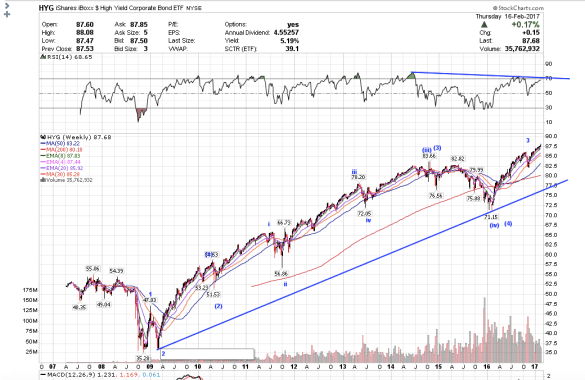

The HYG, corporate bond etf, tracks the DOW very closely. It is a slower moving vehicle than the indices, but has basically the same trend. It looks to be topping by the end of February in major wave 3 up since 2009.

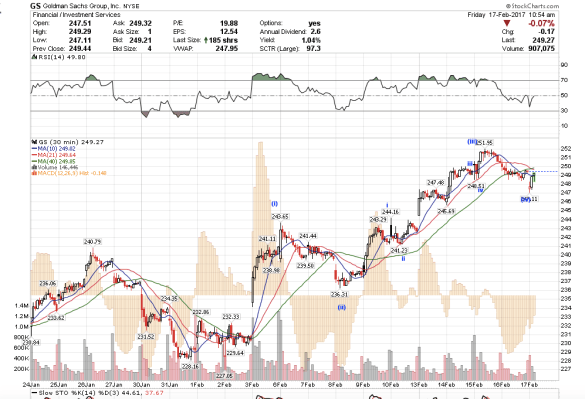

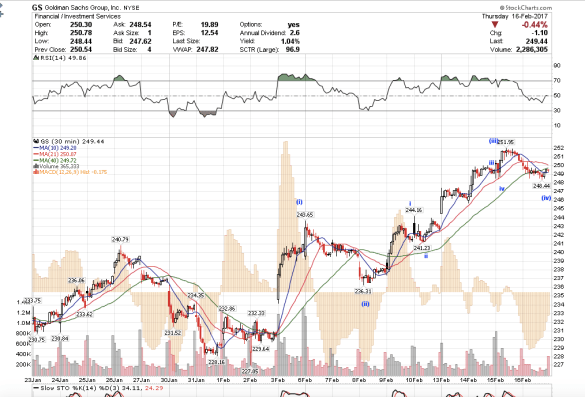

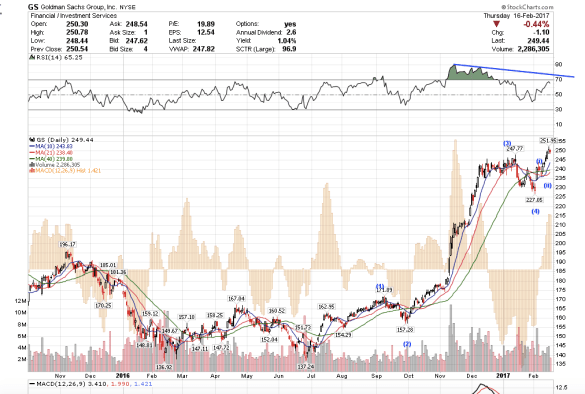

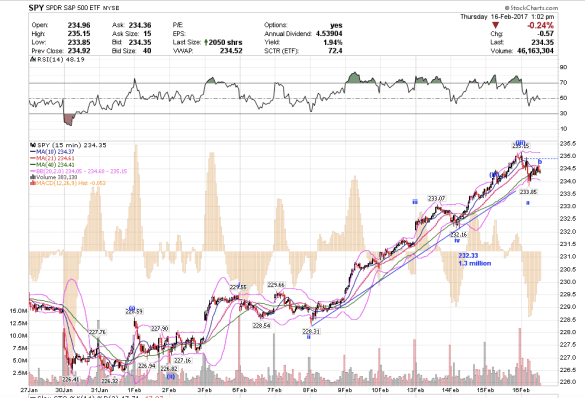

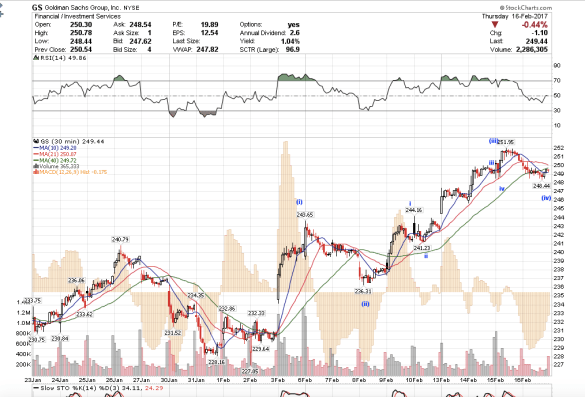

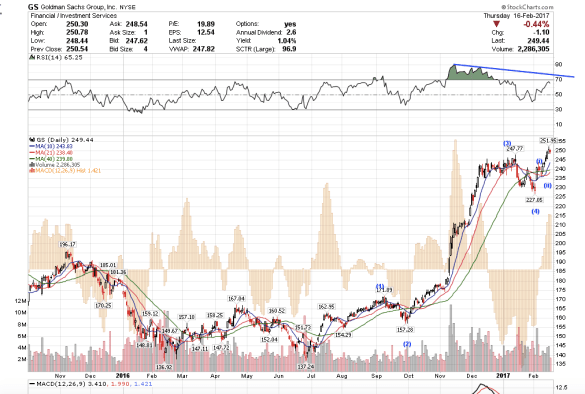

The Goldman Sachs wave counts also confirm that there is only a minute wave (v) higher, which looks like it will probably end next week. Wave (i) took three days. Wave (iii) took five days, and so wave (v) will take less than a week to complete which brings us to next week. Once wave (v) completes that will probably mark the end of Major wave 3 in the indices, at least that is my thesis.

This is a look at the Daily chart and the RSI confirms a topping process right now.

This morning’s low in the SPY for the completion of minute wave (iv), and is a buy for me for one more ending minute wave (v). Simultaneously, the miners are a sell in an ending wave up.