I feel happy to be back at home and at my desk. I love waking up early in the morning when everything is quiet to think about the day ahead. Today I thought I would attempt a review of the various markets to prepare for this week trading.

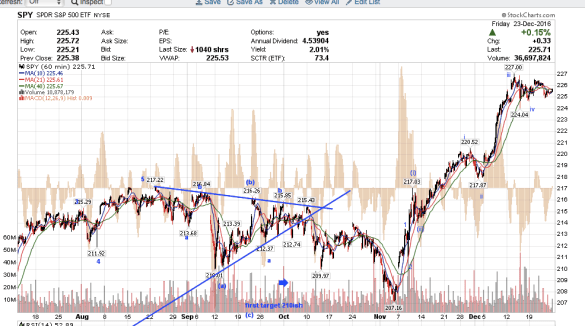

Here is my chart for SPY. It appears last week the indices took a breather and consolidated sideways really nicely. I think we still have more upside into the new year.

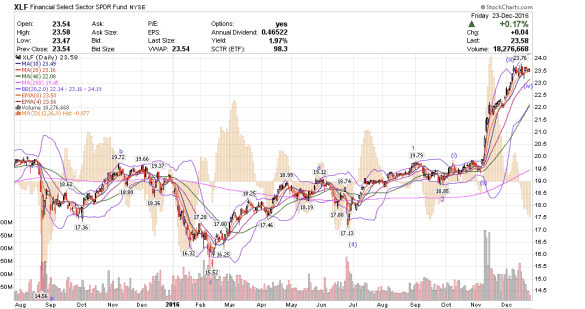

I like to compare the XLF chart side-by-side with the indices to make sure I have my count correct. XLF is still in bull mode. XLF could possibly go as high as maybe $29 by mid-next year. It would take some time. If XLF can go there, the indices would rally together.

The dollar ETF UUP still looks bullish. I see a continuation of the bullish trend and short-term move up to $27 into the new year.

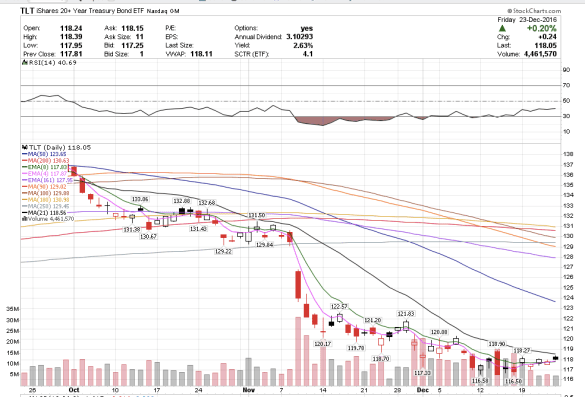

The 20-year treasury bond etf TLT will likely find resistance at the 21-sma day chart at 118.56. I think sellers will take the bonds down again into the new year and beyond.

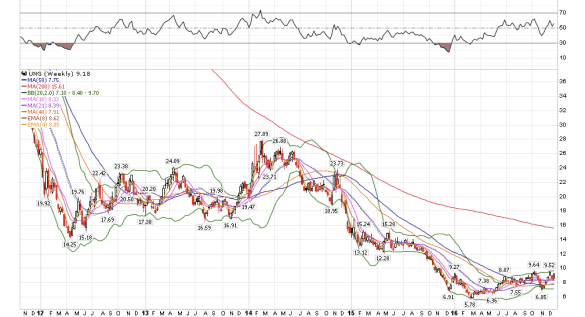

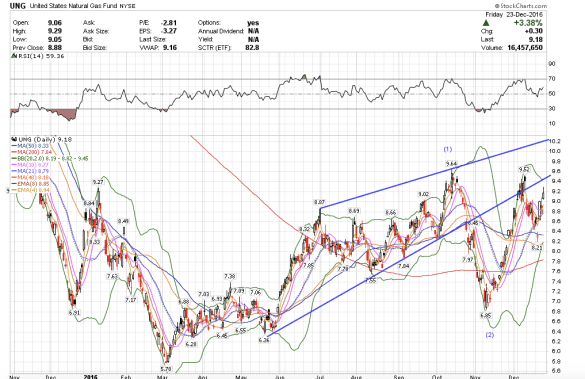

Natural gas has been really moving well lately. I wonder if UNG might rally up to the 200 sma weekly chart eventually at $15.61.

Shorter term, I still think UNG could go to 10.20. I plan to watch UNG/UGAZ closely.

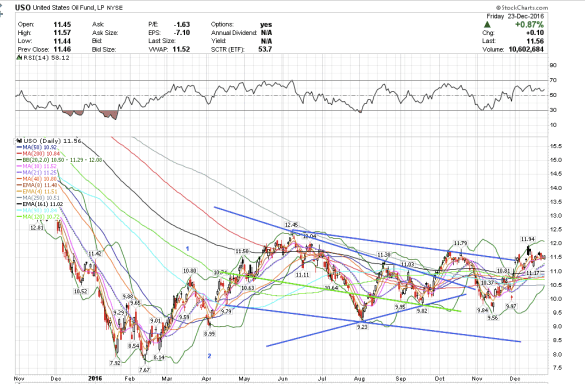

Oil’s etf USO closed bullishly last Friday. It is also now above the corrective channel. USO could possibly go to $12 short term.

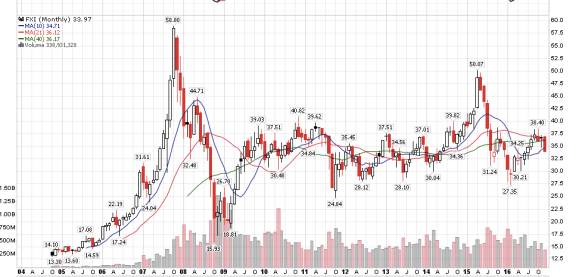

China’s FXI looks like it still has some more downside. I think China could crash into 2020 longer term. I eventually would like to buy into China if it does as I think China will rise from the ashes a lot faster than almost anyone else.

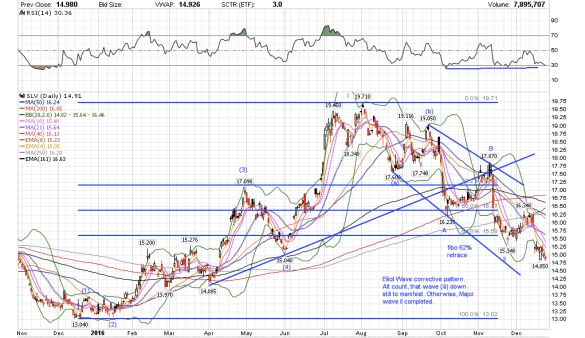

Silver looks like it is so awfully close to a bottom. The silver chart shows a highly corrective pattern. It is not impulsive. I hardly expect silver to break below its December 2015 lows. On the other hand the dollar rally still looks strong, so I have a hard time trust what I see on my chart with regard to silver, but it really does look so close to a buying opportunity.

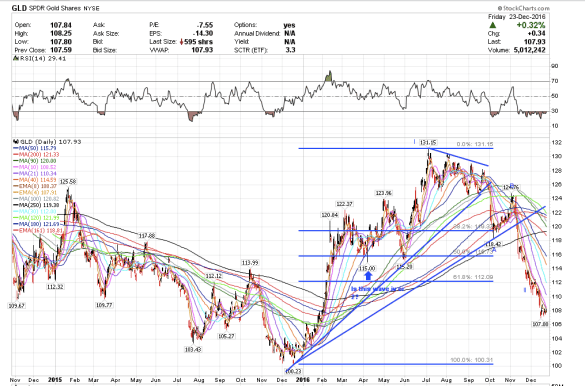

Gold could just keep trending downwards into January until there is a massive capitulation sell-off where sellers who have been holding to the long-side this entire drop down since July just panic and give up to stop the pain. The last wave down is usually the most steep and most dramatic. Gold could just drop $30-50 in one day or night. It is at that time that I will buy, perhaps near the end of January.