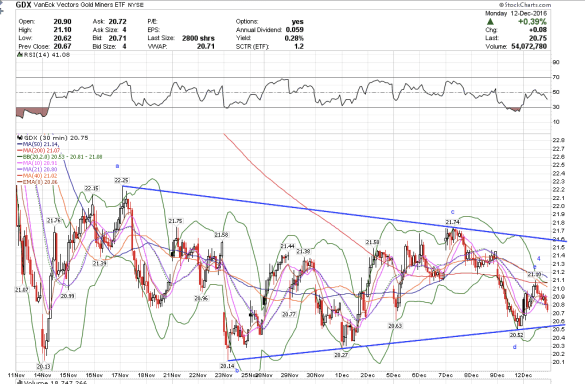

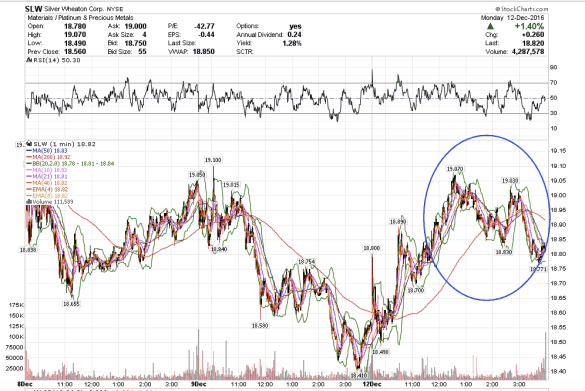

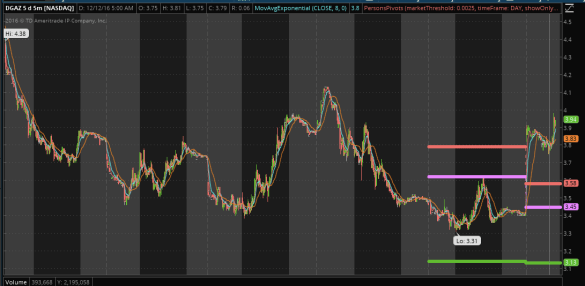

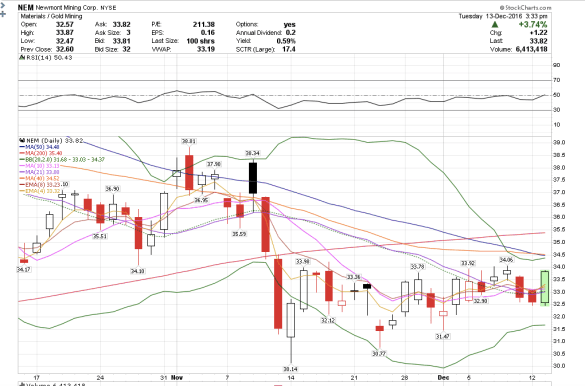

12:45 pm. I added onto my JNUG position and also bought NEM, PAAS, and ABX to the long side. We are above the GDX, GDXJ, and NUGT prints, plus the pattern looks bullish. I really like how the mining stock charts are shaping up. I also saw SLV prints, 135,907 at 16.01 and we are above. I saw about another 660,00 shares of IAU traded at 11.15-.14 and we will probably close above, and another 234,490 of GDX traded at 20.95 and it looks like we will close above. All very bullish.

The market makers are the best traders in the room. They know what they are doing and they have shown their hand on the miners. They are buying.

I am a bull on Newmont Mining now. If it can break above 34.50, that is going to be huge. It will close above the 4/8/21 today.

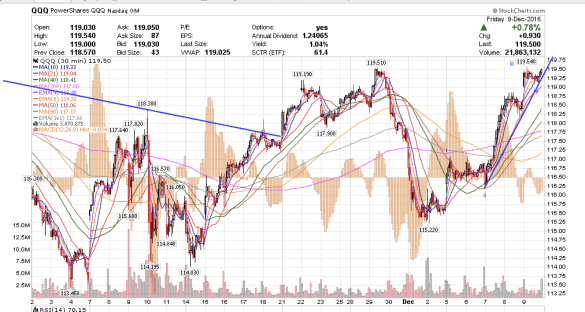

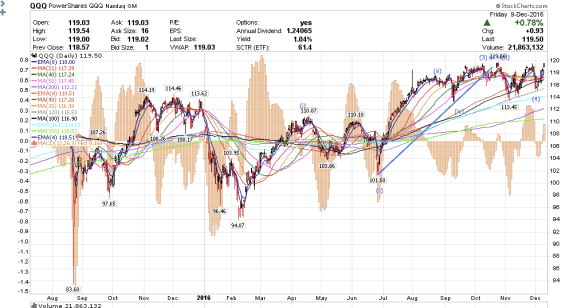

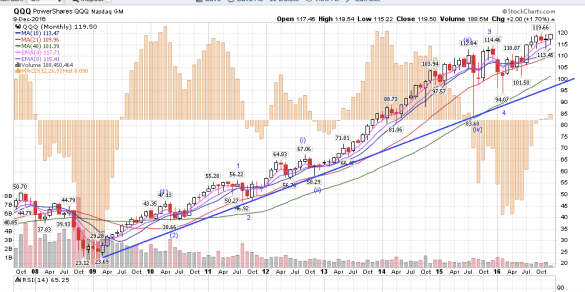

QQQ also reached my target of $120 and $121 – nice call! – and could do a little more to the upside before rolling over.