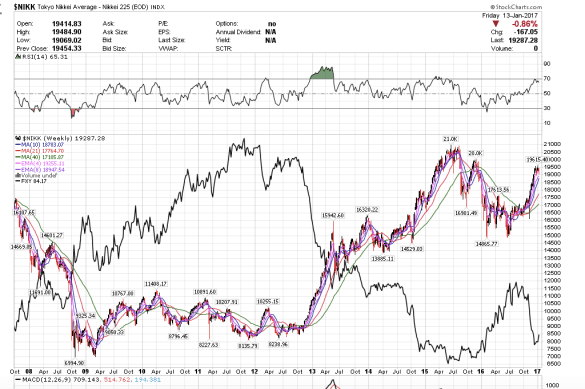

I wanted to look at the correlation between the Yen, the Nikkei index, the dollar, and gold and post the charts. Whoa. It looks as though the Nikkei is on route to making new multi-year highs as the Yen is poised to breakdown to new lows.

Nikkei compared to Yen etf FXY

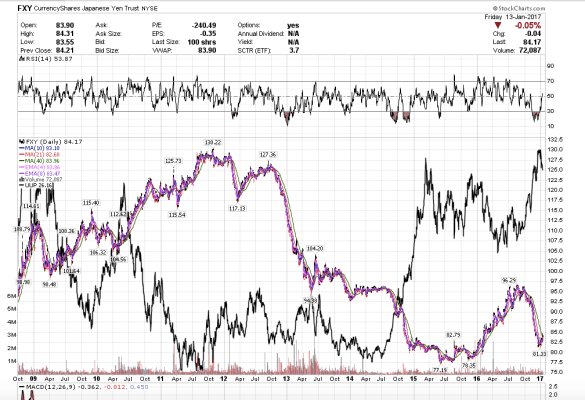

Here is the Japanese Yen etf FXY compared to the US Dollar etf UUP. They look inversely correlated, but not exactly and not proportionately. The Dollar and the Yen both declined together the second half of 2013.

The FXY compared to the USD ETF UUP

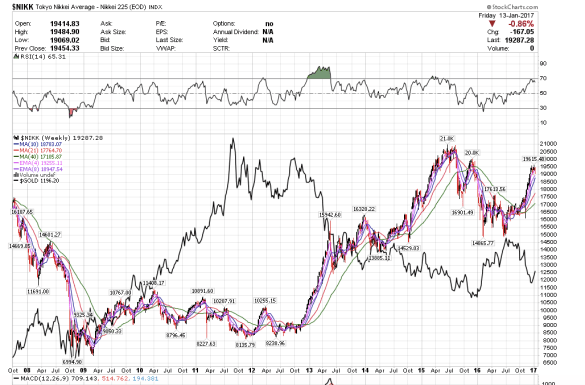

Nikkei compared to $Gold

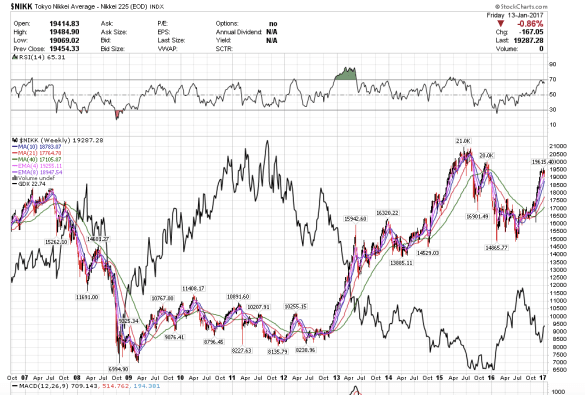

Nikkei compared to GDX

The correlations between the Nikkei index compared to gold are almost inversely related. I would not say perfectly inversely correlated because from 2009 to the first quarter of 2010 both gold and the Nikkei rallied together. It appears the Nikkei index bottomed after gold bottomed in 2009 and topped out before gold bottomed in 2015. Will gold bottom before the Nikkei tops out or after this time?

It does look to me like the Nikkei is going to make new highs this year. Looking at the last 10 years of correlated performance between the Nikkei, Yen, Dollar, and gold, it appears that the Yen and gold might have further to fall as the Nikkei and dollar rise to new highs. I can see, if everything is connected, how some traders are still skeptical about the gold rally. I do know of one fairly well known trader who is bullish on the Nikkei and just turned bullish again on the gold mining stocks. It is just something interesting for me to think about.

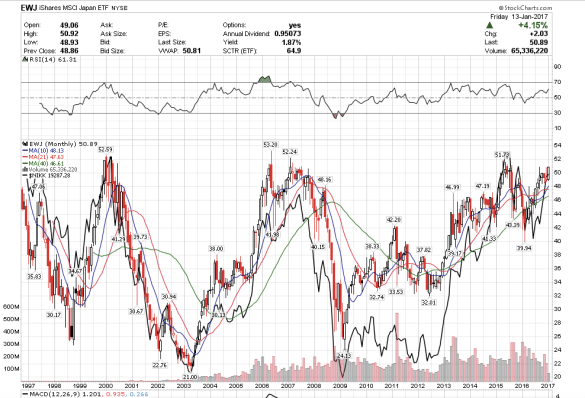

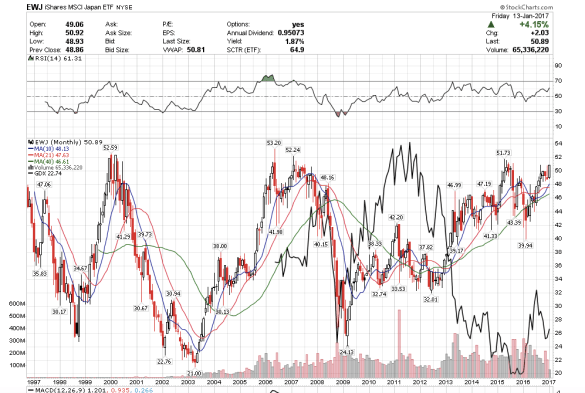

EWJ compared to $Nikkei

The EWJ is little more forgiving than the Nikkei.

EWJ compared to GDX

EWJ and GDX both rallied together from 2009 to 20011 and declined together from 2001 to 2012. In 2012, they were inversely correlated from 2013 to 2015. Something happened in global capital flows that caused the Nikkei to continue to rise while gold fell – Abenomics was good for the Nikkei and the dollar, but not gold. Confidence shifted to the dollar.

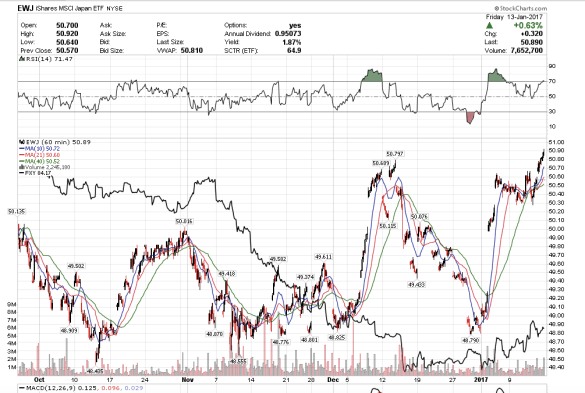

The EWJ is becoming overbought short term.

EWJ compared to FXY

I am not sure I see a good correlation either way for EWJ: FXY.