I believe that if you want to make the world a better place you have to make yourself a better and happier person. Whatever is going on in the world, I do not believe I can change anyone else or the behavior of anyone else. I choose not to focus on the bad news anymore and in fact tend to avoid the news at all costs these days. It is ironic because I used to be journalist and a news generator, lol. The past is the past and I certainly believe that I can change myself, make myself happier, take care of myself, allow myself to think positive thoughts, and to have a positive outlook on life. I choose to focus on the good things in life and there are a lot of good things I have in my life and feel thankful for. I have gratitude for all the good things in my life, and writing this blog makes me feel happy and thankful. Feeling happy and thankful in and of itself is a great reward.

Having and generating wealth is one component to taking care of myself. Who wants to be poor? There is everything good in the attempt to create wealth legally and ethically. And for me money represents freedom. What does money represent for you? I learned recently that my hidden purpose in life is freedom. The way that I can find freedom is through discipline – discipline in my personal life, discipline in my trading, and discipline in what I think, say, and do.

The mining stocks during the first half of this year served my purpose of wealth generation very well. They moved quickly and they moved a lot. But since July they have been more of wealth destroyers if one was long, and one of wealth creation if one was short. I do have to say that I traded the first half of this year with the mining stocks supremely well, and well, the latter half, I certainly could have done a lot better. I am still up for the year, but yes, I have learned quite a lot about needing to change directions! 🙂

Okay, so with that cautionary note in mind, here is my mining stocks shopping list that I wanted to take a look at: (and please remember my blog is for educational purposes only):

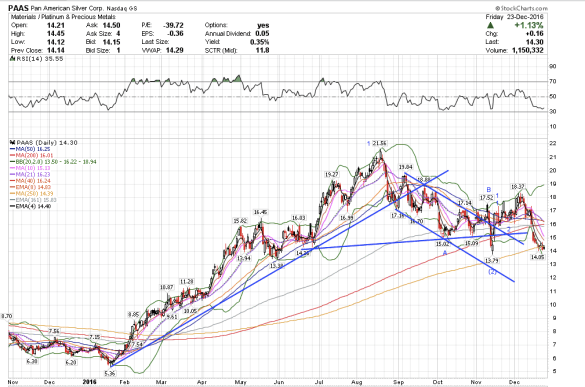

Starting with my favorite mining stock, PAAS. As gold and silver continued to sell off to new lows, this stock rallied up above its neckline break and is still trading above its November low. The pattern looks very corrective. PAAS could go to $13 to complete the corrective wave down, and if and when it does, I will want to buy this stock. Or it may have already bottomed. It looks like it is backtesting the upper trendline. I do not need to be the first one in to buy the next bull market. There will be plenty of upside and opportunities to buy in if indeed the next great bull market in mining stocks is around the corner.

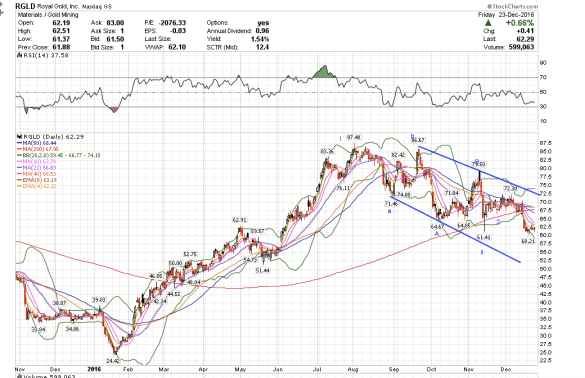

Royal Gold, RGLD, also is trading within its bullish corrective channel. I like RGLD.

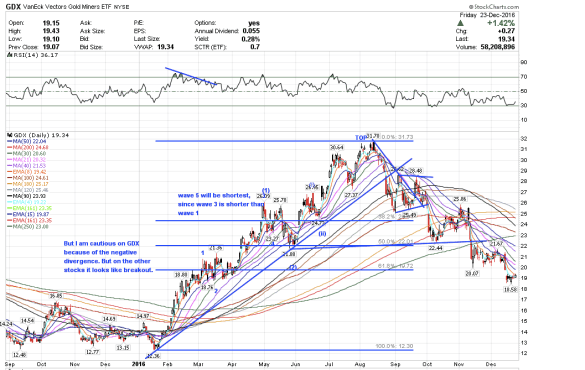

The GDX chart looks a lot like silver. It too looks corrective.

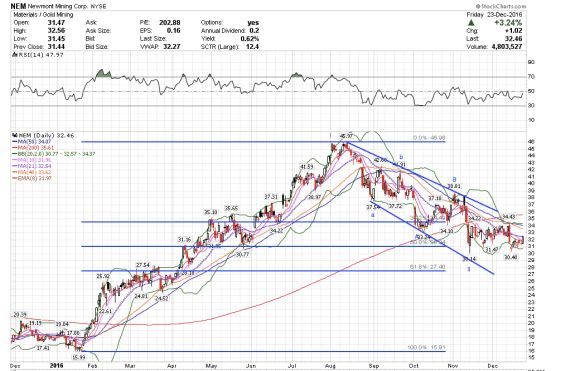

Newmont mining, NEM, also looks like it is in a bullish corrective channel and ready to rally. Friday’s rally certainly helped the bull case. I wonder if it might already be a buy. I might have already bought into this stock if it were not for the gold chart. And so I stand by and watch for now. I watch closely.

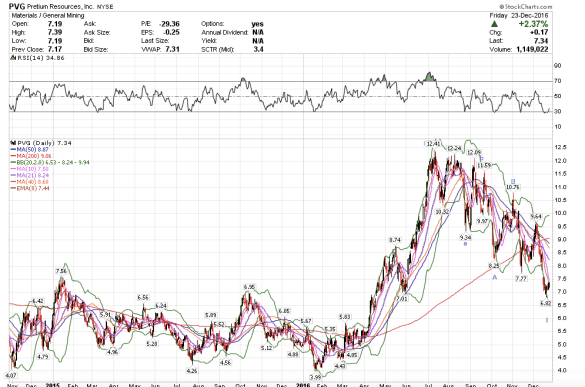

Pretium Resources, PVG, shows a classic bullish corrective pattern. This pattern is really common and you can see this same exact pattern on so many different time frames. This fact that these mining stocks show this pattern is why I am bullish on gold mining stocks for the long term. To be fair, I do sometimes see this pattern at the start of a massive bear market, but in this case, I think this is corrective considering that gold has already fallen so much. One always has to look at the pattern in context with how the underlying commodity has performed.

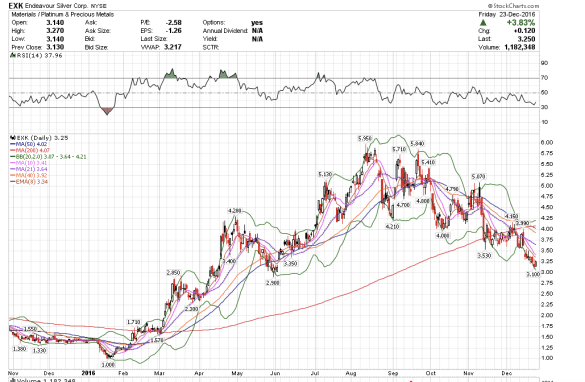

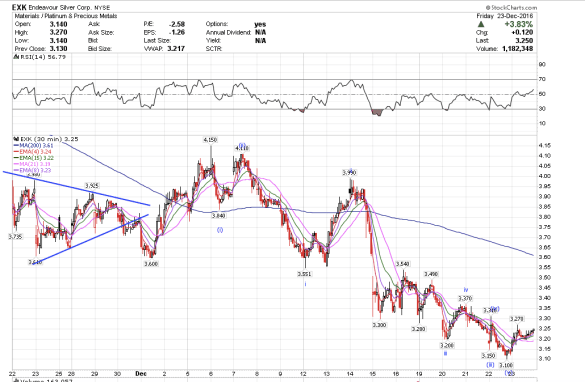

Endeavor Silver also looks like it might have bottomed or is bottoming.

Look at this huge bullish descending wedge on Kinross Gold, KGC. We just bounced off the bottom trendline.