Stopped out CHK for +.04,

Monthly Archives: December 2016

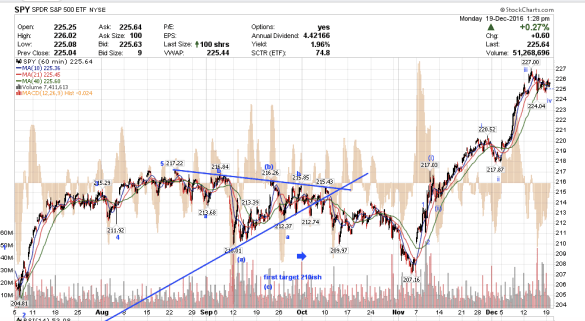

SPY wave count

We might have another series of iv-v’s up in SPY.

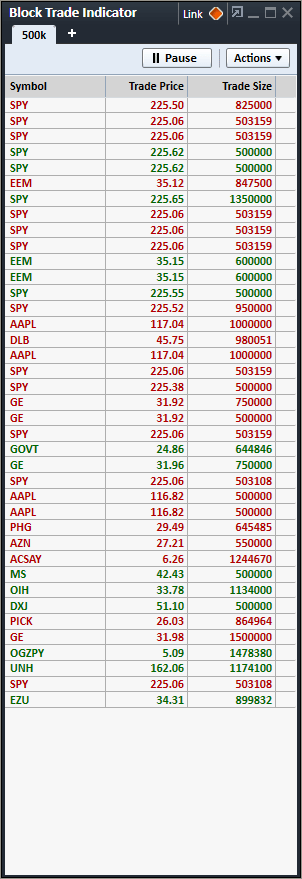

A lot more prints coming in on SPY. They look like buying at 225.06, about 4.5 million shares.

gold sell

9:38 covered gdx +.07

9:30 reshorted gdx, gdxj going to a new low.

9:17 stopped GDX short -.02

9:05 am. Gold might be a sell here. It looks like someone sold 161,000 shares of IAU at 10.99. I have a short GDX position on. Not quite sure, but if we close below, I imagine someone sold IAU.

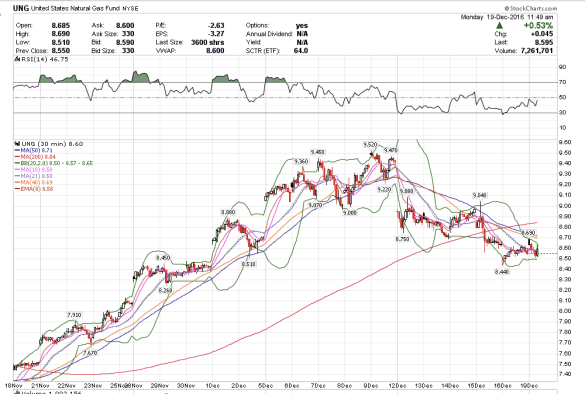

UNG

If UNG can close in the green today, we might have a shot at new highs. I have a position in UNG and UGAZ.

QQQ

8:39. exit remainder APPL +~.90, out more QQQ +. 57. Closed DE

8:28. fickle me. Scaled bulk out QQQ +.81, AAPL +.90. Closed QQQ call +60%

~8:00 a.m Bullish. I cannot tell if this is an ending wave v, or the start of a wave 3. Whatever the count is, it looks bullish. I am holding on to the long side. Somehow I get the feeling that when the new year starts the money is gonna gush into the indices. The volume is only starting to come back into the indices. Sometimes when I think this is an ending wave v and we ought to have consolidation after, the market takes off to the upside, so I am just going to hold and see. The market makers are already on holiday vacation, I see only a few SPY 501k’s.

Morning Update

7:56 added CHK, there was a 500,000 share print at 7.17.

7:29 closed out the remaining 10-percent of ABEV

7:16 bought a little RGLD.

7:09 close GDX short for break even. Watching.

7:06 am. Scaled out QQQ calls for 20% gain.

6:57am

The indices are this morning as suggested by Friday’s close. The QQQ’s are on target to make new highs, as is AAPL and DE.

Nat Gas looks like the correction might be over and I am bullish. I like UGAZ here. CHK is consolidating a bit – watching it.

GDX is rolling over and I still expect new lows and for DUST to make new highs.

FCX might be a buy soon.

Premarket

I am just going to watch what the market makers do today and if I see anything interesting I will post. Thanks Siu for asking about dark pool data feed. I will explain how you can obtain it for $50 after the market close. It is very useful information.

What is the Dark Pool?

Here is a funny article about the Dark Pool I came across:

“The biggest reason people are afraid of “Dark Pools” is the name, like a kid being stuck in a closet by a mean sibling, the image is frightening. Maybe they should be called “Block Trading Venue for Institutional Traders Who Know What They are Doing”. BTVITWKWTD -Doesn’t exactly roll off the tongue does it?” http://www.cnbc.com/id/100424690

In fact, the dark pool has been around for a while, how long? I do not know. But I do know that it used to be called “upstairs room” trading.

I personally have watched dark pool action for about four months now. Sometimes I can see the prints come in within minutes of their execution and other times not until a day later. As I understand it, the rule is that the institutional traders must report their dark pool trades for public view within four hours of execution. I think the way some of the institutional traders get away with really late reporting on their trades is they do the trade in their London or Asia desks, i.e. a different time zone, which gives them more time delay to report in the U.S. If someone has a better explanation, please enlighten me!

Watching institutional traders trade has been a really interesting learning experience. I think that when the institutional traders start buying GLD, SLV, GDX, IAU, NUGT, JNUG, GDXJ by the millions of shares per etf is when it will be time to buy. I have not seen that yet. I did see an isolated 5-6 million share block trade on IAU a few weeks back, which was short covering. I also saw some buying before the fed announcement, but that was only in the hundreds of thousands and very short-lived. I think they exited the morning after in smaller share amounts.

Peaceful Warrior

This is a great movie about a young gymnast who wants to perform a triple flip on the rings. He shatters his leg in a motorcycle accident. With his mysterious mentor “Socrates” he works past his injury and goes on to achieve his dream. It is based on a true story.

DUST

Target $75.