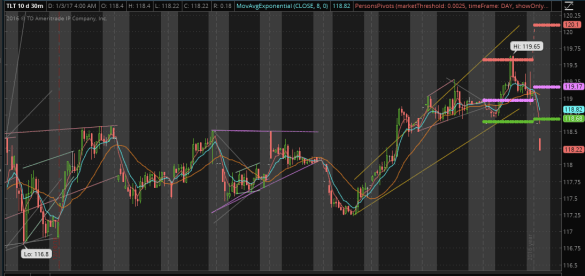

4:39 am. PST. The capital continues to flow out of bonds this start the new year as anticipated last Friday. We can see that TLT is down this morning. I will watch to see if I have to exit my TLT short position or whether I can continue to hold to a new multi-month low. There will be resistance at 118.60 and support at 118.16.

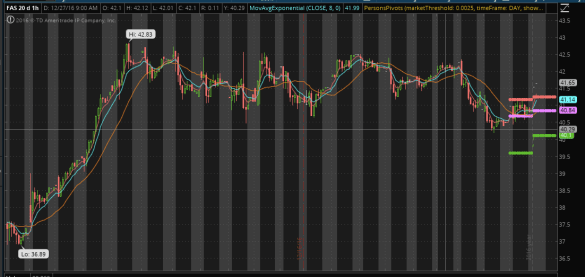

As capital continues to flow out of bonds, it looks like it is going into stocks. This morning the Dow mini futures are up about 148 points and it looks like we will very likely surpass the 20,000 psychological barrier this week, possibly today. This could be an ending wave of a minute v degree as my XLF chart suggests, but certainly not the completion of the bull market. I will probably look to see whether I have to exit my FAS long position today.

As capital continues to flow out of bonds, it looks like it is going into stocks. This morning the Dow mini futures are up about 148 points and it looks like we will very likely surpass the 20,000 psychological barrier this week, possibly today. This could be an ending wave of a minute v degree as my XLF chart suggests, but certainly not the completion of the bull market. I will probably look to see whether I have to exit my FAS long position today.

The dollar is also having a really nice rally with the index futures up more than a dollar this morning! This helps to confirm that I probably have the right wave count as posted earlier with EUO and UUP. I think this is an ending-minute-wave-v move.

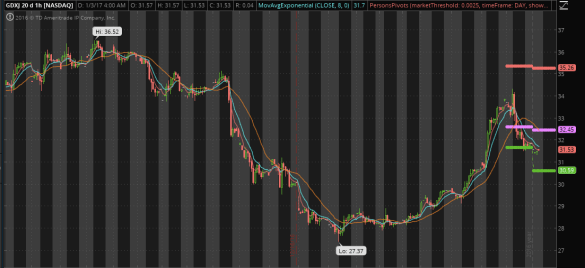

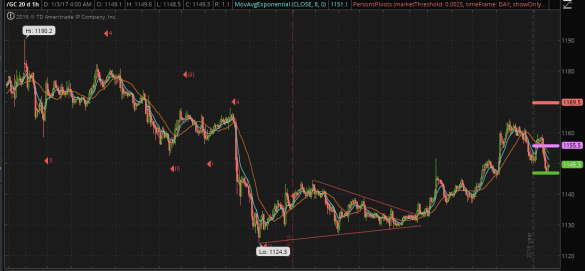

Considering the dollar futures are up 1.19% this morning as of this writing, gold and silver futures are faring quite well in comparison. /GC and /SI are only down slightly and I think it is probably because this is an ending move and traders are anticipating another bounce in the precious metals. I might look to buy mining stocks for that bounce once the dollar completes its minute wave v quite possibly today or tomorrow.

You can see /gc finding support at the 1148.70 support level this morning.