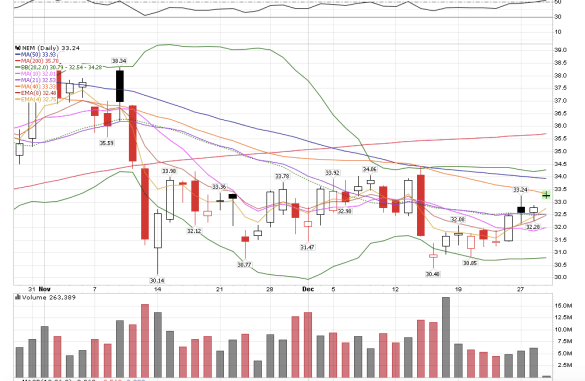

Yesterday NEM closed above the 4/8 on volume. That’s bullish for the next day – today. 33.33 is the next level and if we close above that, price could go to the upper bollinger band.

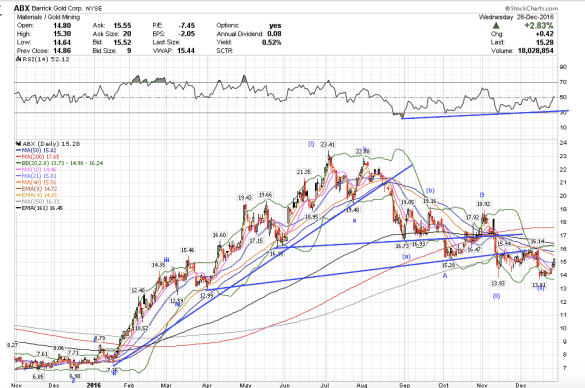

I personally dipped my toe into my mining stocks shopping list that I posted last Monday for a long-term trade to see if maybe this might be the start of wave III. I bought Endeavor Silver and Pan American Silver last Tuesday. I turned around and went long after stopping out to the short side.