I am going to set my ego aside for a moment and review a handful of trades that I ought to have nailed, but instead failed. This is a diary after all. Just because I write a blog does not mean I know anything about trading. Past performance is not an indication of future performance. So please excuse me while I engage in a little self-flagellation. If this is not pretty to read, please click away. I do this to help myself learn because I really want to improve my trading.

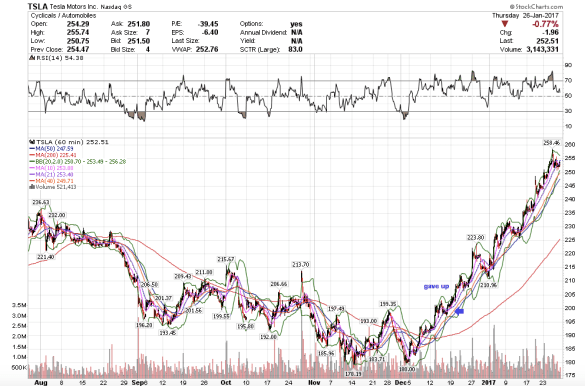

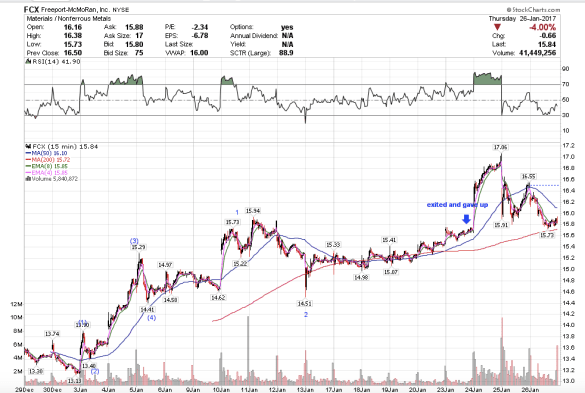

Trades I ought to have nailed: FCX, VALE, AMZN, TNA, FAS, LUV, TSLA. I was in right up until the very last minute shakeout before the big move up that I knew was in the works and could tell was coming but failed to be in the trade when it occurred. I will be damned if I let this happen again. I all knew these stocks would rally, that is why I had interest, but gave up. Good grief. All had the same situation to it – a corrective wave pattern, a couple more minute wave degrees lower that shook me out. My response was the same in all cases. I was just a 1-3 days too early, but ultimately right about the medium-term picture. How do I correct this? First be aware of the problem, then take steps to correct it. Change my response to the situation.

Susan,

I am very happy for you that you’re doing your own critical performance review. This points out that you’re a very objective person in analysis even your own. I have similar experience that I got chickened out of some positions before big moves. I also stayed on several positions for too long resulted big losses. It is very difficult to control our own emotions but we can get better as we learn collectively.

Knowing what you know, what would you do in the future for similar situations? 2X the normal stop loss or something else? Greatly appreciate your comments in advance.

Thanks again for sharing,

SKT

LikeLike

SKT, thanks. Last year, I primarily traded only gold. This year, I am trying to trade stocks that I have never traded before and I think that is where I am finding lack of confidence in my trade. However, the one good thing is that I was able to identify a potentially bullish set up, which comes from learning how to recognize patterns. That is the first step – being able to identify a situation and pattern that I could capitalize on. The next step is to have the confidence in my ability to recognize the trade and I think that comes with confidence.

My stops are always very tight. I think I often get side tracked watching other stocks and I have to remember to be persistent in continuing to watch the same stock.

LikeLike

rather, confidence comes with practice

LikeLike

deliberate practice

LikeLike