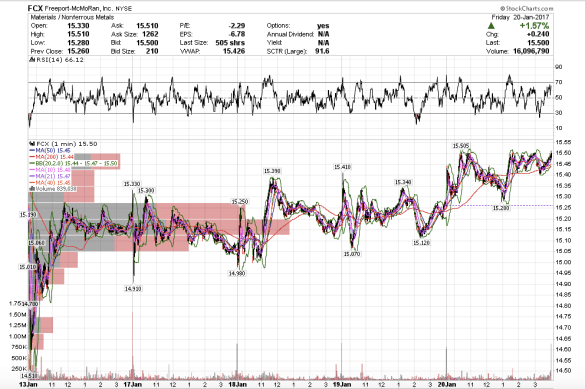

FCX might just have given a green light today. I bought FCX and will swing it over the weekend. It is slowly stair stepping higher. It also closed above the 4/8 emas on higher volume which is what I like to see.

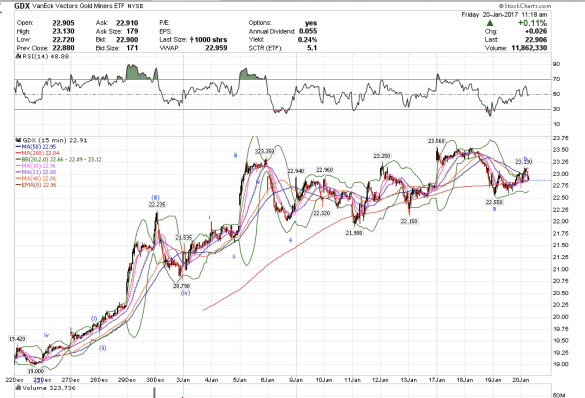

UUP closed at $26.03, which is below the bulk of the prints and would normally be bearish. It also closed below the 4/8 emas on much higher volume. I am bearish the dollar. I have still have longs on GDXJ, although lightened up on my positions. I will add if GDXJ can break above 23.45, otherwise, I will continue to look for the retrace back to the 21-sma day.

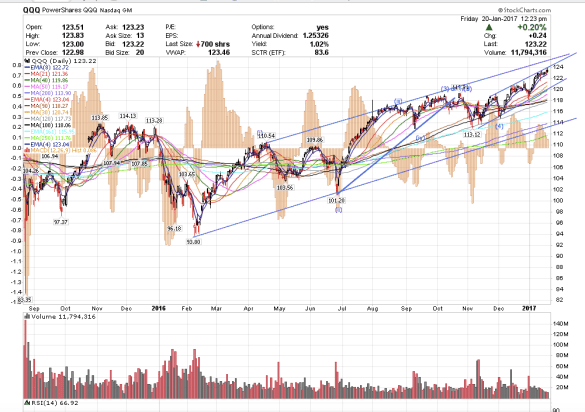

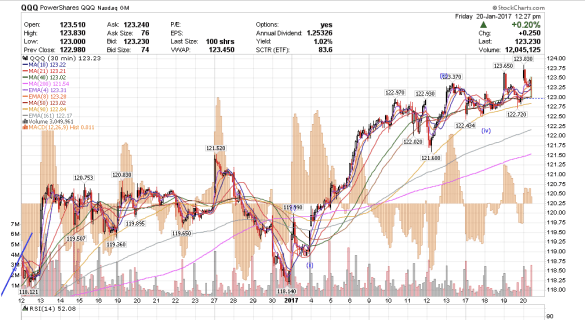

QQQ looks like it could have another last shot to the upside to $124.

I am going to take this weekend to rest. I have been under the weather this whole week – caught something from my daughter.

Ciao! Happy trading.