A few days ago I was on a mentoring call with T. Harv Eker, author of Secrets of a Millionaire Mind, and he said something really interesting about achieving goals. He said people need to “slow down”. I thought his advice very wise. I like the idea of slowing down my trading process. It helps me to notice the subtleties.

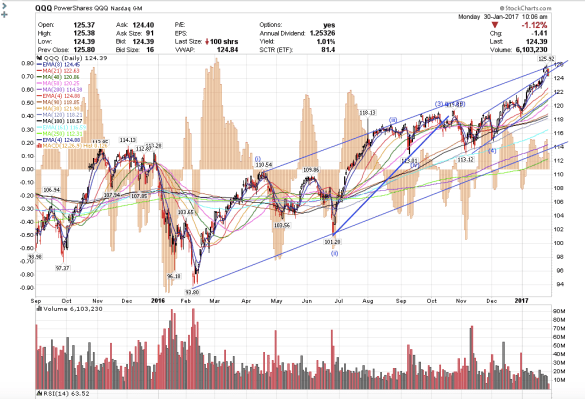

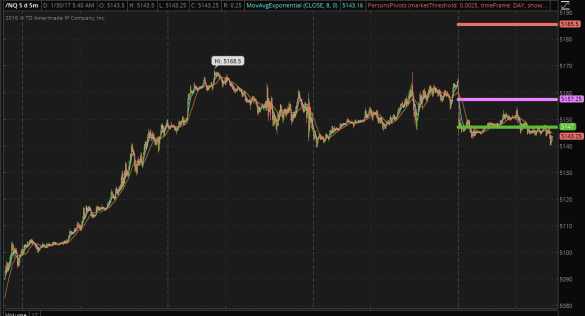

For the close, the SPY for the most part consolidated the entire day barely moving at all. The Dow traded in a really tight 30 point range. I think the close looked bullish to me. I remain long XIV.

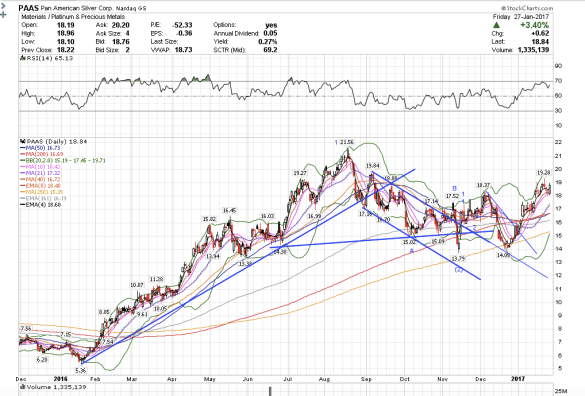

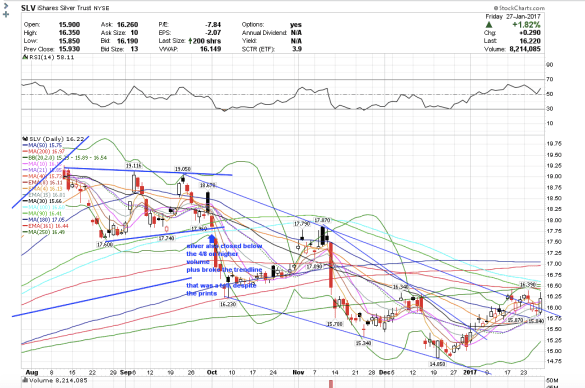

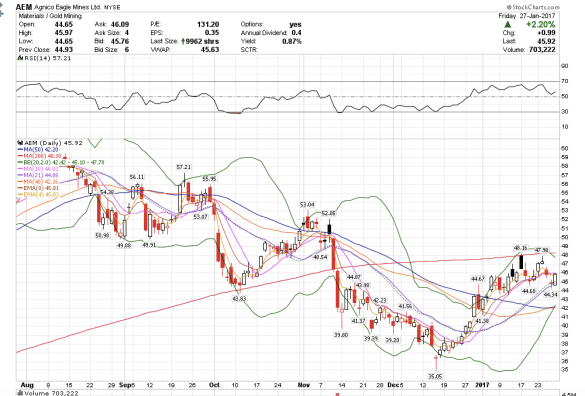

The mining stocks rallied into the close and we did see some prints that make me bearish for Monday. First we closed above the UUP prints, second we saw 480,000 shares of JNUG traded within the last 30 minutes at 8.37 and we closed below. We also had 396,067 shares of IAU traded at 11.47 and we closed below. GDX also closed below the 4 EMA again on lower volume. ABX also has a bearish pattern to it. I remain short ABX.