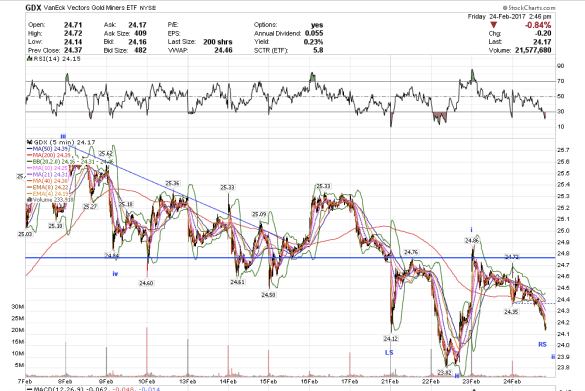

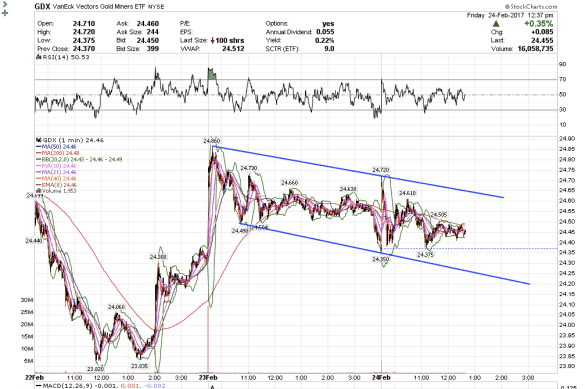

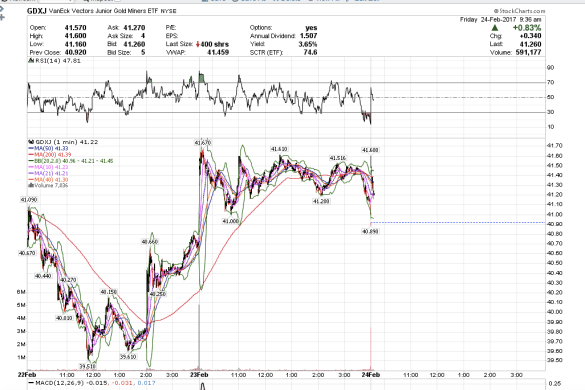

3:58 am PST. I stopped out of my QQQ. JNUG jumped right back up after yesterday’s head fake sell-off. This is uber bullish price action in the gold, silver, and precious metals mining stocks. I actually bought back in after the close yesterday on JNUG at 11.20, but it was just a small position, because the sell-off looked suspicious like a potential wave ii and I wanted to test it. Gold looks like it could close this week above the critical 1243.20 level. Then I will look to see if it will close the month above to confirm the new wave 3 up is on.

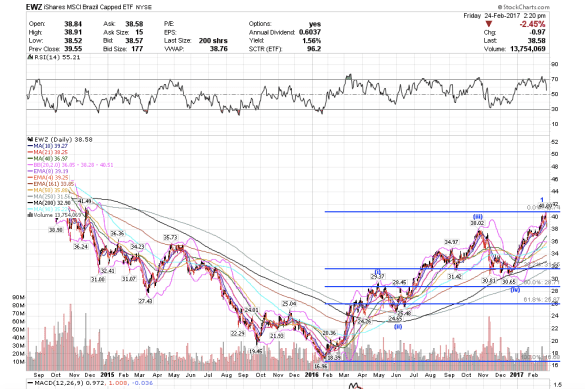

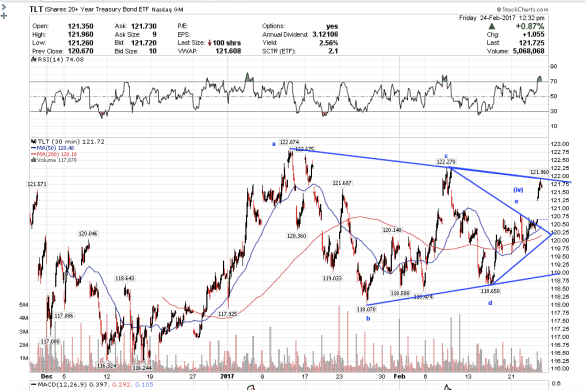

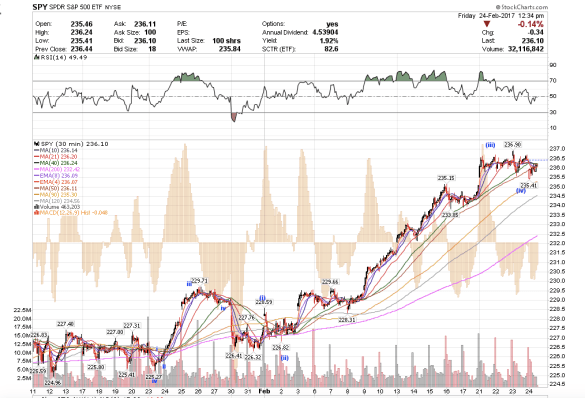

I am not going to try to attempt going long the indices anymore. With TLT, gold, and silver looking bullish, it is just not worth the risk. We are so close to a top everywhere I look on the Dow, SPY, QQQ, retailers, corporate bonds, airlines, and banks. It is not worth trying to get those last few dollars that might not happen.

First level of support for QQQ is 128.86. If we close below that, I might buy puts.