Wow. I am so glad I bought those mining shares on Tuesday. I basically said to myself to heck with it if there is only one possible wave lower, I might as well start accumulating here just in case that wave never happens. So I bought PAAS and EXK near the close last Tuesday after I stopped out to the short side, glad I did because the short side was not working. I could feel the force was strong to the bull side. I think this might be the start of a major wave to the upside in the gold mining stocks because I just noticed today the dollar made a tiny, possibly ending, wave to the upside yesterday. I was too exhausted yesterday afternoon after sledding all day with the kids to do anything else and missed that tiny move up and then pullback in the dollar – hey, it is the last week of the year and my kids do not have school – I am entitled to a little vacation. 🙂

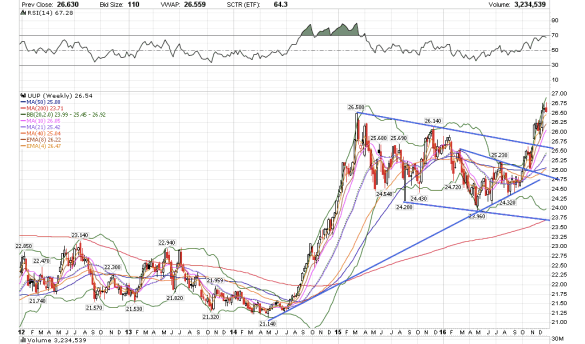

I am back now at my regular trading desk. So here goes my outlook on the dollar. I had been watching and waiting for an ending move in the UUP to complete the wave. I had written previously that we were almost there, but not quite done with the UUP wave higher and we finally got it yesterday. If you trade gold, you must understand the movement in the dollar. The correlations are not exact, but for the most part if the dollar goes up gold goes down, and vice versa.

There was negative divergence on UUP from the Daily, Weekly, Monthly, 30-min, to the 5-min charts. This is very indicative of a possible top. I am not quite sure if this is the final top, but it is certainly a major top here, possibly at least the top of wave 3. This means UUP could pull back as far down as $26. If so, this will push gold and the mining sector up.

There is one small possibility, however, that this is still only a wave iv for UUP, but either way, the negative divergences on all the time frames is mounting.

As for the Dow, S&P, and Nasdaq, I do not think the rally is over even for the short-term. Just by looking at the XLF chart here, I only see a minute wave pullback. I think the first week of January will see buying again. XLF could pullback to 22.50, but I do not see a change in trend.

SPY finds support at the 21-sma day chart.

The mining stocks had a massive rally today. Today’s rally did a lot of technical damage to the bear case. ABX closed above the neckline break for the first time since the November breakdown. That is very bullish. Plus the gap up from this morning held. I see continuation for the last trading day of 2016. Today’s gap up must hold open during the first week of January for this to be the beginning of the major wave III up in the precious metal mining stocks.

Newmont Mining closed above the upper downtrend channel line from July. Hugely bullish if we back test and bounce off that line.

Gold is getting her shine back, but she still has a way to go to confirm a new bull market. Gold has to close above 1242 to confirm a new bull market, in my view. The mining stocks will lead the way and give us clues.

The only other caveat I have right now for a continuation of the gold rally is TLT. Gold and TLT have near identical patterns since July and TLT’s pattern is not done to the downside. TLT will likely find resistance here at the 30 SMA.

The correlations are never always the same, though. Things always change. We will see.