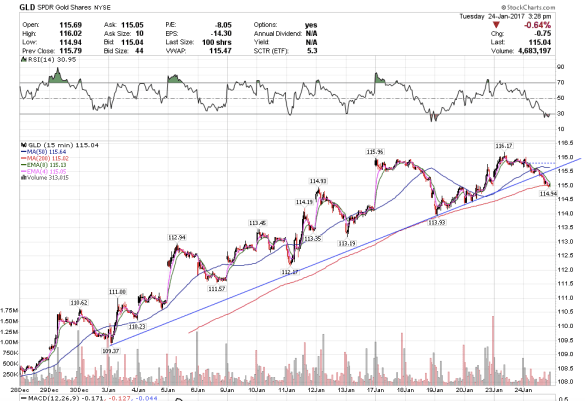

12:34 pm PST. I covered GDX and GDXJ short for +.47 and +.95 respectively. If they pop up again, I will look to re-short to the 21-sma day. GLD broke down from the rising trendline from its December low, which means this wave 1 up is complete and I would expect a more significant retracement. GLD might backtest the broken trendline, which would probably be another great place to re-short.

Now I am looking at maybe taking a flight on Southwest Airlines, LUV, for tomorrow. I do not normally trade LUV so it will probably be a small position, but I want to try it because the technicals look possibly bullish. I find that the trades where I lack the most patience are on stocks that I am new to trading. Usually, when I get shaken out it is because I do not have the experience trading it, and/or my position size is too large. It is good to know how one is liable to make mistakes so as to do something to counter and reduce the mistake from occurring. Every stock has their own personality and they move differently.

I just watched a video of a multi-millionaire trader who said he actually trades only one stock at a time. Apparently he made his millions trading this way. Tim Sykes talking at Harvard University, I think it was, penny stock trader. Interesting.

…

One other thing on needing to cultivate patience in a trade. I closed out my FCX yesterday and look what happened today. lol. Well maybe not so funny, lol, but one has to laugh at oneself from time to time. I live and learn. I was too busy looking at the gold mining stocks. Steel and aluminum mining stocks up a lot today too. One day I will be have more patience in my effort towards performing the perfect trade and be able to hold multiple positions. 🙂 At least I had a good day on GDX and GDXJ. One thing at a time.

TNA as well was another instrument I was trying to go long on. In a smaller account like mine, though, I think one really has to decide where to allocate capital in only the best trades that one feels most confident in and can watch like a hawk. Having too many positions makes it more difficult to watch every single tick to make sure the stock is doing exactly what you expect it to do, otherwise out.