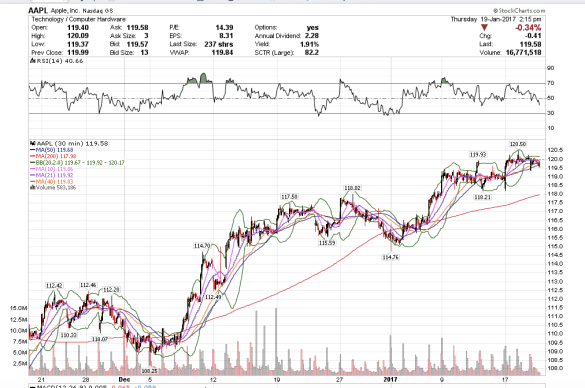

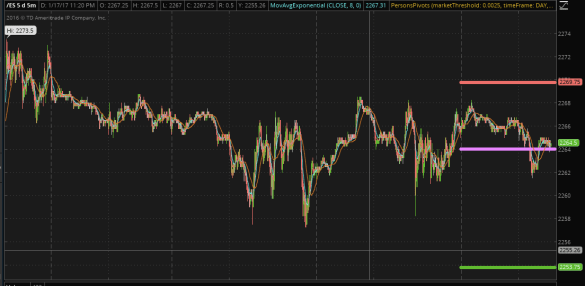

11:19 am PST. I bought puts on AAPL too. I think AAPL is topping out and will lead the tech stocks lower. AAPL had 600,000 shares block traded at 119.81 and 500,000 shares block traded at 120.00. Plus it is below the S1 pivot right now. If we close below the prints, look out below!

Steve Jobs, may you rest in peace. I walk by your old house from time to time. I bought the last three of your company’s iphones, and I love your products.