7:16 am PST.

It would have been good to be in LUV. 🙂

7:16 am PST.

It would have been good to be in LUV. 🙂

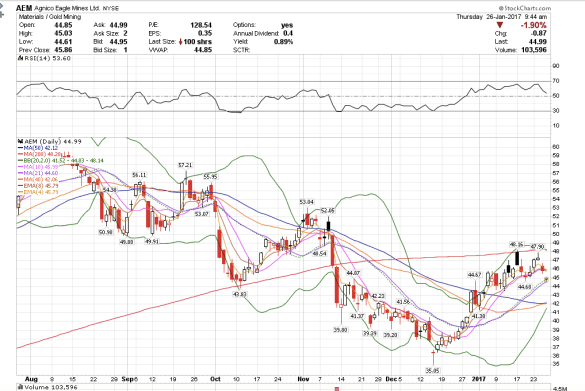

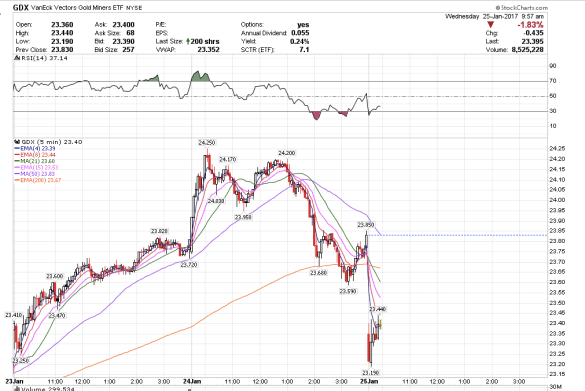

6:47 am PST. GLD almost tagged the 21 sma, which is what I have been looking for since the Monday high. This might be all the retracement we see. We can see AEM also tagged the 21 sma. I wanted to also see GDX do the same, and it has not yet tagged the 21, but sometimes some mining stocks, the etfs in particular, can have more bullish levels than individual stocks.

I was right to be cautious on gold yesterday at the close. Although we closed above the smaller prints, GDX closed under the 4 EMA, as well as GLD and SLV. It might have been better to write that I was more cautiously neutral because of the technicals despite closing above the smaller prints. Sometimes it is better to ignore the smaller prints in light of the technical situation. Plus we closed under the GOVT print which probably was a red light for gold too. /GC dropping this morning and first support is at 1184. The dollar index made a marginal new low overnight and has popped higher.

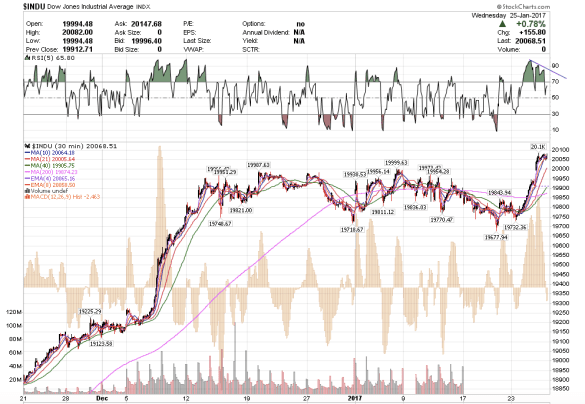

I can see /YM rallying to 20126 after a little consolidation today.

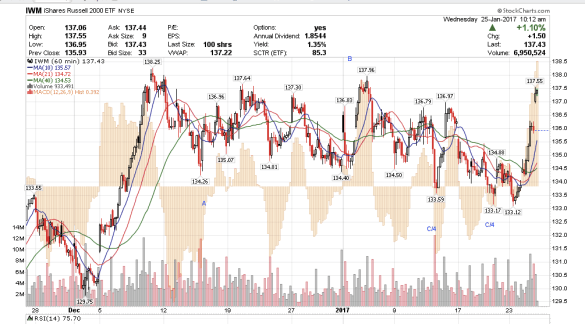

The Dow closed above 20,000 today! Congratulations. I still think IWM could go to 138.50. GOVT closed below that really big print which is bearish for now on U.S. treasuries.

The mining stocks retraced a bit and then caught a bid going into the close. We had some smaller prints in the mining sector which makes me cautiously bullish for tomorrow. SLV saw 181,000 shares at 16.07 and we closed above. GDXJ saw 100,000 shares at 36.90 and we closed above. GLD saw 330,000 shares at 114.10 and we closed above. GDX saw 235,000 shares at 23.45 and we closed above. IAU saw 320,000 shares from 11.53-.55 and we closed above. Gold managed to close just above 1200. The dollar closed in a bearish posture.

10:38 am PST.

After I had written that I thought money would start moving back into bonds as the markets top out, a really really big print came in on GOVT, the core U.S. treasuries etf.

6,922,063 shares traded at 24.93 on GOVT. I personally think that it may have been buying. However, I am going to give it some time to watch how prices perform around it. It could have been selling too, depending. Bearish below, bullish above.

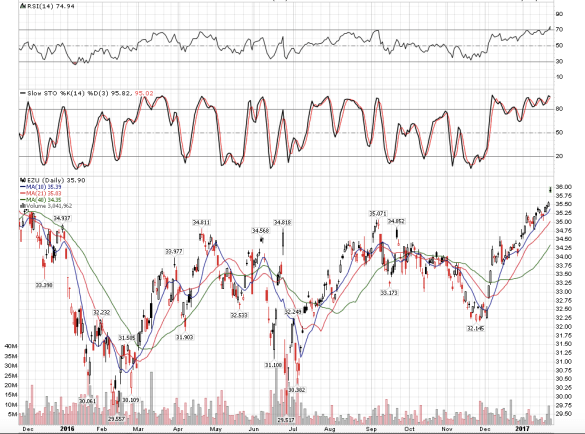

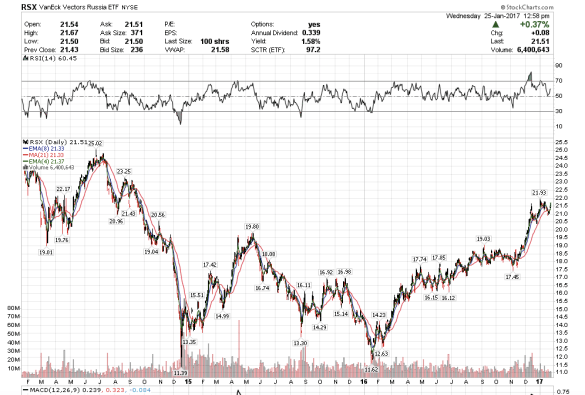

10:02 am PST. There has been a lot of really unusual and interesting market maker action in the emerging markets today – notably in EEM, Russia – RSX, Taiwan – EWT, and the Eurozone – EZU. To me, it looks like profit taking or selling. I think the emerging markets might be nearing a top and it will be interesting because if the money comes out of their indexes, where will it go? These will be levels to watch.

EEM: 2.5 million block traded from 37.48-37.57.

EZU: 864,714 block traded at 35.89

RSX: 850,259 block traded at 21.57

EWT: 885,140 block traded at 31.51

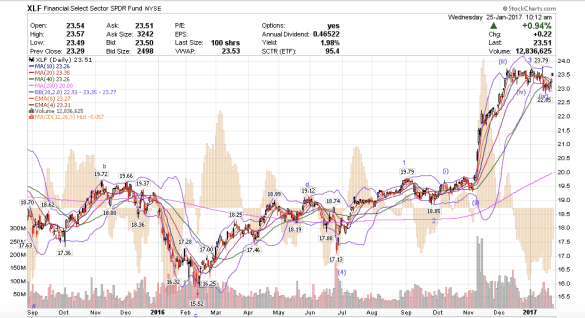

7:13 am PST. The wave 4 pattern is working out really nicely on the Russell and XLF. I had thought it was a wave 4, but then started calling a top when I gave up on them because of a couple of more minute wave degrees shakeouts lower. LOL. I live and learn. It turns out my wave 4 was right after all.

I think, though, that this is an ending wave 5 on all the indexes and the financials, which works in tandem with my thesis that the gold mining stocks bottomed and are now just doing a wave 2 retrace as the indexes make their final new highs. Once the market finishes to the upside, I think the money will rotate back into gold and out of the indexes. Ironically, the money might also go back into bonds as interest rates retrace.

6:57 am PST. I covered a GDX short from pre-market for about +.18. I think I am going to call it a day and watch now. XME and FCX are seeing a lot of dark pool action, this morning. XME 450,000 traded at 33.42 and 294,000 traded at 33.39.

5:52 am PST. Nat gas looks interesting again this morning. I would not be surprised if gold retraced all the way back to 1180. It found support this morning at 1200. XLF and the Russell will probably make new highs, along with the Dow and SPX. I think after consolidating a little today, the Dow will surge past 20,000 either this week or next.

The dollar made a new low overnight and it looks like a completed wave. I expect it to rally to 100.50 and then we will see.

2:14 pm PST. I was just thinking about the strategy of trading one stock at a time and wanted to write about it. I think it is a good idea, especially for someone just starting out, like me, to trade one vehicle at a time. Watching one stock at a time allows me to watch it very closely and carefully. I can see every single tick and formulate a careful plan on how to trade it. I think trading one stock at a time reduces error and helps me to think very carefully about it. It also helps to develop patience and the practice to understand that every trade requires the same level of time and attention to enter and exit.

There are so many opportunities in the market everyday, literally hundreds, if not thousands of different ways to make money in the market. But each strategy requires careful, thoughtful action, and experience.

Which is why I am now out of LUV. 🙂