I booked my ticket to Hong Kong for the Martin Armstrong May conference. This will be my first time visiting Hong Kong. And this will be the first time I have ventured outside the United States by myself in 20 years. I cannot believe it. My passport was so expired. lol.

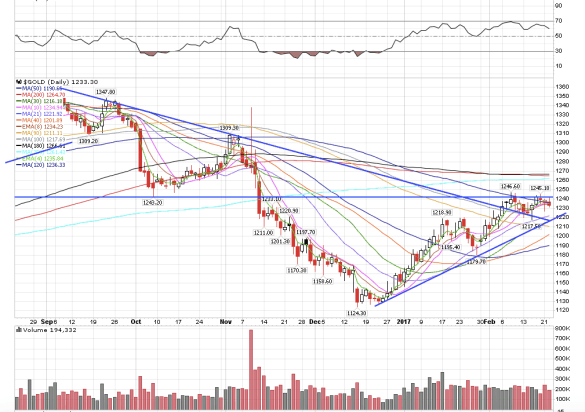

5:02 am. Gold futures are now trading above the critical 1243.20 level and are up more than $10 this morning. Yesterday’s reversal was definitely an interesting one for gold, silver, GDXJ, and treasuries. Gold has to close the week and the month above 1243.20 to signal a more significant rally ahead. I had mentioned 1243.20 as the critical overlap point to confirm that a new leg in the gold bull market was underway. You can see that once we overlapped 1243.20 gold pulled back because the market needed a rest. It took a lot of energy to do that. Now we will see if it is time to rally again.

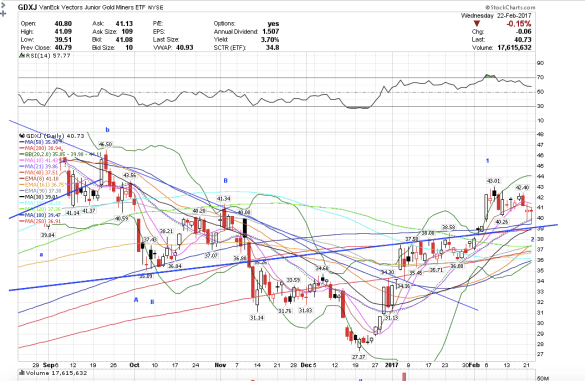

I want to post my GDXJ and gold charts up.

Gold also broke up out of the downtrend line from July and has stayed above it for two weeks now. The critical resistance level is 1243.20 that the market has to close the week and month above to signal a new bull leg up.

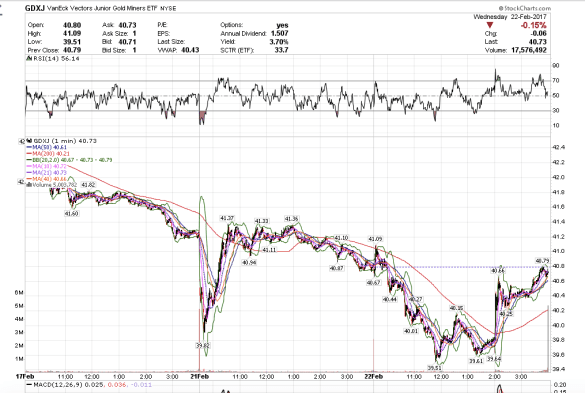

GDXJ made a new low yesterday and then rallied back up to break even at the close.

GDXJ backtested the neckline that it rallied back up above and looks like it is holding it as support. Very bullish price action.