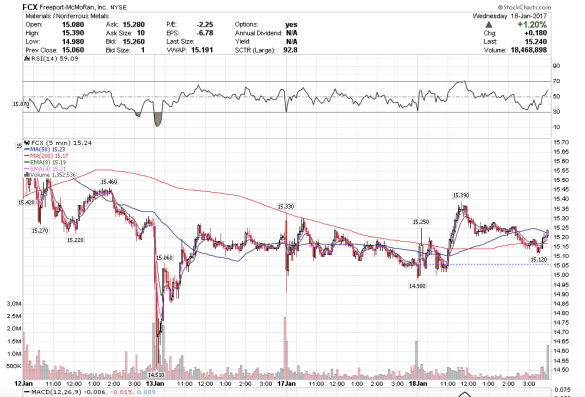

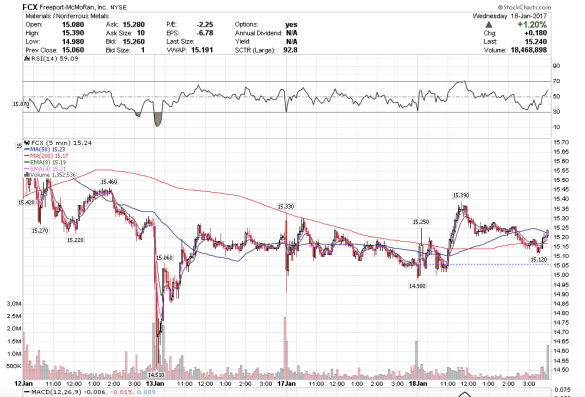

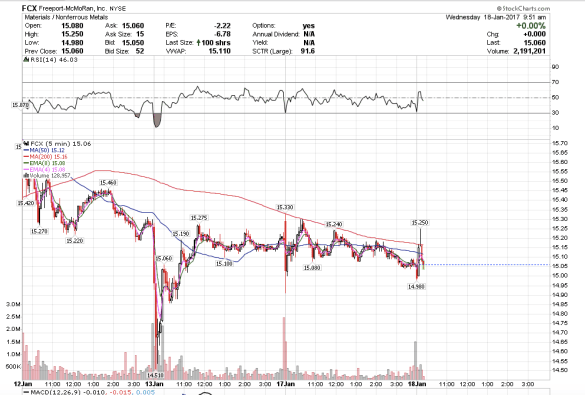

1:39 pm. We played a bit of ping pong today on FCX to the 15.35 area that I mentioned earlier today. FCX closed above the 4/8 emas today and had a small 200,000 share print at 15.16 that we closed above. It looks interesting.

1:39 pm. We played a bit of ping pong today on FCX to the 15.35 area that I mentioned earlier today. FCX closed above the 4/8 emas today and had a small 200,000 share print at 15.16 that we closed above. It looks interesting.

12:29 pm PST.

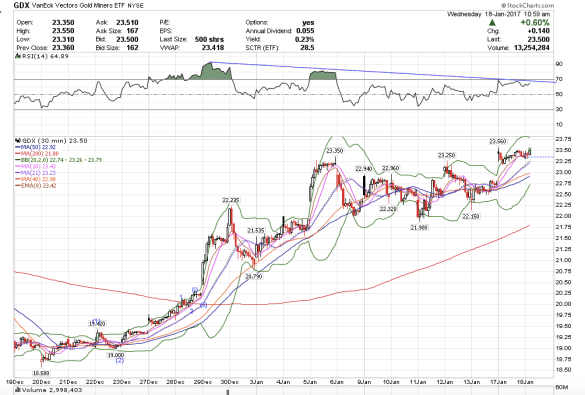

As expected, the miners and gold are selling off into the close. We saw significant negative divergence today as well as a completed five-wave count from the December low in a handful of the mining stocks such as ABX, PAAS, and AEM.

The dollar is catching a bid and could make its way to new highs. The Dow continues to trade in a really tight range possibly waiting for Trump’s inauguration.

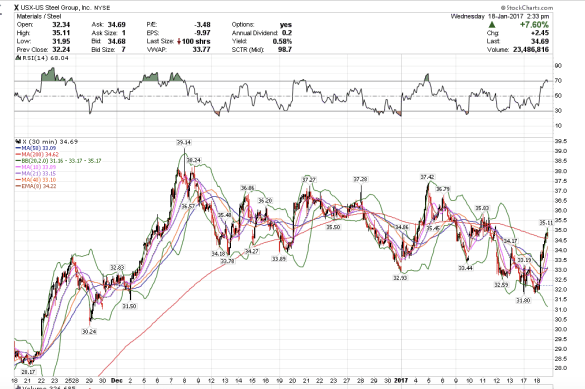

Steel stocks had an amazing rally today, in particular X.

Thank you, Marty, for posting your blog update on gold and calling a top for this week. Folks should check Martin Armstrong out at: https://www.ask-socrates.com, and http://www.armstrongeconomics.com for updates on the market.

11:28 am PST.

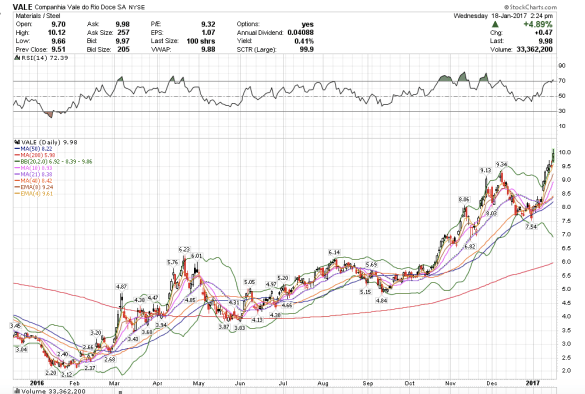

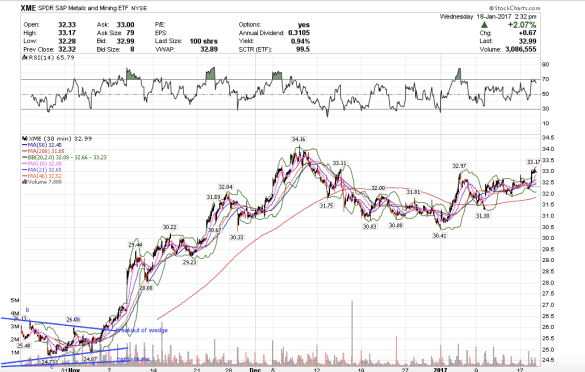

Goodness VALE. I stopped out at around 7.60 and never decided to wade back in. Hmmm, now, was that the right thing to do? VALE is probably going to retrace a little and continue its march higher. I think this is what FCX and XME have in store, so I better keep alert.

X doing a major leg up today. It needs to retrace with an a-b-c correction and then it is a buy again. X is going to look like VALE in a few weeks.

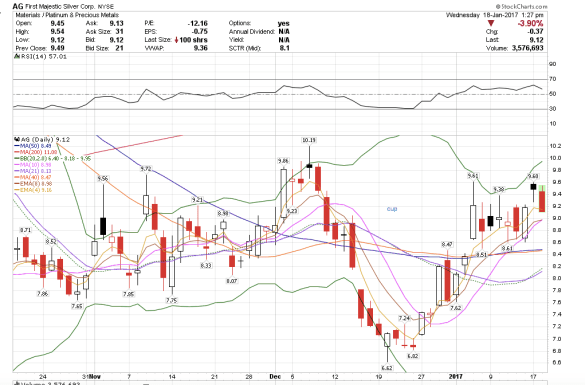

10:27 am PST. We have a nice cup on AG. Now we just have to handle it with a retrace to about 8.20-8.50.

8:58 am. Stopped out everything. I am going to wait until the close to see what happens.

8:00 am PST.

I have been scaling out of JNUG, average +.08 or so, and scaling into FAS and shorting the VXX. Lots of negative divergence on GDX. I am now completely out of mining stocks.

6:48 am PST.

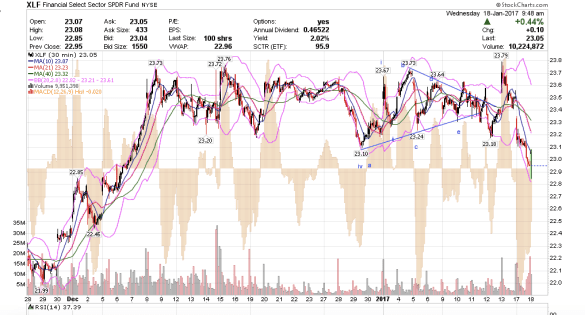

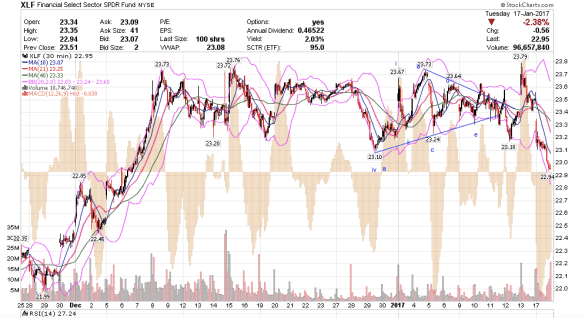

I think XLF bottomed here at the open and we are off to new highs this week. Trump’s inauguration is going to rally this market just like his election did.

Goldman Sachs moved their buying position to 14.83 in the pre-market on FCX, which is exactly where FCX went pre-market. They are also lined up to sell at 15.45. There is a large 500,000 share block to sell FCX at 15.35. I think FCX is going to ping-pong between 14.83 and 15.35 today.

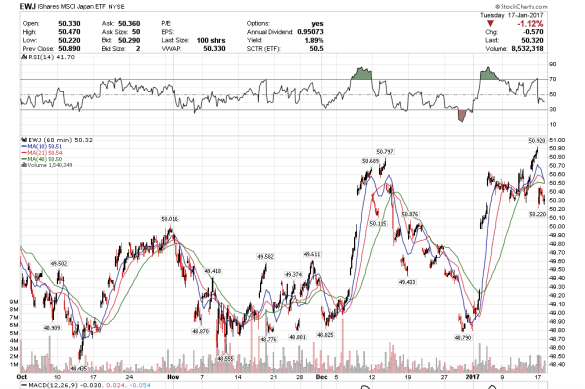

5:59 am PST. I was thinking EWJ looked overbought over the weekend. It gapped down yesterday. It could find support around $49.50.

XLF also just about tagged my $22.90 support area yesterday at the close. I think it is a buy this morning.

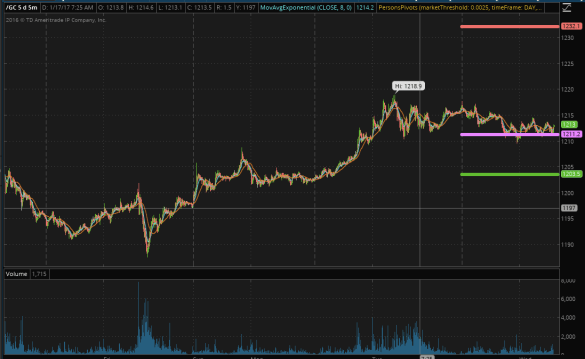

5:21 am. I am watching to see whether /gc can rally to 1223 and whether the indices have bottomed.

The reason why I still live in earthquake country, otherwise known as California, lol, is because of family, jobs, and the people here. Specifically, I like living in the Silicon Valley. Yes, I realize we have issues with our political system – believe me, I know that first hand, especially when it comes to medical-freedom rights, which is the reason why I almost wanted to move out of California. Yes, taxes are way too high. Yes, we are due for the “big one”. Yes, I have to wake up at 4:30 am in the morning to trade the markets on N.Y. time. But, there is no where else where I feel most comfortable.

There are a lot of interesting people here. I have a friend who started up a new company that has one of the most non-invasive cancer detection technologies in the world – Accuragen: http://www.accuragen.com. My son used to have playdates with one of the kids of a founders of Instacart: https://www.instacart.com, who lives just blocks from us. I have another friend who just organized one of the first ever China-U.S. biotech investment events in the S.F. area with people flying in from all over the country: http://cticcapital.com. There are so many innovative people who live in the area.

We also have electric-car-charging stations even at our local library so when people go to check out a book they can charge their all-electric cars. When I drive around the neighborhood I get to see the cute Google self-driving-test cars. Life is interesting here. I get to see a lot of innovation first hand. Or perhaps it is just inertia.

This is an electric-car-charging station at our local library.

Here is a picture of Google’s self-driving-test car that I took Tuesday afternoon while driving my daughter to her dance class.

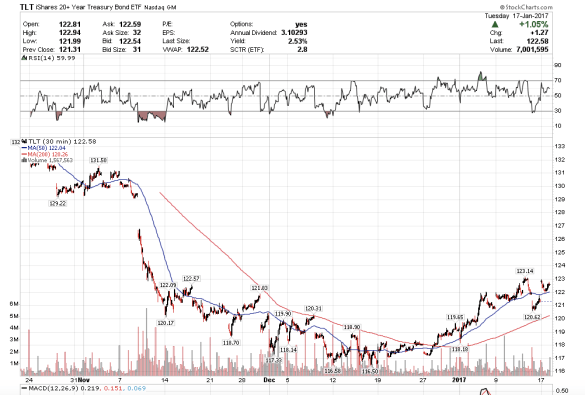

1:01 pm. We closed .01 above the prints on GLD at 115.85 which is normally bullish. It looks like TLT could make one more high and the dollar one more low. I am waiting for the TLT to complete this wave higher with a new high above 123.14 on negative divergence so I can re-short the VXX.

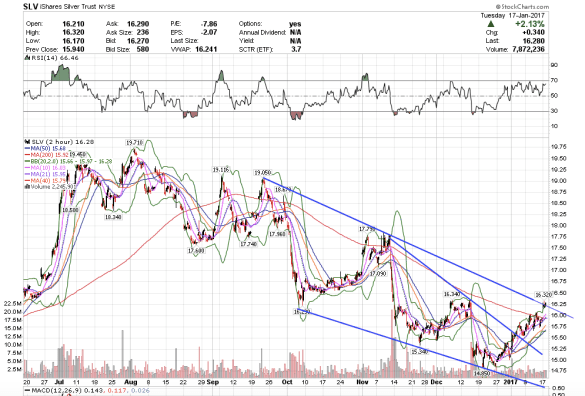

Silver also had a strong close just above the downtrend line.