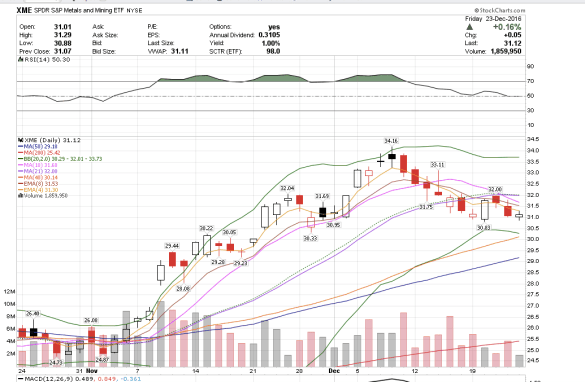

I bought FCX and XME at the close yesterday, the only two positions I decided I would try holding over the long weekend. Although both closed under the 4 EMA, making it a little more risky of a trade, their recent lows held and it looks more like a corrective retrace than the start of a new wave down.

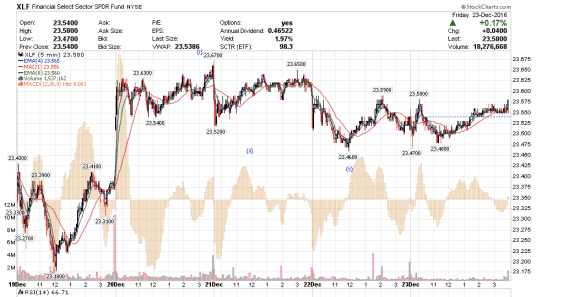

XLF and the indices may have completed a bullish consolidation phase on Friday. The XLF closed positive, which looks like it means the financials and the indices are going to rally next week.

On Stocktwits, I read that there were large block trades on GLD and SLV, which is interesting. Since I am not at my regular trading desk, I cannot verify it, but GLD closed green which means it could rally yet again. I have no position other than FCX and XME which have different patterns from GDX, GLD and SLV.

NEM had a really nice rally into the close, barely giving any of it up into the close, and it could very well pop higher on Monday.

TLT also closed green. I closed my TLT and DUST midday.

EWZ looks like it could rally on Monday. UNG looks like it needs to consolidate. The dollar, i.e. UUP, is still consolidating for its next move higher.

Happy Holidays! I wish you much peace, love, joy, and wealth this year and the next! 🙂