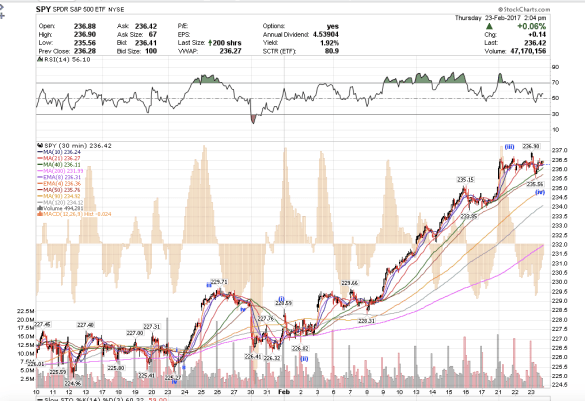

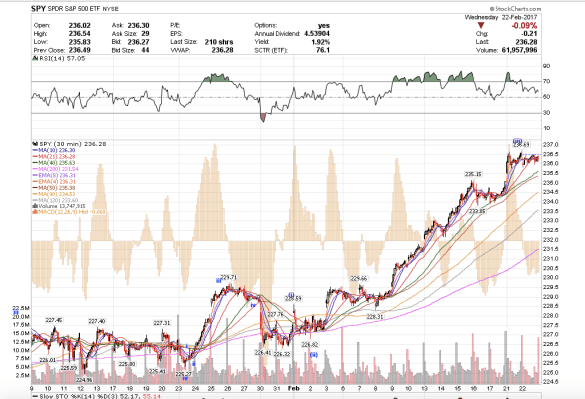

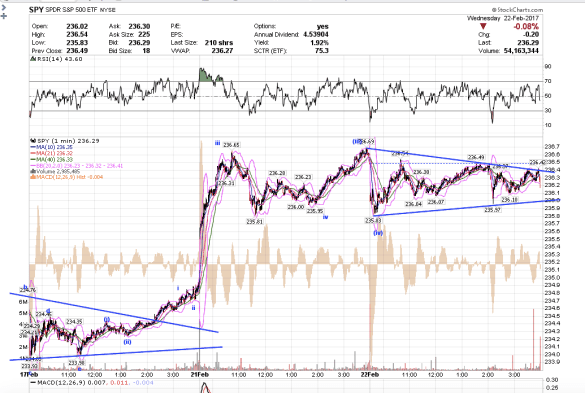

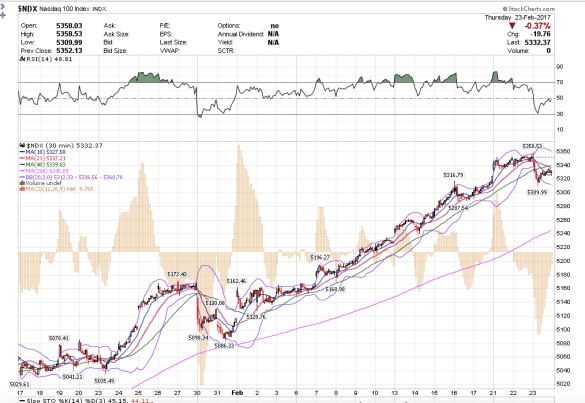

1:05 pm PST. QQQ going to make a new high. Long.

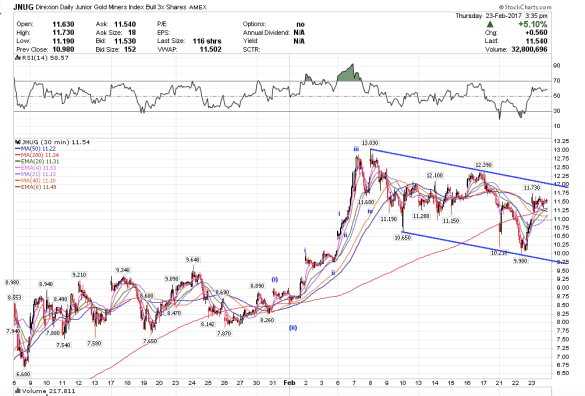

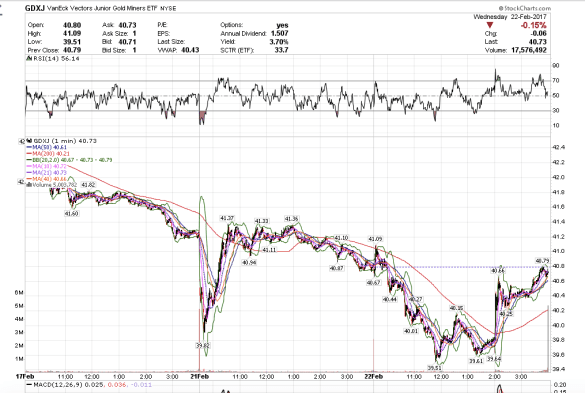

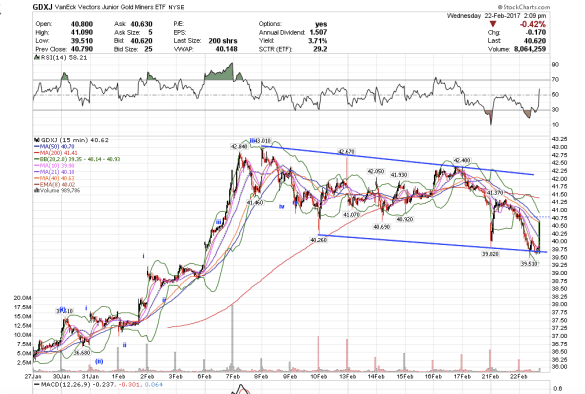

1:00 pm PST. I took profits on JNUG +.90 avg. The miners sold off into the close.

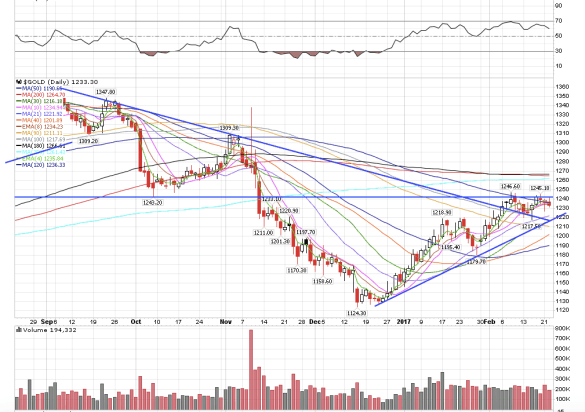

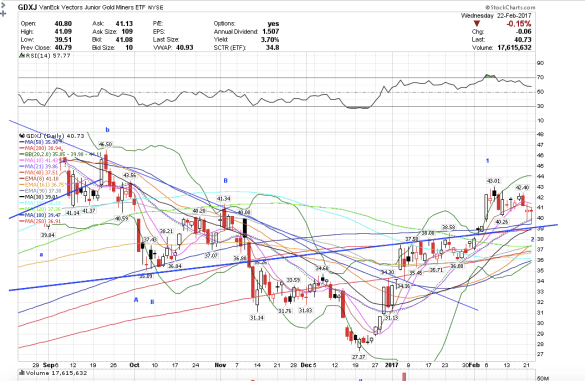

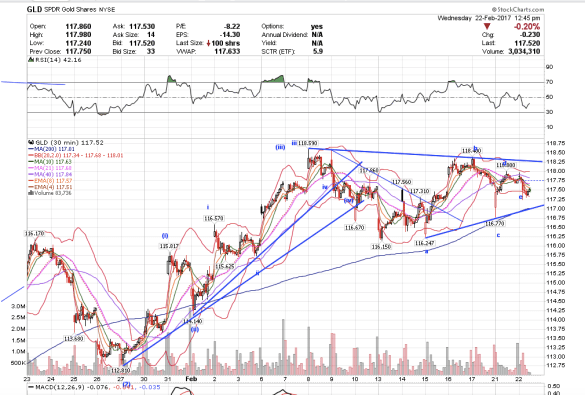

12:35 pm PST. I have been long JNUG from 10.35 since yesterday. JNUG is going to break up out of this bull flag formation. It appears a lot of people are still bearish on gold thinking it is going to break below $1000. That is interesting. Well I trade my own indicators. I do not use Socrates. Yes, I am going to see MA even though I do not really use his system or fully listen to his market forecasts, because I like the guy. I like his outlook on global macroeconomics, politics, and cycles theories. Plus, I want to have a reason to see Hong Kong for the first time. He makes me think, dig deeper, and has helped make me a better trader. In fact, I have gained a lot more confidence in myself as a trader knowing that I can trade on my own and not have to rely on someone else’s take on the market, especially someone with an illustrious track record.

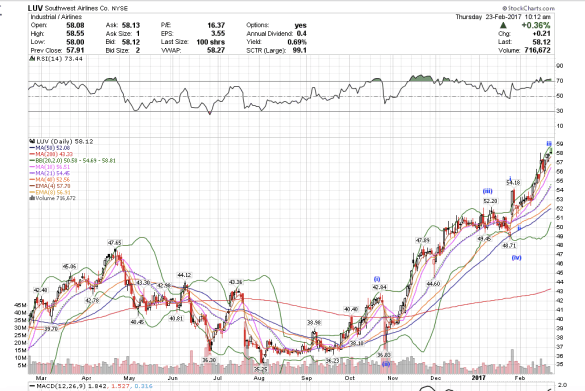

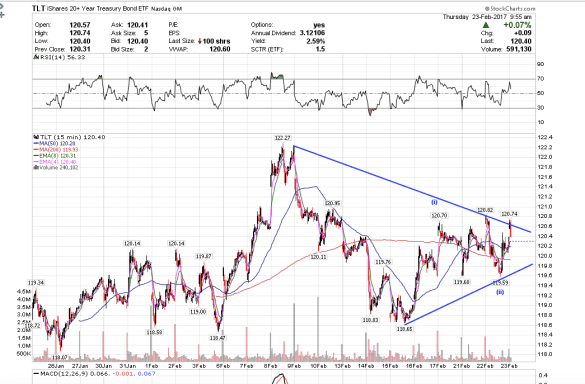

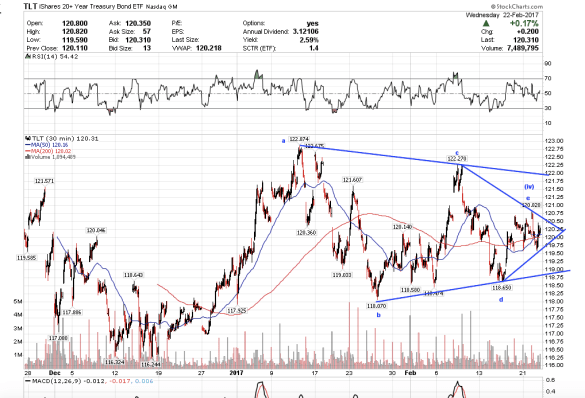

I expect SPY to make a new high tomorrow or next week. TLT is starting to look bullish. Gold and silver still look bullish to me.

Happy Trading!