I am going to set my ego aside for a moment and review a handful of trades that I ought to have nailed, but instead failed. This is a diary after all. Just because I write a blog does not mean I know anything about trading. Past performance is not an indication of future performance. So please excuse me while I engage in a little self-flagellation. If this is not pretty to read, please click away. I do this to help myself learn because I really want to improve my trading.

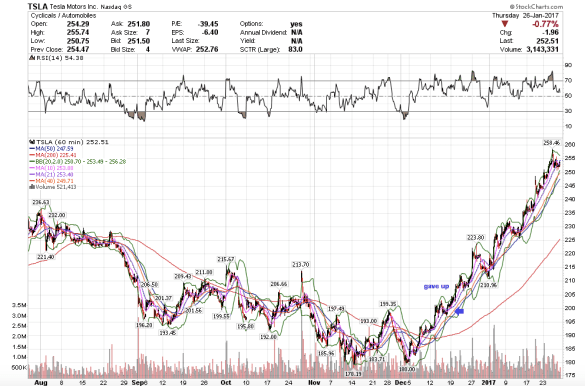

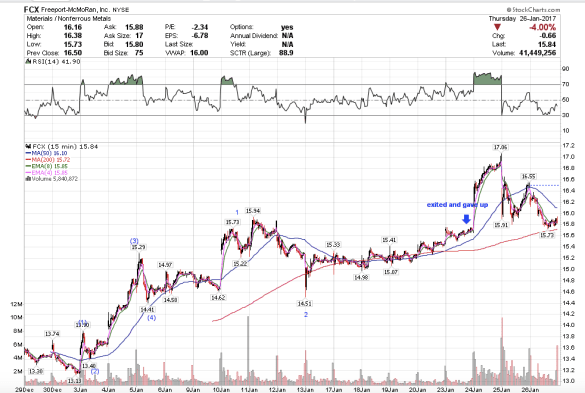

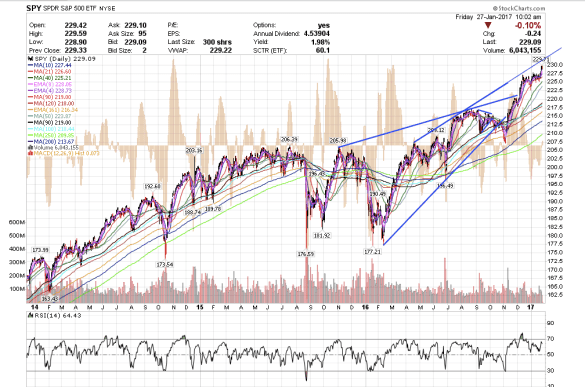

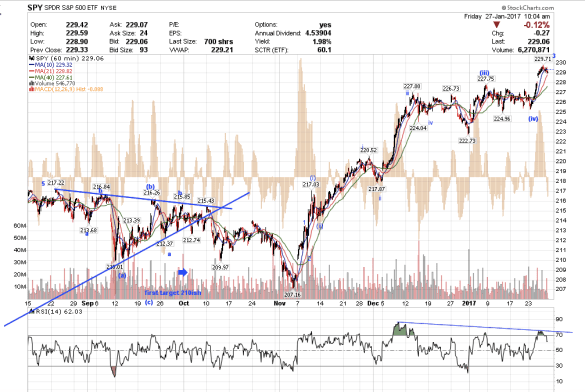

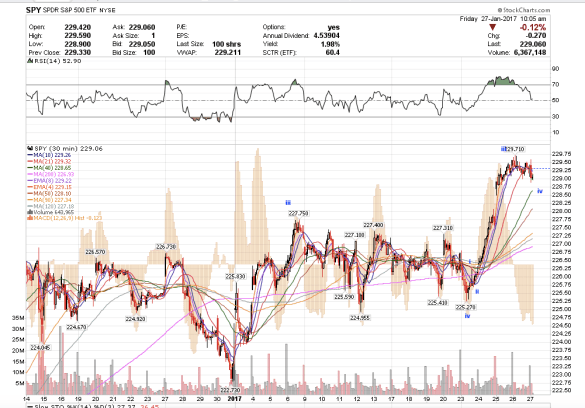

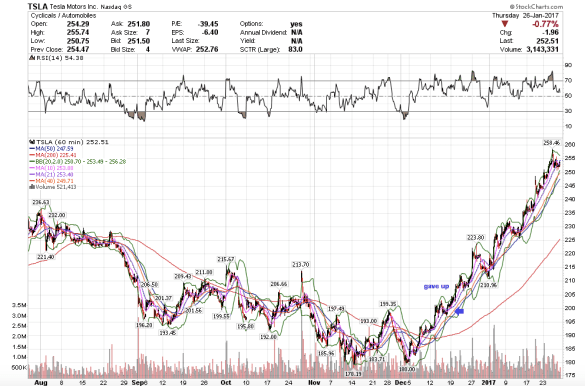

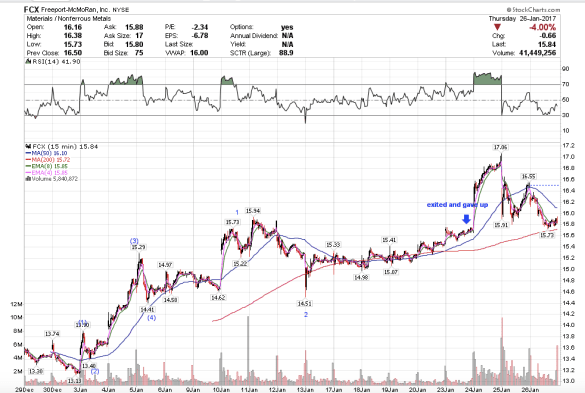

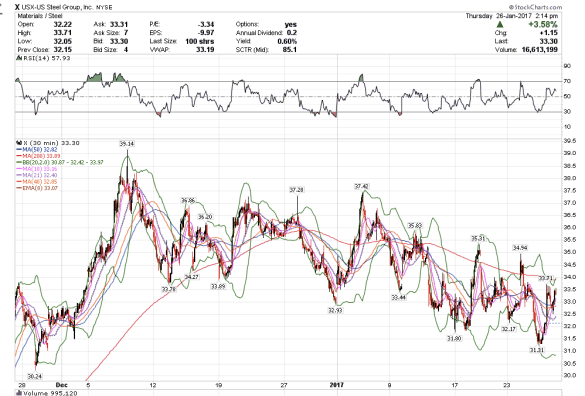

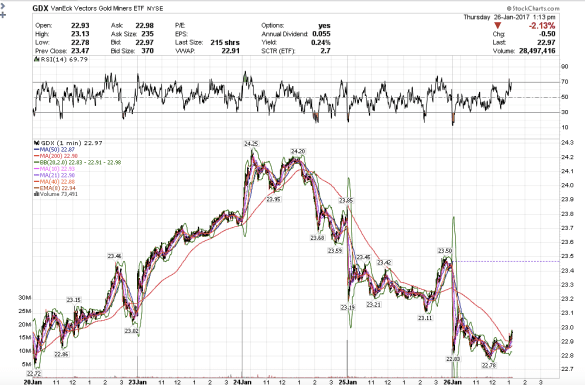

Trades I ought to have nailed: FCX, VALE, AMZN, TNA, FAS, LUV, TSLA. I was in right up until the very last minute shakeout before the big move up that I knew was in the works and could tell was coming but failed to be in the trade when it occurred. I will be damned if I let this happen again. I all knew these stocks would rally, that is why I had interest, but gave up. Good grief. All had the same situation to it – a corrective wave pattern, a couple more minute wave degrees lower that shook me out. My response was the same in all cases. I was just a 1-3 days too early, but ultimately right about the medium-term picture. How do I correct this? First be aware of the problem, then take steps to correct it. Change my response to the situation.