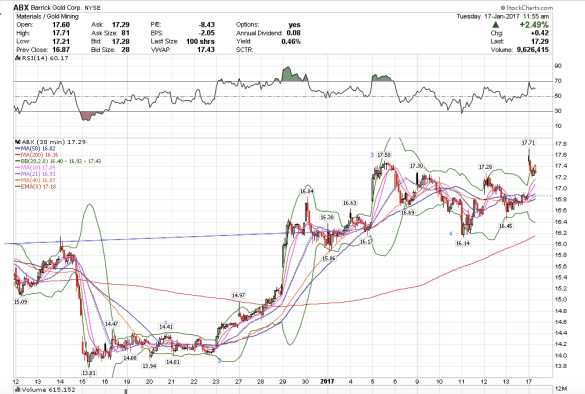

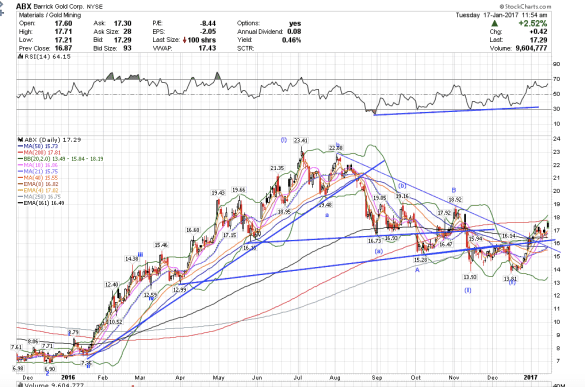

8:59 am PST. ABX is finding resistance at the 200 sma and has made a higher high on negative divergence. The wave count suggests this is indeed an ending wave v. We had a 1,469,700 share block trade on GDX at 23.20, which we are above now, indicating the miners could make one more small fractal wave higher today or by tomorrow before topping out short-term. I think ABX will retrace back to the 21-sma on the day chart which might take until next week to about $15.75-$16. I would give the retrace about three to five days. After it does, then I will see how it goes regarding buying into a longer-term position.

The retrace in gold and mining stocks will help pull bonds down and give the indices the needed energy to rallied to new highs. For this trade, I decided to switch out of IWM and FAS, and short more VXX instead.